TV networks cut prices for ads but still sell less

In some parts of the country, home prices are back near 2001 levels, and now so is the volume of advertising the TV networks have sold.

Buckling under the pressure of a weak advertising market, the broadcast networks have cut prices for commercial time, a rare setback for companies used to commanding ever-higher prices. It shows how the 1 1/2 -year-long recession is finally catching up with the networks, which rely on a rise in ad revenue to cover the escalating costs of prime-time, news and sports programming.

The retrenchment marks the first time in years that ABC, CBS, NBC and Fox have failed to leverage their large audiences to boost ad prices during the industry’s annual bazaar for TV commercials. In previous years, advertisers grudgingly paid the higher rates despite years of declining ratings because the networks still delivered larger audiences than any other media outlet.

Network executives estimated on Thursday that this year’s sales volume would be down between 15% and 20% compared with last year, when the five English-language broadcasters, including the CW network, rang up a combined $9.2 billion in prime-time sales. That would put this year’s advance, or “upfront,” prime-time commercial sales around $7.5 billion -- a level not seen since 2001. Networks declined to provide individual sales figures.

“The advertising market has been exceedingly weak since last November,” said Jon Swallen, senior vice president for research at TNS Media Intelligence, a firm that tracks ad spending. “The demand is down across all media and as a result, advertising pricing has fallen. It has been a very, very soft marketplace.”

In May, when they unveiled their fall prime-time schedules, network chiefs insisted they wouldn’t lower ad rates. But as negotiations over ad sales dragged on into summer, advertisers refused to make deals unless the networks slashed their prices. At that point the networks realized that they were not immune to the economic downturn.

About three weeks ago, after two months of stalled negotiations and with the fall TV season quickly approaching, network sales teams quietly agreed to lower ad rates to break the impasse.

One media buyer, who asked not to be identified because of the sensitivity of the negotiations, said advertisers held the upper hand in this year’s negotiations.

“The demand just wasn’t there,” the buyer said. “And there was no way we were going back to our clients, the advertisers, with anything that didn’t begin with a negative in front of it.”

Each of the networks lowered its rates, according to people on both sides of the negotiations. The No. 1 network, Fox, trimmed its rates by 2% to 3%. Fourth-place NBC had to swallow cuts of about 8%.

NBC had the added challenge of selling five hours of “The Jay Leno Show” at 10 p.m. Advertisers initially refused to pay prime-time rates for the comedian’s new show, although one person close to the situation said buyers eventually agreed to pay rates closer to those for a lower-cost prime-time news program such as “Dateline.”

The networks also sold substantially fewer commercials in the upfront market this year than in previous years, when they would write orders for as much as 80% of their prime-time inventory for the entire season.

“Total volume is down this year,” CBS Corp. Chief Executive Leslie Moonves told analysts during CBS’ earnings call on Thursday. He said CBS, the only broadcast network to achieve higher ratings in the current season, would take its chances selling more of its time later in the season.

“We like our position as the economy continues to improve,” Moonves said.

Last year, CBS sold about 75% of its available commercials during the upfront market. This year, Moonves said, the total would be about 65% -- another reason the dollar volume in the upfront market was much lower this year.

“Some major advertisers remain on the sidelines in this upfront,” Walt Disney Co. Chief Financial Officer Tom Staggs said last week. Disney owns the ABC network.

Cable networks fared a little better. Industry executives estimated that cable executives sold about 10% less volume compared with last year. Their rate cuts averaged about 6% to 7%.

Some cable channels, meanwhile, were able to maintain their rates.

TNS Media’s Swallen said it was important not to read too much into the results of the upfront market. Advertisers have the ability to cancel the orders they placed in the upfront, and the time sold later in the season often goes for much higher prices -- improving the network’s position.

“At the end of the day, it is about how much money is being spent on advertising,” Swallen said. “And the upfront market is when the networks take a deposit. The final size of the check won’t be known for another 14 months.”

--

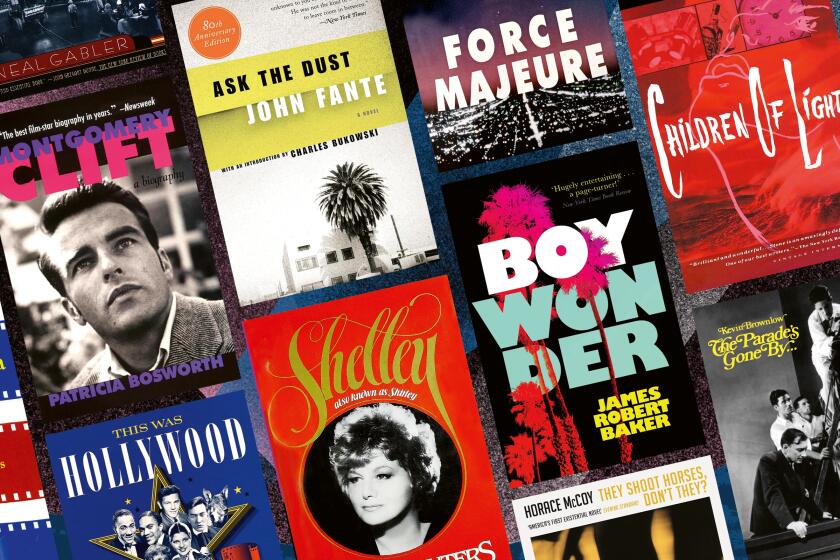

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.