City National deal: A happy union of 2 thriving banks

California, with its booming wealth and population, has always been a fertile place to grow a bank — as in 1904 when Amadeo Giannini founded Bank of America, then called Bank of Italy, to serve immigrant dockworkers.

It may be an even better place to sell a bank. Bank of America was sold in 1998 to acquisition-mad NationsBank for $37 billion — then the largest bank merger in U.S. history.

The latest such deal, announced Thursday, had seemed among the most unlikely until it was announced. City National, the biggest bank in Los Angeles, wasn’t even for sale when it fetched a $5.4-billion offer from Royal Bank of Canada.

City National was founded in 1954 by Jewish businessmen as a Beverly Hills community bank and grew into a local powerhouse known for serving some of Hollywood’s biggest names. Its surprise acquisition falls in a long line of big banks swallowing small to medium regional institutions in California. Most recently, the spate of deals has grown out of the distress of the financial crisis.

Last year, for instance, New York’s CIT Group agreed to pay $3.4 billion in cash and stock for OneWest Bank in Pasadena, created by a group of billionaires from the ashes of aggressive mortgage lender IndyMac Bank, which collapsed under the weight of bad loans.

That echoed deals from an earlier crisis, when big savings and loans, swollen by funding breakneck growth after World War II, were consolidated into bigger savings and loans and then commercial banking operations. First Interstate Bank and Security Pacific Bank in Los Angeles were swallowed into the empires of BofA and Wells Fargo.

Wells itself was taken over in 1998 by Norwest Bank of Minneapolis, which kept the Wells name, San Francisco headquarters and iconic stagecoach logo.

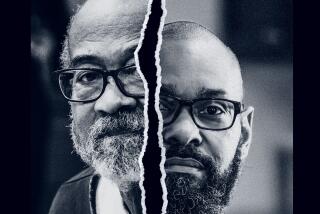

The City National deal is different — a happy union of two thriving banks.

RBC, the 12th-largest bank in the world, was intent on growing its wealth-management operations in the United States.

Who could offer more expertise in the kid-glove handling of finicky high-net-worth customers than the “bank to the stars,” as City National has long been known?

Before getting an offer it couldn’t refuse, City National had been intent on expanding core businesses outside the region, acquiring a series of wealth managers and opening entertainment-oriented branches in New York, Atlanta and Nashville.

But the offer from RBC proved irresistible, City National Chief Executive Russell Goldsmith said in an interview with The Times. What better acquirer than a bank with 340,000 U.S. wealth management clients, operations in the entertainment centers of Toronto and Vancouver, and a banking charter in the United Kingdom, where the merged bank plans to open a London branch?

Such strategic considerations mark a return to traditional mergers after years of shotgun marriages brokered by regulators. Recent takeovers have been driven largely by the Federal Deposit Insurance Corp.’s auctioning off banks that failed — many in California, where borrowers, builders and developers all got sucked under by the housing debacle.

OneWest acquired two failures: First Federal Bank of California in Santa Monica in late 2009 and La Jolla Bank in San Diego early the next year. In other FDIC-assisted deals, East West Bank in Pasadena became by far the dominant player in Chinese-American banking by acquiring United Commercial Bank in San Francisco and Washington First International Bank in Seattle.

Pacific Western, created in the early 2000s by the merger of a score of community banks, acquired small failed banks in Los Angeles, Ventura and Solvang before turning to three more traditional acquisitions, capped by its blockbuster $2.3-billion merger agreement with CapitalSource Inc. of Los Angeles last year.

What remains in California now are many generally healthy small banks and a handful of larger independent regional operators such as Pacific Western, East West, Silicon Valley Bank in Santa Clara and First Republic in San Francisco.

Many bigger banks, including some from overseas, are considering acquiring more California institutions. But the RBC deal for City National has sent a message to potential suitors that they better bring their wallets.

“If that’s your game plan, it’s going to cost you more than you might have thought,” said John Eggemeyer, a prominent bank investor who has been chairman of Pacific Western since its founding in 1990.

It’s also possible that one of the up-and-coming Western banks may cobble together a major institution stretching across the region.

As niche players, East West and Silicon Valley seem less likely to assume that role than Oregon’s Umpqua Bank, San Francisco’s First Republic Bank or PacWest itself.