EMI passes on Warner’s offer

Britain’s EMI Group has rejected a $4.1-billion takeover proposal from Warner Music Group, the latest in a tortuous, six-year courtship that has yet to be consummated.

The prospective deal, which would have brought Metallica, Bjork, David Bowie and the Beastie Boys under the same umbrella, “is not in the best interests of EMI shareholders,” according to a statement released by the company Friday.

Analysts said any sale was unlikely to go through until issues clouding a planned merger between Sony Music and Bertelsmann’s BMG were resolved. On Thursday, the European Commission opened an in-depth investigation of the Sony BMG deal, which was approved in 2004 before being annulled last summer.

“I think this is going to be a long, slow dance,” said P.J. McNealy, senior media analyst with American Technology Research Inc.

New York-based Warner Music first flirted with EMI in 2000 in a proposed $20-billion merger that fell apart when a member of the European Commission threatened to block it.

Then, in 2003, an EMI bid to purchase Warner Music from Time Warner Inc. was rejected in favor of an offer from its current owner, an investment group led by Warner Music Chief Executive Edgar Bronfman Jr. Last summer, talks between the two companies fell apart again after the Sony BMG issues arose.

Some analysts speculated that Warner’s latest bid had a good chance of succeeding because the company received the support of Impala, a powerful European independent record group that was instrumental in scuttling the Sony BMG deal. But Impala has faced internal turmoil since it announced its support of the Warner bid, with Ministry of Sound, Europe’s largest independent record label, quitting the group in protest.

At this point, it is unlikely that Warner will acquire EMI at a “rational” price, Pali Research analyst Richard Greenfield said in a note to investors. He said the price Warner offered was too high, noting that the company’s bid of 2.6 British pounds ($5.05) a share was only 19% lower than it offered for EMI last summer, despite a larger decrease in EMI’s operating profitability.

But the price is a moot point, Greenfield said, because EMI is in “no rush to sell” itself and face the potential hurdles ahead.

“We believe that EMI remains quite concerned about the regulatory landscape,” he wrote, “and for good reason.”

*

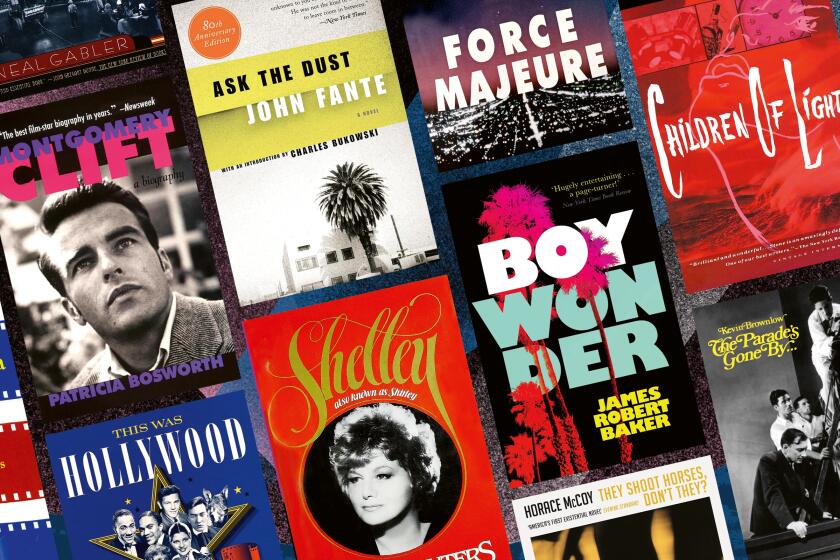

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.