Loan dispute: East West Bank socked with $39-million jury verdict

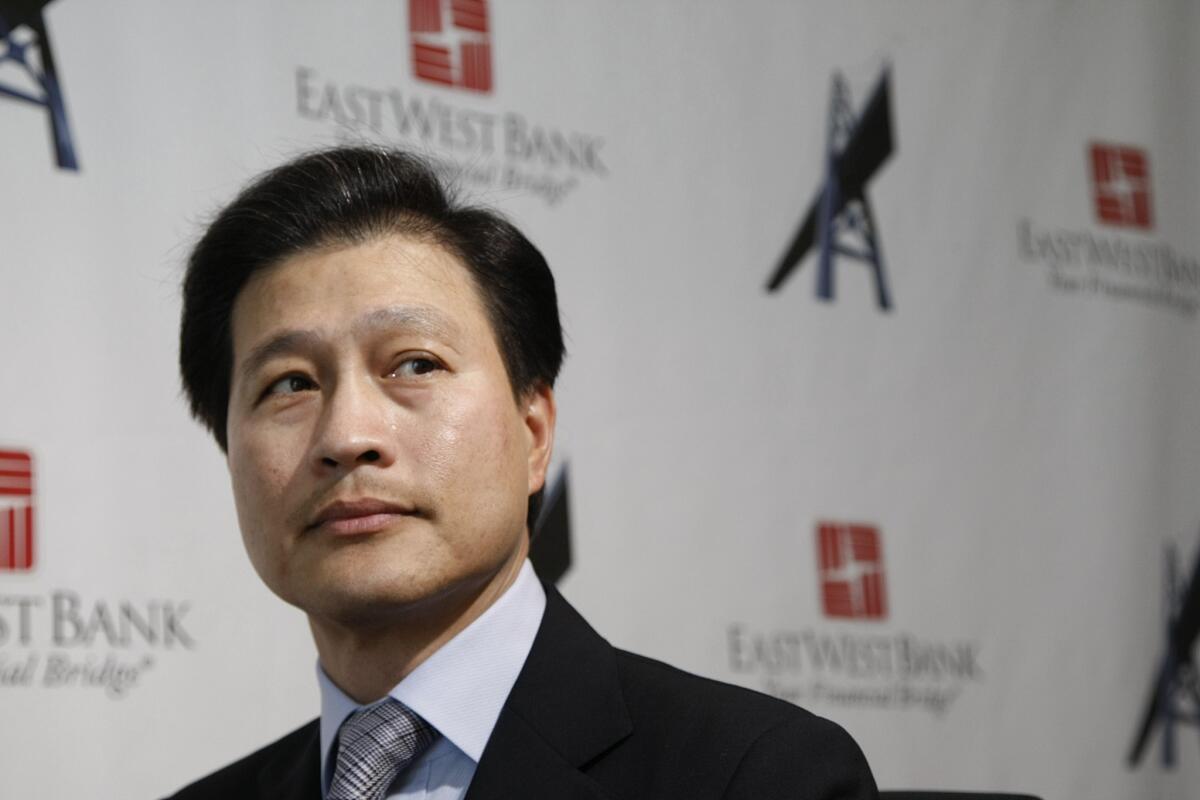

Dominic Ng, East West’s chairman and chief executive, in file photo.

A Cambodian refugee couple won a $39-million jury verdict against East West Bank in their lawsuit alleging that the Pasadena lender breached a contract for financing a commercial development in Rancho Cucamonga.

The Los Angeles County Superior Court judgment this week included $22 million in punitive damages for F&F, a company owned by Choung Fann Yik and his wife, Ying Faung Ley.

The bank’s parent firm, East West Bancorp, said in a regulatory filing Tuesday that it also expects to be hit with a motion asking the court to order it to pay more than three years of fees to Foley Bezek Behle & Curtis, the law firm for the Yiks.

East West said it was considering appealing the verdict, noting that any judgment against it would be offset by $5 million in damages the Yiks already recovered in a related lawsuit against another defendant. It declined to comment further.

The Yiks had arranged a $34.5-million construction loan with East West in 2007 as the economy was heading into a tailspin. They used it to build Victoria Promenade on Foothill Boulevard, a shopping and dining center with offices, a hotel and a gas station.

The couple sued the bank in June 2011 alleging concealment, false promises, intentional misrepresentation and negligence. They contended East West failed to follow through on promises of continued funding after the development, Victoria Promenade, opened.

East West, saying the Yiks weren’t paying their debts as agreed, declared them in default and sold the loan for $22 million to an investor who foreclosed on the couple.

The bank contended at trial that the Yiks lost control of the development partly because of their own bad decisions and partly because of the bad economy. East West said it tried to negotiate an extension and sold the loan only after it was unable to agree with the couple on terms of the extension.

East West, led by Chief Executive Dominic Ng, has grown into the largest Asian American bank, with assets of more than $27 billion. It turned a profit of $142 million during the first half of this year.

The Yiks, residents of Arcadia, came to the U.S. after fleeing Cambodia’s genocidal Khmer Rouge regime more than 30 years ago. Their attorneys said the couple began by working low-wage jobs and eventually made a series of successful real estate investments, all of which they cashed out to build the development in Rancho Cucamonga.

The six-week trial ended with the nine-woman, three-man jury going over a 50-question verdict form over the course of four days, said Justin Karczag, one of the Yiks’ lawyers.

“They paid attention and deliberated with great care,” Karczag said. “We think the verdict will be hard to challenge on appeal.”

Aaron Deer, a Sandler O’Neill & Partners securities analyst, said he expected East West’s earnings to be reduced by a legal charge as a result of the verdict.

“Given that East West allowed the case to go to trial, its outcome was certainly at odds with management’s expectations,” Deer wrote in a note to investors, “and we are not aware of any litigation reserves the company may have set aside for such a verdict.”

Follow @ScottReckard for Southern California financial news