Allergan fights back: Botox maker reportedly pursuing Salix; stocks up

Botox maker Allergan Inc. of Irvine is reportedly interested in acquiring a North Carolina drugmaker, part of its effort to fight off a takeover attempt by a Canadian rival.

The stock market responded, driving Allergan shares up 4%.

Allergan’s Tuesday gain followed a report in the Wall Street Journal that it has had discussions about buying Salix Pharmaceuticals Ltd. and at least one other company. Salix’s stock gained 16% on the news.

Representatives of Allergan and Salix declined comment.

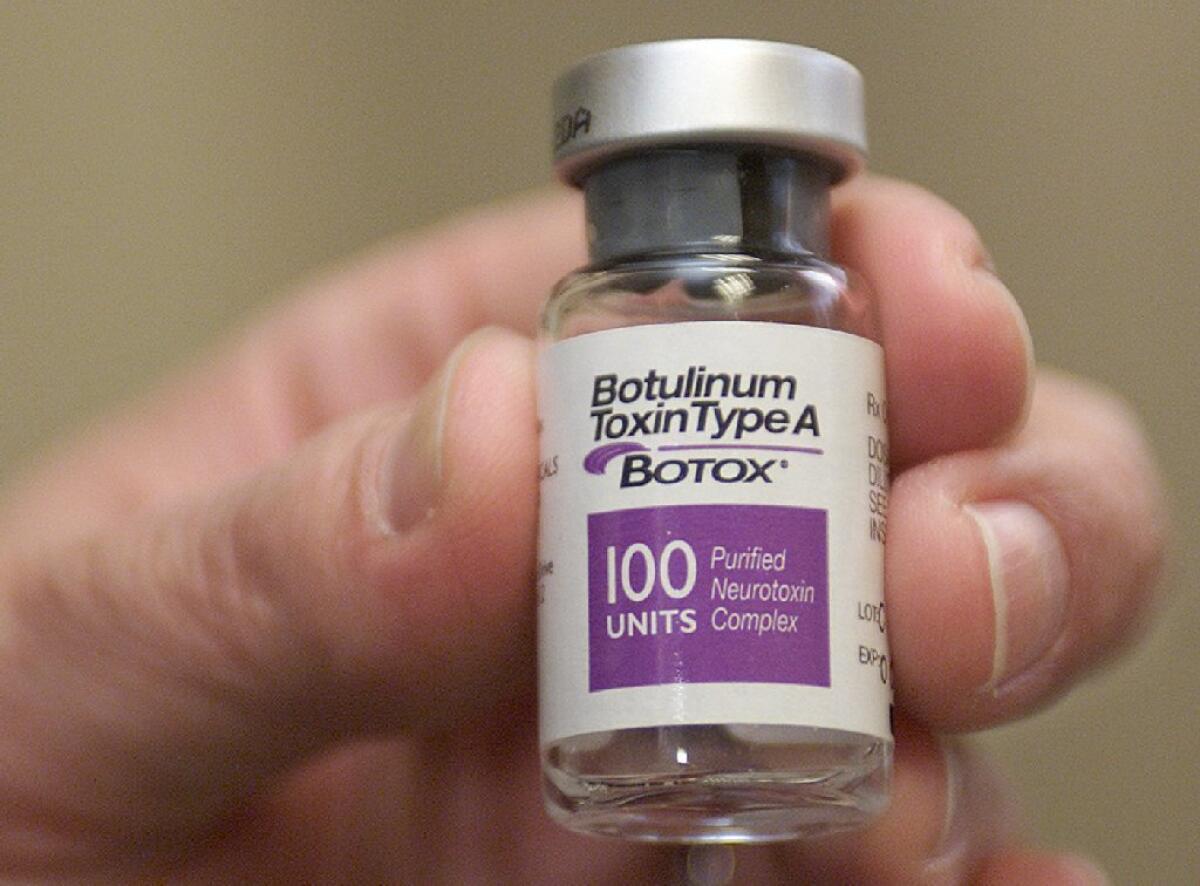

Allergan is fighting a takeover attempt from Valeant Pharmaceuticals International Inc. and its partner, hedge-fund manager Bill Ackman. Valeant has offered $53 billion in cash and stock for Allergan, but the maker of the popular wrinkle treatment Botox has rejected the offer as too low.

Valeant said the deal would be good for Allergan shareholders, saying it would increase the company’s profits by reducing the amount of money it spends on research and taxes.

Salix of Raleigh, N.C., is merging with Italian drugmaker Cosmo Pharmaceuticals, a move that would allow the company to move its tax address to Ireland. If Allergan acquired Salix, it might also be able to move its tax address to Ireland and reduce its tax expenses.

Allergan’s interest in Salix comes as the company takes several steps to fight off Valeant’s bid. In July, the company said it would slash 1,500 jobs and close two plants in an effort to increase profitability, a direct response to Valeant’s allegations that the company is too fat.

Earlier this month, Allergan sued Valeant and Ackman’s hedge fund, Pershing Square Capital Management, accusing them of securities fraud. The lawsuit alleged that Pershing Square violated insider-trading laws by buying nearly 10% of Allergan’s stock before announcing that is was partnering with Valeant in an effort to buy Allergan.

Meanwhile, Ackman and Valeant are attempting to call a special meeting of Allergan shareholders to elect new board members who would approve the takeover. The meeting has not been scheduled.