Paramount Pictures is doing better: It turned a teeny profit in Viacom’s most recent quarter

After racking up hundreds of millions of dollars in losses in recent years, Paramount Pictures is flipping its script: Viacom Inc.’s Melrose Avenue film studio eked out a profit during its fiscal second quarter.

“This is an important step,” Viacom Chief Executive Bob Bakish told Wall Street analysts on a Wednesday morning conference call. “Paramount’s turnaround is really taking hold.”

Viacom has been cheering the success of “A Quiet Place,” a horror movie from Paramount that has scared up $131 million domestically since its April 6 release. However, for the January-through-March quarter, the film studio notched another weak performance at the box office, generating just $50 million in sales — down 79% from the year-earlier period.

Studio revenue tumbled 17% to $741 million. Nonetheless, more than half of the revenue came from lucrative licensing deals, including “Cloverfield Paradox” and the TV project “The Alienist.” Such licensing deals were just enough to nudge Paramount into the black with an adjusted operating income of $9 million, compared with a loss of $66 million in the year-earlier period.

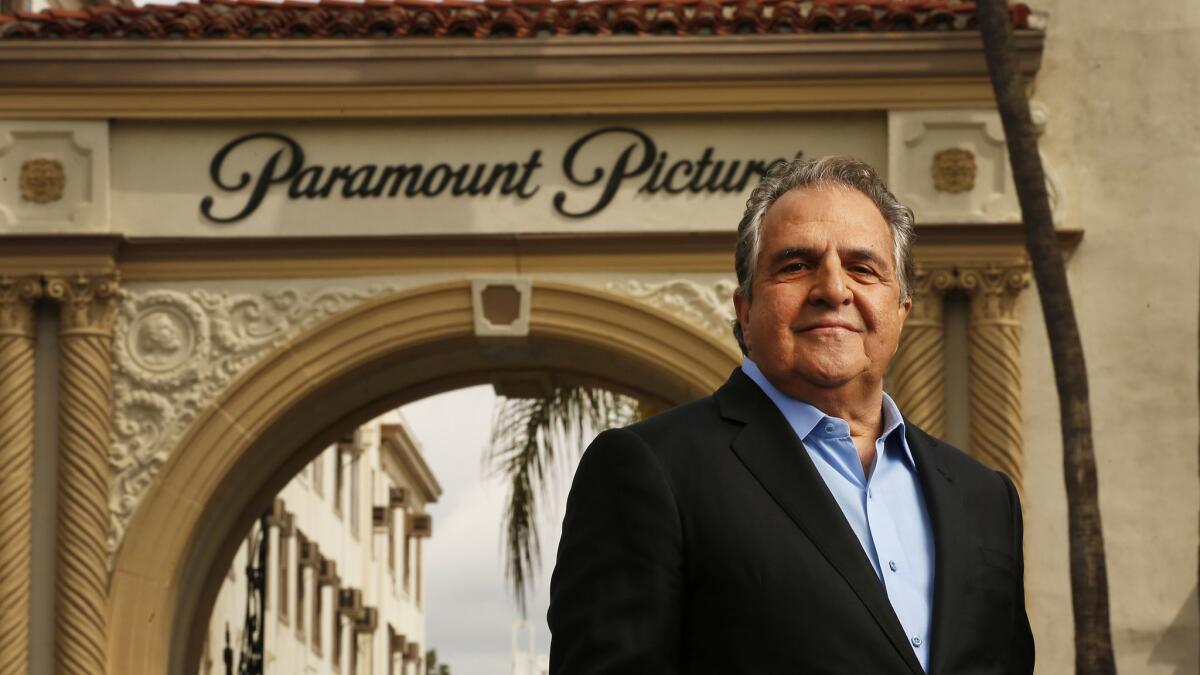

It has been a year since Bakish overhauled Paramount’s management, installing film veteran Jim Gianopulos after a long career at 20th Century Fox. Paramount should return to “meaningful growth” in 2019, Viacom’s chief financial officer, Wade Davis, told analysts.

Paramount increasingly has focused on its television pipeline; it has 17 shows ordered or in production. TV production should produce $400 million in revenue this fiscal year.

“We love the trajectory of this business,” Bakish said about television production. “We’re exiting the first half of our fiscal year with real momentum, and we are excited about our return to growth.”

Viacom’s core business is its cluster of cable TV networks, including MTV, Nickelodeon, VH1, BET, TV Land and the rebranded Paramount TV. Its television networks’ revenue inched up 1% to $2.43 billion in the quarter, boosted by international growth that offset declines in domestic revenue.

Adjusted operating income for the TV networks group declined 5% to $706 million in the quarter. Viacom also recorded a $185-million write-down in the quarter for restructuring in the television unit.

Overall, Viacom reported net income of $266 million, or 66 cents per share, up from $121 million, or 30 cents per share, in the year-earlier period. Total revenue fell 3% to $3.15 billion.

Viacom’s fiscal second-quarter results were issued without a whisper of the behind-the-scenes wrangling between CBS Corp. and Viacom over the fate of a merger that controlling shareholder Shari Redstone is pushing. Analysts were told that Viacom would not field questions about the closely-watched negotiations.

Redstone’s campaign marks the second time in less than two years that she has tried to coax CBS and its chief executive, Leslie Moonves, to agree to a marriage with Viacom. Redstone is eager to rebuild the media company that her father — the ailing Sumner Redstone — helped build into a cable programming juggernaut.

Shari Redstone believes Viacom and CBS would be stronger together as they compete against streaming-video titans such as Netflix and Amazon, which are taking viewers away from traditional television channels.

The Redstone family, through their investment vehicle National Amusements Inc., controls both CBS and Viacom, with nearly 80% of the voting stock of both companies.

The main sticking point appears to be whether Shari Redstone, 64, would be heavily involved in managing the combined company. She has said she wants Moonves to run the new company for at least two years, with Bakish, her hand-picked lieutenant at Viacom, serving as second-in-command and heir apparent.

But Moonves has insisted on picking his own management team, which would include Joseph Ianniello, the chief operating officer at CBS.

Redstone could simply shake up CBS’ board, and a new board could fire Moonves, who has run the network since 1995 and served as chief executive of CBS Corp. since 2006. But Wall Street has confidence in Moonves, and CBS’ stock dropped more than 10% earlier this year on reports that National Amusements might unilaterally reconfigure CBS’ board. That reconfiguration still could happen if merger talks stall.

Viacom shares closed up 26 cents or nearly 1% to $31.18.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.