SEC tightens rules to avoid runs on money-market funds

Investors in money-market mutual funds face potential new fees and selling restrictions under rules approved by securities regulators Wednesday.

The Securities and Exchange Commission voted to allow money funds to charge special fees, or temporarily prohibit redemptions, during turbulent periods in the financial markets.

The goal is to stave off crippling withdrawals that could exacerbate a market selloff.

The SEC also imposed an additional change that applies only to funds serving large institutional investors. That rule will eliminate the $1 fixed share price that long has been a hallmark of the industry and instead let the value float, much like bonds.

All the changes will be phased in over two years. None of the changes would apply to money funds investing in government securities, which are considered to be safe and unlikely to face mass redemptions.

The changes, which represent one of the broadest shifts in money funds, are a long-awaited response to the 2008 global financial crisis.

At the time, one large money fund suffered sharp losses that caused its value to drop below $1, or as the industry calls it, “break the buck.” The federal government stepped in to backstop temporarily all money funds, potentially avoiding a mass exodus that could have inflicted losses on small investors.

The fees and selling ban would apply only during dire financial times, said Peter Crane, president of Crane Data in Westboro, Mass.

“These things would only be used in a meltdown scenario,” Crane said. “You’re talking a September 2008 type of scenario.”

Nevertheless, the changes are intended partly to remind investors of the risks in money funds.

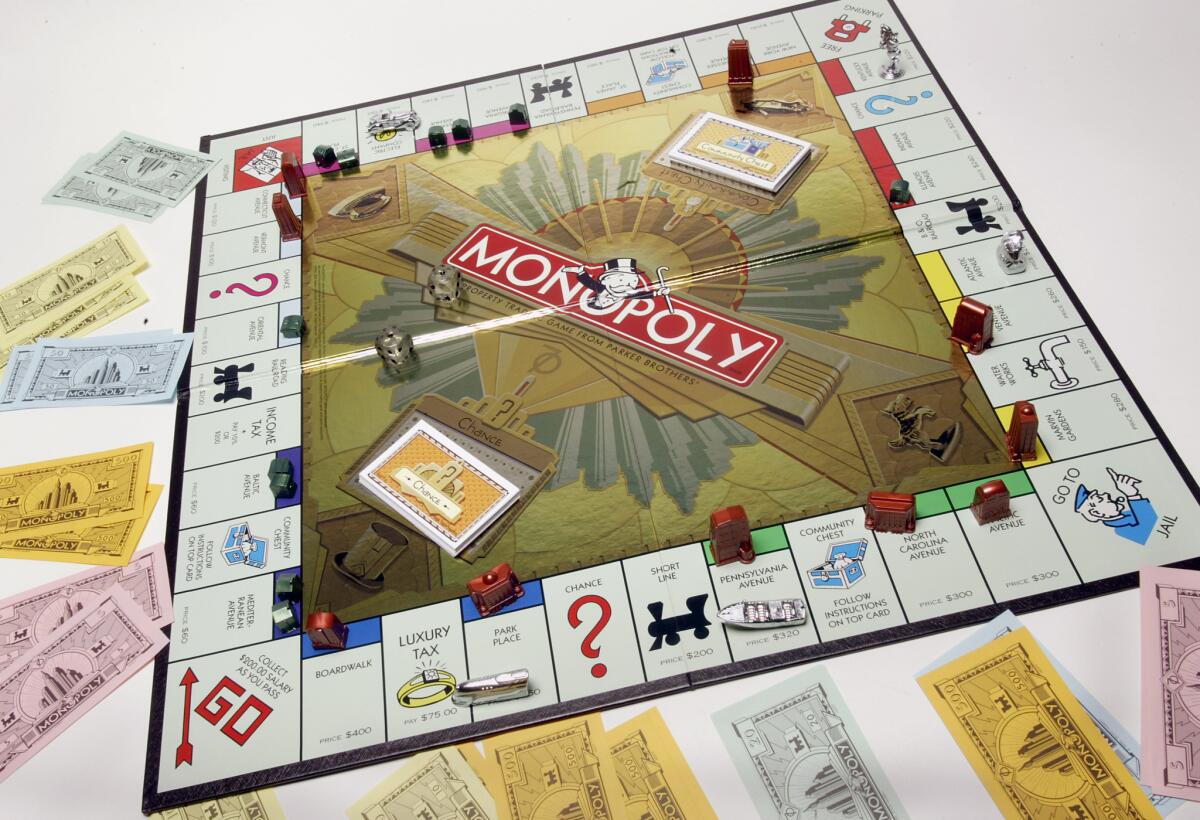

Money funds have long been thought of as the free parking of the financial markets -- a generally short-term and safe holding spot for investor cash. However, unlike federally insured bank accounts, money funds do not carry government deposit insurance.

Follow Walter Hamilton on Twitter @LATwalter