China’s growth rebounds in fourth quarter

BEIJING — China’s economy rebounded in the fourth quarter, softening the blow of its slowest annual growth in a decade.

China’s gross domestic product beat expectations by rising 7.9% in the quarter from a year earlier, the result of increased infrastructure spending and relaxed monetary policy. For the year, China expanded 7.8% in 2012, its slowest rate of growth since 1999 and well below the 9.3% recorded in 2011 and 10.4% in 2010.

“China’s economic growth has slowed down, but it has been stable,” said Ma Jiantang, head of China’s National Bureau of Statistics, at a news conference Friday. “In 2012, the economic situation was complex and challenging.”

Economists still warn that the current rebound could be short-lived once the infrastructure developments near completion. And although Chinese exports surged in December, there’s little certainty that demand in the U.S. and Europe will hold steady.

“A strong and sustained economic rebound does not seem likely,” said Mark Williams, an economist for Capital Economics.

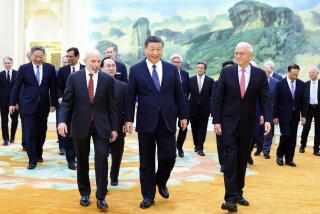

The current rebound will come as a relief to China’s incoming government, which is set to assume full leadership in March, having already taken the reins of the ruling Communist Party in November.

Stable economic growth is paramount during a period of political transition. China was hurt last year by tepid export demand in its two biggest markets, the U.S. and Europe, which is reeling from a debt crisis.

Growth also was subdued by two years of restrictions on buying property, rules aimed at controlling runaway prices.

Fearing the prospect of an economic “hard landing,” policymakers halfway through the year began approving more road, rail and other infrastructure projects. Low inflation also allowed the central government to relax monetary policy, albeit modestly.

In October, a closely watched survey of factory managers showed conditions were improving. In November, a gauge of industrial production broke out of a three-month skid.

The positive conditions appear to have reinvigorated the country’s property market, a cornerstone of the domestic economy. An official index of new-home prices in 70 major cities rose 0.3% in November — a mere uptick, but still the highest in 19 months, according to Reuters.

The days of double-digit growth may be gone forever, but analysts still expect China to outpace its growth target of 7.5% this year.

The World Bank said Wednesday that it expected China to expand 8.4% this year, down from its previous forecast of 8.6%, because of rising risks over inflation and trade.

A stable Chinese economy is crucial to commodity-exporting nations such as Australia and Brazil, which rely on China for its voracious iron ore demand.

American consumer giants such as McDonald’s Corp. and Yum Brands Inc., which owns KFC and Pizza Hut, are also relying heavily on Chinese growth. The two brands saw revenues trimmed by last year’s slowdown in the Asian market.

To sustain long-term growth, the Chinese government is under growing pressure to reform its $8.3-trillion economy to rely more on domestic consumption rather than investment and trade. But that will require massive changes to the nation’s financial system, state-owned enterprise sector and residential permit laws. Reforms could take years and anger powerful interest groups.

China’s new leaders “will be eager to achieve a positive economic story in 2013,” said Nicholas Consonery, an analyst for Eurasia Group. “That would build on a moderate uptick in growth over the final months of last year.

This would bolster confidence, from the public and the Communist Party, in President Xi Jinping and Premier Li Keqiang and enable them to solidify domestic support. The result would be that China’s new leaders focus on economic stability and political consolidation more than on comprehensive reform initiatives during their first year in office.”