Must Reads: As streaming video grows, TV networks fight to keep their share of upfront ad dollars

Even as they face rising competition from digital video and tumbling ratings, TV networks proudly tout their new offerings every spring in front of advertisers gathered at glitzy New York venues such as Radio City Music Hall.

The annual ritual begins Monday when network executives will once again make their pitch to advertisers to kick off the all-important commercial sales period for the fall TV season known as the upfront market. But they will have to dance faster than the high-kicking Rockettes to get past the challenges they face.

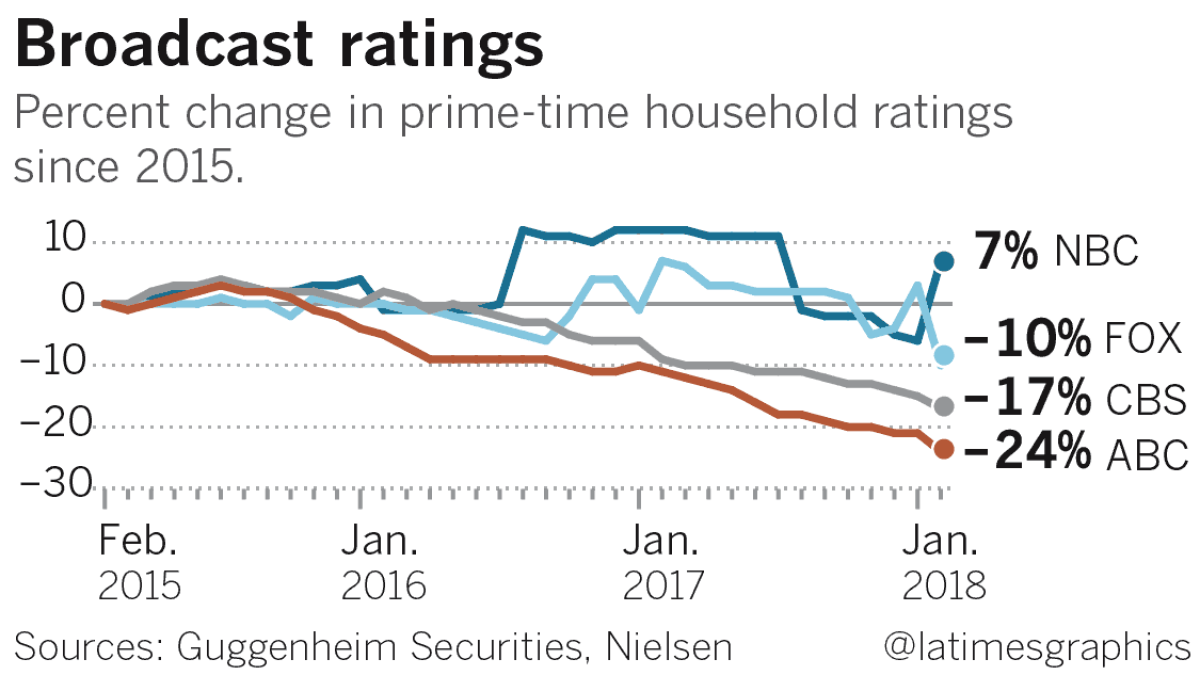

The broadcast networks have seen double-digit declines in viewing by the 18-to-49 age group most coveted by advertisers. Many cable channels are seeing audience erosion too, as pay TV subscriptions dropped by 3.6 million in 2017 and an additional 700,000 in the first quarter of 2018, according to data from Kagan, a unit of S&P Global Market Intelligence.

A generation of younger viewers is eschewing traditional TV viewing by watching what they want when they want it online, with fewer commercials or no ad interruptions at all. Overall prime-time TV usage among the 18-to-49 age group is down 9% from last year, according to Nielsen.

Meanwhile, streaming video behemoth Netflix has rubbed salt in the traditional television industry’s wounds by poaching brand name show creators such as Shonda Rhimes, who created “Grey’s Anatomy” and “Scandal” for ABC; and Fox’s Ryan Murphy, who gave the network its newest success “9-1-1.” Netflix lavished them with lucrative production deals that offered more creative freedom.

With all the technological turmoil that has altered audience habits, the TV industry’s weeklong parade of new shows seems like an anachronism. The tradition of upfront presentations started in the early 1960s, when the launch of the TV season was tied to when new automotive models hit car showrooms.

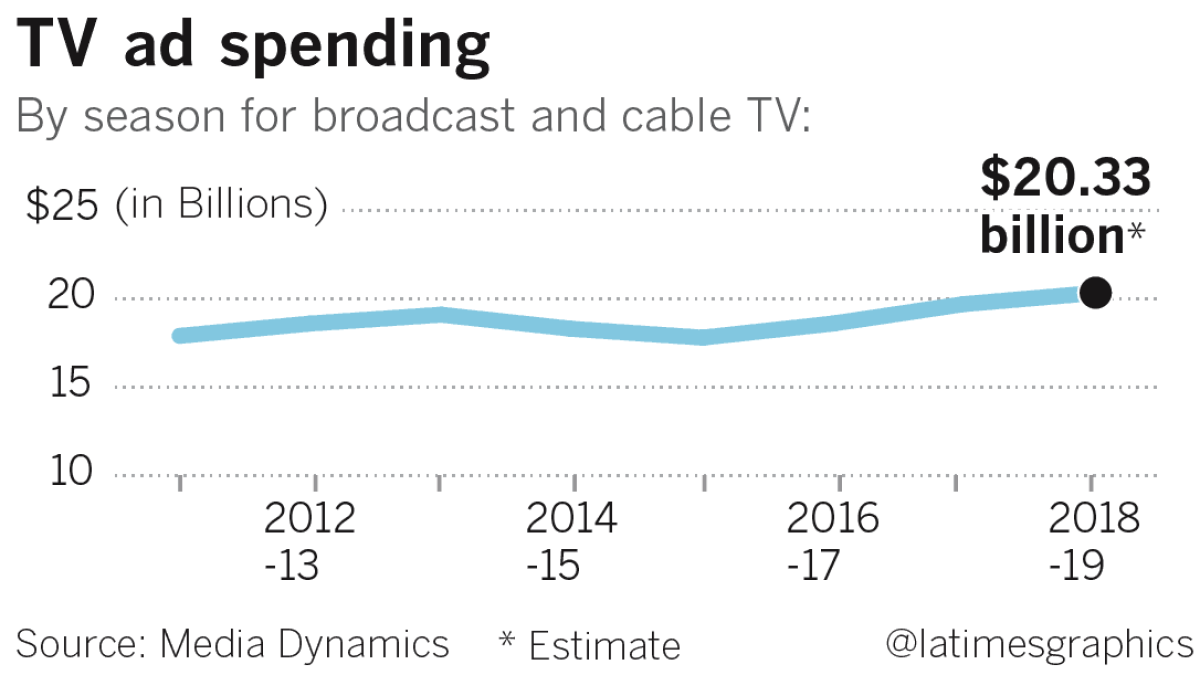

Despite the disruption occurring in TV, the annual take for broadcast and cable networks in advanced advertising sales is not expected to drop significantly this year after hitting $19.7 billion in 2017, a 6% increase over 2016, according to the research firm Media Dynamics.

Research firm EMarketer is projecting a 3% rise in upfront sales this year. But other analysts are less optimistic, projecting a decline in the 2% to 3% range.

Brian Wieser, advertising analyst with Pivotal Research Group, predicted that overall ad-spending for television probably will be down about 2% for the full year. The networks sell the bulk of their time, but not all of it, in the upfront market.

“The available spending for television is the proverbial melting ice cube, and the ice cube isn’t going to refreeze anytime soon,” Wieser said.

The anticipated ad revenue decline is modest compared with the continued downward ratings spiral, largely because the upfront market offers advertisers the opportunity to lock in commercials on the shows and dates they want at a lower price than if they purchased the spots closer to air time. CBS Chairman Leslie Moonves recently told Wall Street analysts that the “scatter market” for last minute commercial buys has been running 20% above last year’s upfront pricing, an indication that demand will remain healthy.

“Even as ratings go down somewhat … network advertising is still the best game in town, “ Moonves said.

Declining ratings have actually helped prop up TV ad pricing. As it takes more commercials to reach the same number of people, the pressure on the supply of available time has driven up rates. A survey taken by Ad Age found the average 30-second spot in a broadcast network prime-time program in the current TV season cost $134,006, an increase of 6% over the previous year.

“The key to the upfront market has always been scarcity,” said Arnie Semsky, a media consultant who negotiated on behalf of major ad agencies for two decades. “If you wanted the best shows with the best time periods you needed to move early or otherwise those opportunities would be gone. That’s the underlying premise.”

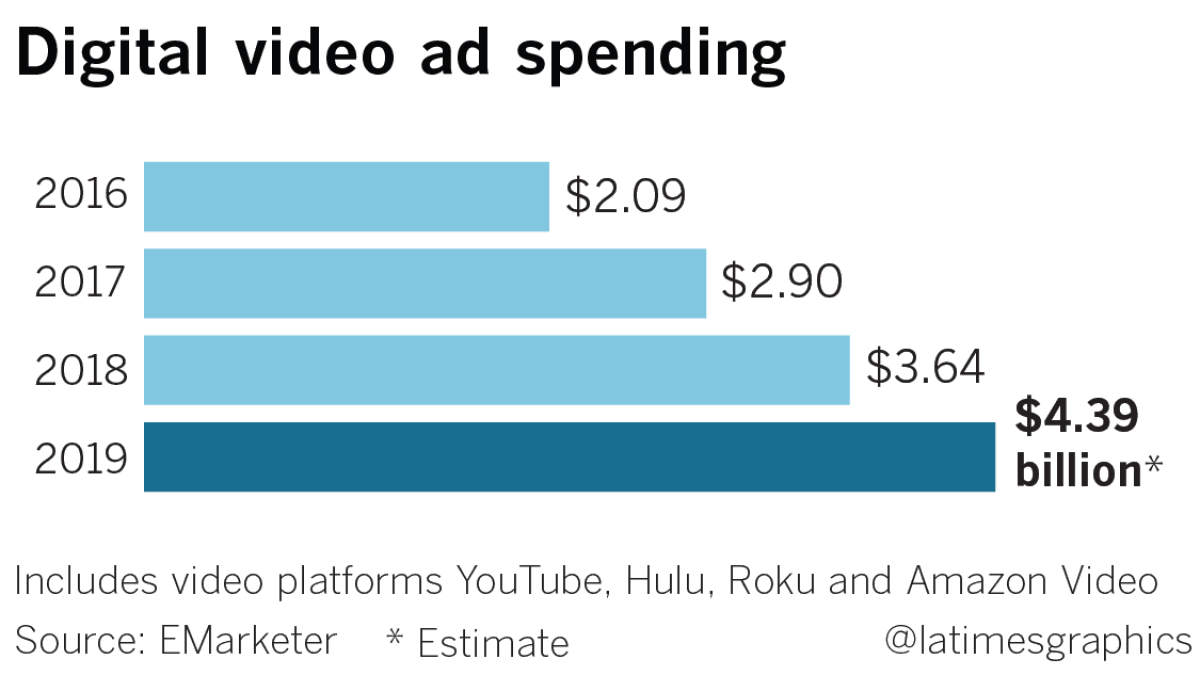

But as more viewers are flocking to video online, advertising dollars are following them. The total upfront ad spending on digital video platforms such as YouTube, Hulu and Sling TV is expected to hit $3.6 billion, a 25% increase over last year, according to EMarketer.

One way the networks will be fighting that tide during upfront week is stressing how TV is a more reliable platform than YouTube, Facebook and other digital offerings that carry user-generated video.

Jason Maltby, president and co-executive director of national broadcast TV at the media buying firm Mindshare, expects the networks to repeat last year’s strategy of exploiting advertisers’ fears about seeing their commercials run next to a video that is potentially offensive or carries a politically provocative message.

“TV is inherently brand safe,” Maltby said. “You know exactly what piece of content you’re going to run in before it runs. There’s no guesswork, particularly when you’re buying prime time.”

It’s a concern not lost on the streaming companies. At the recent YouTube advertiser presentation, Chief Executive Susan Wojcicki touted corporate efforts to better police the content appearing on the site, which has pulled many younger viewers away from traditional TV viewing.

While the major beneficiaries of digital video advertising are YouTube, Hulu and Roku, the TV networks (and their production studios) are in the streaming business too. Even as traditional TV consumption declines, network executives know that their shows are being watched by millions of viewers online.

The biggest hit shows on the networks, such as CBS’ long-running drama “NCIS,” are also among the most popular offerings on Netflix.

“A lot of the content that networks are creating is increasingly monetizing through digital video platforms,” said Paul Verna, senior analyst for EMarketer. “So the fact that the dollars are moving out of linear TV doesn’t necessarily mean that those companies are losing those dollars. They’re just going to a different platform that they also participate in.”

The networks sell ads on the shows they present on their own streaming video players, but for a far lower rate than what they get for the audience they reach on TV.

While ad revenue is still a crucial part of the network TV business, executives say the upfront presentations also serve as a marketing launch for programing that will generate revenue from other sources.

The networks’ production studios sell their programs to Netflix, Amazon and other streaming services. They also negotiate for compensation from their TV station affiliates and retransmission fees from cable companies, satellite services and direct-to-consumer streaming video providers that carry their stations.

“The value proposition has definitely flipped,” said one network executive who was not authorized to discuss the upfront market publicly. “Advertising was once the be all, end all and that’s just not the case anymore.”

Nevertheless, the networks will try to extract more value out of the commercial spots they sell this year. Fox, NBC and a number of cable networks have committed to reducing the number of commercials in some programs — an acknowledgment that viewers who use streaming platforms are accustomed to seeing fewer or no ad messages when they watch.

The networks will be looking to sell those commercials at a higher rate, with the reasoning that messages in a less-cluttered environment improves what they call the “viewer experience” and, thus, are more effective. It remains to be seen if such a strategy will work. Ad agency buyers are reportedly already balking at NBC’s asking price for ads that will run in the shorter ad breaks.

“It needs to be proven out,” Maltby said. “If there are two pieces of video content and both get a million people, and one has five messages instead of 10, does the one with five actually drive more sales? That’s what advertisers care about.”

They also care about hit shows, which are harder to come by in today’s crowded landscape with more than 400 scripted programs. But it’s not impossible. Two new series — CBS’ “Young Sheldon” and ABC’s “The Good Doctor” broke into Nielsen’s top 10 most-watched programs for the season, both averaging around 16 million viewers. NBC’s post-Super Bowl airing of its sophomore drama “This Is Us” had more viewers than this year’s Oscars telecast.

The broadcast networks are tempted this year to launch more reboots of proven titles after the successful revival of “Roseanne” on ABC and “Will and Grace” on NBC. For example, CBS plans new versions of “Murphy Brown” and “Magnum P.I.” And Fox plans to revive “Last Man Standing,” starring Tim Allen, after that show was canceled by ABC last year after six seasons.

Maltby, however, said he would prefer that network programmers replenish their shelves with new titles.

“The shows that have resonated the most in the past two years are the ones that are most distinct,” Maltby noted. “They are not copycats of anything else.”

Twitter: @SteveBattaglio

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.