Redstones scrap proposed CBS-Viacom merger, unnerving investors

After flirting with the prospect of reuniting Viacom Inc. and CBS Corp., Shari Redstone on Monday abruptly reversed course, saying the two media firms were strong enough to stand on their own.

Viacom shareholders were unnerved by the news, the latest surprise at a company that has been roiled by turmoil for more than a year.

Shares in Viacom plummeted 9.4%, or $3.63 a share, to $34.99. CBS slipped just 41 cents, or less than a percent 1%, to $62.15 — reflecting sentiment on Wall Street that CBS might indeed be better off without Viacom’s struggling TV channels, including Comedy Central and MTV, weighing it down.

Some Viacom investors expressed confusion and disappointment that the Redstone family, which controls the two media companies with nearly 80% of the voting shares, abandoned the proposed merger just just three months after advocating for it.

“Expectation of rational behavior at family owned companies, especially in the media industry, proves to be misplaced often, which now seems to be the case at Viacom,” Barclay’s Capital media analyst Kannan Venkateshwar said in a report.

Wall Street had been rooting for a deal, believing that CBS — with its stronger management and hugely popular CBS broadcast network — would boost the value of Viacom and enable it to negotiate more lucrative deals with pay-TV operators and streaming services.

Shari Redstone was expected to hand the keys of the kingdom to CBS Chief Executive Leslie Moonves so he could run the combined company. Investors had been banking on Moonves’ Hollywood touch and his willingness to experiment with digital platforms to make Viacom’s cable channels more relevant to a new generation. They also thought Moonves could turn around Viacom’s struggling movie studio, Paramount Pictures, which lost nearly $450 million in the most recent fiscal year.

“There are a lot of dots that I can’t connect,” said Mario Gabelli, whose funds make up the second-largest voting shareholder group in Viacom and CBS, behind the Redstone family. “Just stay tuned: This ain’t over.”

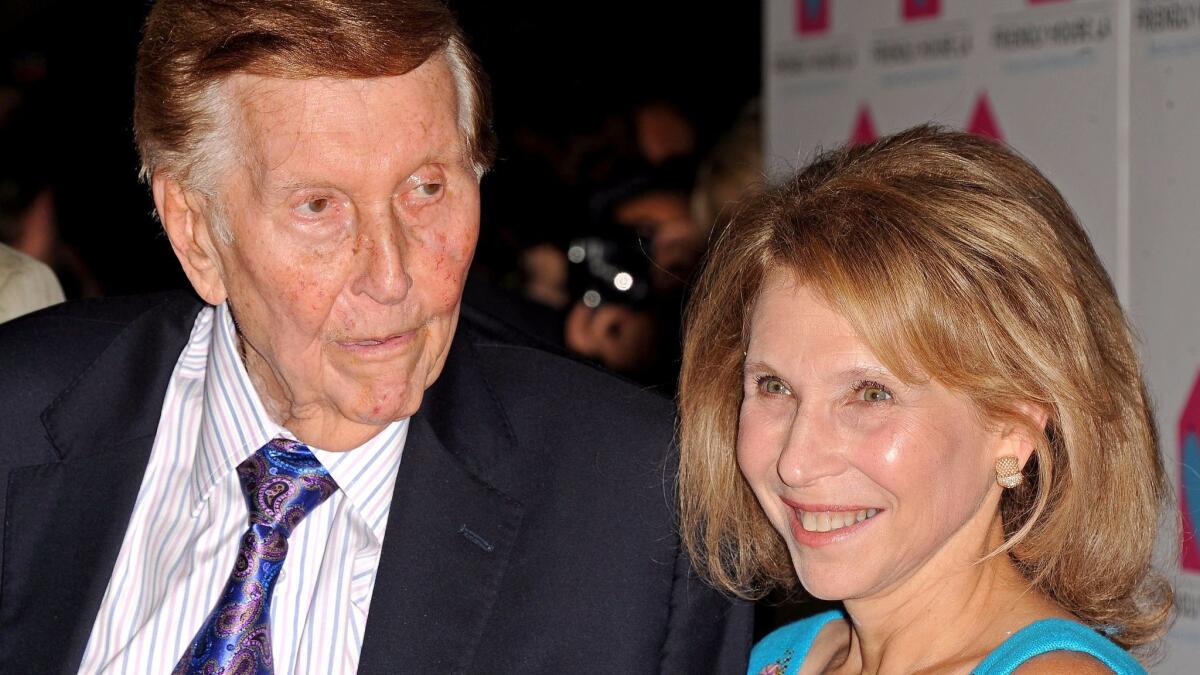

In a letter to the Viacom and CBS directors, Shari and Sumner Redstone said: “Over the past few months, after careful assessment and meetings with the leadership of both companies, we have concluded that this is not the right time to merge the companies.”

The Redstones control nearly 80% of the voting shares of both companies through their Massachusetts-based investment vehicle National Amusements Inc. Shari Redstone -- who is president of National Amusements and vice chair of Viacom and CBS -- this year has asserted authority over the family’s holdings amid her 93-year-old father’s deteriorating health and boardroom battles with the previous Viacom leadership and legal squabbles with the mogul’s former girlfriends.

Initially, the Redstones viewed a merger as the best way to boost the value of Viacom, whose stock has fallen dramatically in the last two years, and make the family’s media empire whole again. Viacom and CBS were part of the same company until Sumner Redstone split his empire apart in 2006.

The proposed consolidation was expected to be a crowning achievement for Sumner Redstone, combining his sprawling media assets into one large company that could better navigate the challenges facing traditional media companies.

However, the marriage broke down over proposed valuations for Viacom and Moonves’ request for autonomy running the combined company, according to three people familiar with the situation who were not authorized to discuss the matter.

Moonves sought assurances to run the merged company as he saw fit, including the power to make changes in Viacom leadership team and a board with whom he felt comfortable.

Moonves also favored a provision to require a super-majority vote of the combined company’s board in order to fire him, according to one of the knowledgeable people. That would have diluted the Redstone family’s clout to make changes like the family did this year when it revamped the Viacom board.

Some Viacom board members were uncomfortable with such a measure, particularly after the family’s high-profile and expensive battle to unseat Viacom’s previous CEO, Philippe Dauman. However, two others said merger plans were halted before the two committees tried to hammer out governance issues or even decide on the name of the combined company.

Ultimately, CBS board members did not want to punish their shareholders by paying too high a price for Viacom, given the ratings declines at key networks and missteps at Paramount Pictures.

Just before Thanksgiving, Viacom’s board committee made a case to CBS’ special committee members that Viacom’s stock was worth considerably more than its current levels — and more than what CBS was willing to pay.

CBS wasn’t prepared to go above $40 a share for Viacom, which has lost nearly 50% of its value in the last two years, people familiar with the matter said.

There were other factors, too.

Since the proposal was first made by the Redstone family in late September, Bob Bakish was named interim CEO in mid-November, and five new board members have become engaged in the affairs of the media company. With the merger talks ceased, Viacom on Monday appointed Bakish as president and CEO of the media company.

Shari Redstone, who has become more active in Viacom’s management, said she was encouraged by Bakish’s plans for Viacom and his energy in his first month on the job.

“We have been very impressed with the forward-looking thinking and strategic plan being pursued under Bob Bakish’s leadership,” Shari Redstone said in the letter to the boards of Viacom and CBS.

But analysts are not convinced that Viacom, under Bakish, is poised for a turnaround.

“It’s going to be a long slog,” said Tuna Amobi, media analyst with CFRA Research. “There is going to be a lot of heavy lifting for a while, and there’s skepticism out there. Many investors were hoping for the merger and the new management will have to demonstrate some type of vision.”

Monday’s move was not particularly surprising, said Marci Ryvicker, media analyst with Wells Fargo Securities.

“We had been saying that the longer this took, the more likely a deal was NOT going to happen,” Ryvicker said in a research note.

“We think the underlying issue came down to value — we don’t know that either company was able to get to a valuation that made sense for their respective shareholders,” she said.

Times staff writer Samantha Masunaga contributed to this report.

ALSO

Trump’s way of saving U.S. jobs has companies on edge

Rupert Murdoch seeks to add British Sky to the Fox empire

Parents pay for their kids to be models on the fringe of the children’s fashion business

UPDATES:

5:05 p.m.: This article was updated with additional reaction from investors and analysts.

1:13 p.m: This article was updated with closing stock prices for Viacom and CBS.

12:50 p.m: This article was updated with information that Viacom board members had named Bob Bakish permanent chief executive of the media company.

10:15 a.m.: This article was updated with additional background, stock prices and analysis.

7:35 a.m.: This article was updated throughout with additional details, analyst comment and background information.

This article was originally published at 6:50 a.m.