Cellphones may make wallets obsolete

Ever write a check while shopping and sweat over whether the check would clear? A growing number of banks are offering a new and fairly painless way to eliminate the guesswork.

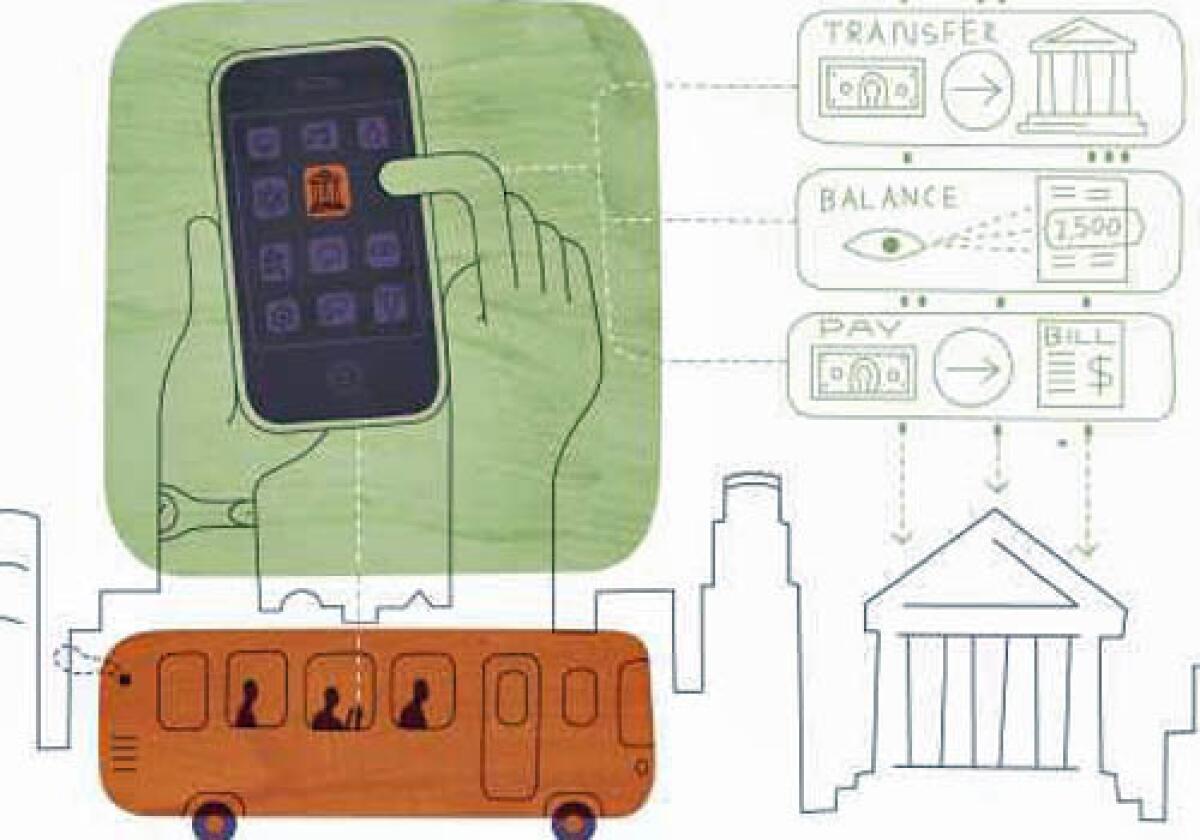

The solution fits in your pocket.

Eight of the 10 biggest U.S. banks now provide at least basic services on cellphones, allowing account holders to check their balances by tapping away on their tiny keypads.

For the record:

Mobile banking: An article in Business on Sunday about mobile banking gave the wrong name for the chief executive of Vivotech Inc. His name is Michael Mullagh, not Hans Reisgies. It was Mullagh who said mobile banking systems should catch on by 2010 as more phones come with built-in radio-frequency mechanisms, that about 50 million credit cards equipped with radio-frequency chips have been issued and that the number of such cards should reach 80 million by the end of the year. Reisgies, to whom the comments had been attributed, is Vivotech’s director of software business development.

Millions of U.S. consumers have signed up for mobile banking as those services grow increasingly useful. Depending on your bank, your phone and your wireless plan, you might be able to approve bill payments, transfer money and receive alerts when balances get low, all while riding the bus.

“Most consumers aren’t aware that it’s out there yet, but the day is coming,” said Mark Schwanhausser, an analyst with Javelin Strategy & Research in Pleasanton, Calif. “Phones are ever-ready, always on and always with you, and you can’t match that with a computer.”

In one sign of where things are headed, Visa Inc. launched a pilot program last week with eight major banks to send text alerts to 2,000 consumers within seconds after unusual transactions. The customers could then cancel their cards before anything else happens.

All the services are handy, free -- and may be just the beginning. The banks hope that getting you used to making payments with a phone will lead to the day when you’ll be happy to buy things with it, as folks already do in Japan and South Korea. Phones there act as a virtual wallet, enabling their owners to ring up purchases with a wave of their handset near a sensor.

It’s still going to be a while before many people in the U.S. use phones instead of quarters to buy a can of soda from a vending machine.

But here’s what you can do now and what you can reasonably expect to do in the near future.

At Bank of America, more than 1.2 million customers have signed up for mobile services since their launch in May 2007, putting that bank at the head of the pack. To use them, a customer must have a phone that can browse the Web.

The bank sees it as an extension of online banking from personal computers, said Doug Brown, senior vice president of e-commerce product development. “Anything they can see from a desktop [computer], they can see from their phone,” he said.

Bank of America, Capital One and Wachovia are among the few institutions that allow transfers between bank customers.

Bank of America says 98% of its mobile banking customers check their balances on their phones, and 40% transfer funds or approve online payment of a bill to a regular vendor. One limitation: The ability to pay each creditor has to be set up first on a PC.

Wells Fargo has fewer things you can do but still allows mobile users to check balances and transfer money among their own accounts. They can accomplish that with either a smart phone’s Web browser or simple texting, which is enabled on the vast majority of U.S. cellphones. (Wireless companies charge varying fees for text messages and Web surfing.)

“A lot of our customers are doing text messaging at the point of sale, with their debit cards in hand, saying: ‘Do I have enough money or don’t I?’ ” said Jim Smith, head of Wells Fargo’s Internet services group.

Wells Fargo, Bank of America and Citibank, among others, also send text warnings if your account balance dips below a certain level or if something else has happened that you want to know about.

Beyond that, Bank of America uses your phone as a security check. If customers enroll in a free security program called SafePass, they get text messages with a different numeric code sent to them during each online banking transaction. That way, even if someone else has swiped your log-on name and password, they would need control of your phone as well to move money.

What would be really useful, of course, is a message or phone call warning you that a check you wrote is about to bounce -- alerting you to deposit enough to cover it. Wells Fargo and Bank of America both say they’re working on the idea, despite logistical hurdles, but they’re not there yet.

Most banks are still building out their efforts and adding new tricks. Sooner or later, Bank of America says, you’ll be able to make payments to non-Bank of America customers.

But what the banks really want is to bring the virtual wallet concept to the mainstream. That’s because they crave a piece of the action, perhaps from the merchant, when you pay somewhere just by swiping your phone. Many banks have done limited tests of such systems, but with an enormous catch: Participants had to go to their banks to get a specially equipped phone.

For such a system to catch on, a lot more has to happen.

Many more phones have to come with built-in radio-frequency mechanisms. That should happen in 2010, according to Hans Reisgies, chief executive of Vivotech Inc. His Santa Clara, Calif.-based company sells the majority of contactless card readers in the U.S. These devices catch the payment signals sent by phones.

And there will have to be readers installed in many more places. That’s already happening, courtesy of the credit card companies and some enthusiastic vendors. Some 50 million credit cards equipped with radio-frequency chips have been issued, and the number should reach 80 million by the end of the year, Reisgies said. The more radio-enabled credit cards there are, the more readers will be needed -- and the same readers will work with phones, speeding their distribution.

The telecommunications carriers could certainly gum up the works by demanding a big cut in exchange for allowing radio-enabled phones to be sold through their stores. But they are generally becoming more obliging about allowing new technologies to use their networks.

Bank of America’s Brown pointed to Apple Inc.’s iPhone and Google Inc.’s nascent software platform for other smart phones, called Android, as examples of products driving change in the wireless market that will benefit banks.

“It will happen,” he said. “There’s a lot of forces providing the ecosystem.”

In three to five years, he predicted, you will be able to buy a whole host of things directly through your phone.

Until then, at least you can use your phone to see whether you can afford the things in the first place.