Column: How much would Elizabeth Warren’s wealth tax raise? Economists battle over the number

One of the most pointless exercises beloved of our policymakers is nitpicking at a novel proposal in its earliest stages, as though the details are vastly more important than the concept.

That’s what seems to be happening with the tax on “ultra-millionaires” proposed in January by Sen. Elizabeth Warren as part of her campaign for the Democratic nomination for president. Warren’s plan is to impose a 2% tax on household net worth above $50 million, with an additional 1% on fortunes over $1 billion. “This small tax on roughly 75,000 households,” she said, “will bring in $2.75 trillion in revenue over a 10-year period.”

Critics promptly declared the idea unconstitutional (we examined that issue here), and have since followed up with calculations questioning whether it would really produce revenue that high. The critiques of the plan are important because Warren proposes using the money for some of her social policy proposals, such as eliminating student debt and making public higher education free.

It is not appropriate to assume that a Warren wealth tax would be as poorly enforced as the estate tax currently.

— Emmanuel Saez and Gabriel Zucman, UC Berkeley

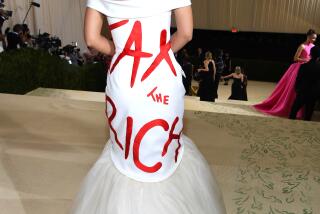

More broadly, the inequities built into the federal tax structure have begun to give pause to its richest beneficiaries, 18 of whom recently issued a call for a wealth tax on the top 1%, including themselves.

“This revenue could substantially fund the cost of smart investments in our future, like clean energy innovation to mitigate climate change, universal child care, student loan debt relief, infrastructure modernization, tax credits for low-income families, public health solutions, and other vital needs,” they said in an open letter this week.

Emmanuel Saez and Gabriel Zucman, the UC Berkeley economists who helped Warren craft her wealth tax, have just published their response to the quibbling over the numbers. It’s worth examining, not because it nails down their revenue estimate as indisputable (it doesn’t), but because they take point-blank aim at the odd notion in American politics that the wealthy — especially the ultra-wealthy — are somehow impossible to tax.

The quibbling has come from several sources, including a few compiled by FactCheck.org in a piece that suggests that some of Warren’s assumptions are “too rosy.”

But the most detailed attack came from former Treasury Secretary Lawrence H. Summers and Natasha Sarin of the University of Pennsylvania, published in the Washington Post on April 4. They extrapolated from estate tax data to conclude that the estimate by Saez and Zucman is at best more than twice what really would come in, and more likely eight times the real inflow. Summers and Sarin peg the revenue at $75 billion or possibly $25 billion in the first year, compared to the Saez-Zucman estimate of $212 billion.

Among the reasons for the shortfall, Summers and Sarin suggest, is that the wealthy have “myriad ways” to avoid the tax and that the proposal would “require vast audit resources at a time when the IRS is unable to audit even 10 percent of millionaires.” They point to the harboring of wealth in privately owned businesses, which are hard to value precisely. Summers says that his time at Treasury taught him that economists always overestimate the revenue from tax reforms because they don’t account for the “variety of legal tricks” conjured up by the targets.

Summers and Sarin imply they write not in anger but in sorrow. Their piece is nothing like a conservative screed carrying water for the 0.1%, the target of Warren’s plan, but a warning that reality will “disappoint advocates” of the wealth tax. (Reality has a way of doing that.)

Saez and Zucman treat this warning as defeatist. They say Summers and Sarin “start from the premise that the rich cannot be taxed, to arrive at the conclusion that a tax on the rich would not collect much.”

They say they factored into their calculations the expectation that the wealthy would shelter 15% of their income, rather than the 90% posited by Summers and Sarin. They agree that there’s “widespread estate tax dodging” amounting to about 50% of taxes owed. (This is not necessarily illegal; the estate tax offers an exemption of $22.8 million per couple.)

Saez and Zucman also say that appraising the net worth of the ultra-rich isn’t as difficult as it’s often made out to be. “The richest 15 Americans alone are so rich that they would pay $28 billion in wealth tax,” they write, “more than the Summers and Sarin grand total of $25 billion.”

Most of those potentates’ wealth comes from their shares of big publicly traded corporations such as Amazon, Microsoft, Berkshire Hathaway and Facebook, which have easily discernible valuations.

“For them, avoiding the wealth tax is impossible,” they write. “How could Jeff Bezos pretend that his wealth in Amazon stock is worth only a fraction of its observable market value?” Overall, they say, 80% of the wealth of the top 0.1% comes from publicly traded stocks, bonds and real estate.

Then there’s the issue of enforcement. Put simply, today’s ultra-rich are getting a free pass. Among households with annual income of $10 million or more, the percentage of returns that get audited has fallen from about 30% in 2011 to 6.7% in fiscal 2018. The rate for those with income between $5 million and $10 million has fallen from 26.75% to 4.2%.

Warren’s plan explicitly calls for reversing the systematic hollowing-out of the Internal Revenue Service’s enforcement resources seen in recent decades, an obvious boon to the rich. She says her plan would encompass “strong anti-evasion measures,” including “a significant increase in the IRS enforcement budget.”

As Saez and Zucman observe, “It is not appropriate to assume that a Warren wealth tax would be as poorly enforced as the estate tax currently.” That’s true: A Congress and White House that enacted the wealth tax would make sure that enforcement would be part of the package.

To some extent, the actual revenue numbers being debated by economists are beside the point even if, by the most minimalist figures offered by Summers and Sarin, the wealth tax would bring in a mere $250 billion over 10 years.

The real point is that our tax structure has become a major contributor to wealth inequality in the U.S., as the signatories to the tycoons’ open letter acknowledge.

We’ve relentlessly cut the top marginal rate on the richest Americans and endowed them with exemptions and loopholes that have fostered aristocratic family fortunes utterly alien to the America envisioned by our founding fathers. This trend hasn’t made America richer; it has just contributed to the stagnation of economic opportunity for the 99%.

Warren’s concept is right: It’s time to stop allowing the rich to evade their fair share. The details will be worked out soon enough.

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email michael.hiltzik@latimes.com.

Return to Michael Hiltzik’s blog.