What to expect from company health insurance plans in 2014

Obamacare may be in the spotlight, but an estimated 16 million California employees are facing healthcare decisions of their own — at work.

Like most other Americans, a majority of Californians get their insurance through their employers. Although they may be among the least affected by the Affordable Care Act, a flood of news about the new law has left many workers befuddled about their own coverage.

Adding to the confusion is that this is the season when employers are asking workers to re-enroll in company health plans for 2014 and to pick among a variety of healthcare options.

“There is a lot of confusion among the workforce,” says Hugo Sibrian, a benefits consultant based in Los Angeles who works with a number of large companies, including Vernon meatpacker Farmer John.

Sibrian says some employees mistakenly believe they are eligible for hefty subsidies or low-cost insurance plans available to the nation’s poorest citizens under Obamacare.

That’s rarely the case. Under federal law, those offered coverage at work generally are not eligible for financial help from the government.

For workers enrolling in company health plans for 2014, choices can be numerous and complicated. And as the price of healthcare continues to rise, employers are shifting more of the costs to workers.

With deadlines looming to select coverage, experts say consumers may discover:

- higher monthly premiums, typically deducted from worker paychecks

- increases in deductibles, co-pays and other charges

- cheaper health plan options with more limited choices of doctors and hospitals

- more attention to worker health and wellness

Expect higher premiums

Although hardly a new trend, the biggest difference employees can expect in their health benefits for 2014 is an increase in what they pay.

According to a number of industry surveys, employers will see a lower-than-average jump in health benefit costs of roughly 5% in 2014, due largely to healthcare costs rising at a historically low rate.

Employees are likely to see those costs passed along to them.

“You see workers paying more ... because premiums have gone up, but they’ve gone up proportionately to what employers have been paying,” says Paul Fronstein with the Employee Benefit Research Institute. “You haven’t really seen, surprisingly to some, employers ask workers to pay a greater percentage of premiums.”

But Sibrian says the increases he sees firms facing for next year are closer to 15% over this year. About 4 to 5 percentage points of that increase is a direct result of new taxes levied on health insurance carriers to fund provisions of the Affordable Care Act, he said.

Out-of-pocket costs

To keep overall costs in check, employers make changes to their benefit offerings. This year is no exception.

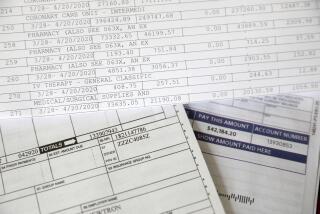

The biggest sticker shock for workers, experts say, will come from higher deductibles, co-insurance and co-pays — costs associated with trips to the doctor and getting prescriptions filled.

Each year, Sherry Silinger, chief financial officer at a New Jersey information technology consulting firm, says she and her team tweak their benefits package to keep monthly premiums from rising too high.

“I think most people would rather have their premium stay the same, and endure the extra cost” of higher deductibles or co-pays if they see a doctor, she says.

But consumers recognize those fees can add up.

“I worry about my out-of-pocket cost as well,” said Los Angeles County social worker Azar Namin, 40, who is grappling with various options. “I’ve run into so many problems.”

Usually, she said, she simply extends her current policy for another year. But this year, with new choices, she is exploring her options.

If your employer offers family coverage that’s too expensive, don’t expect much help from the Affordable Care Act. The law stipulates that if the employee’s plan alone is affordable, dependents won’t be eligible for federal subsidies to help cover their costs, regardless of family income.

Under the law, employers must offer coverage for dependent children up to age 26 — but they aren’t required to cover spouses.

“When the company does not offer insurance to the spouse, then the spouse could go to the exchange and get a subsidy,” says Carrie McLean, senior manager of customer care with online insurance broker EHealthInsurance.

Bigger deductibles

High-deductible plans are becoming more common, and not just as one of several options. According to an annual report by PricewaterhouseCoopers, 44% of employers are considering offering a high-deductible plan to replace their current plans.

These plans typically come with a larger-than-average amount that consumers must pay before insurance kicks in. You’ll pay less for these plans upfront but pay more out of pocket when you go for medical care.

To help offset the higher costs, the plans are usually paired with a type of tax-saving account — most commonly a health savings account (HSA). These allow workers to deposit, accumulate and withdraw money tax free, as long as it’s spent on qualified healthcare costs, such as doctor visits, dental care or prescription drugs.

Watch your networks

Changes to provider networks are common, so you should always check to make sure your doctors participate in the plans you’re selecting, experts suggest.

“Plans are offering narrow networks of providers who are more efficient and may [deliver] higher-quality care, so that lowers overall costs,” says Steve Wojcik, vice president of public policy at the National Business Group on Health, based in Washington, D.C.

You typically won’t be required to select a plan with a narrower network, Wojcik says, but the cost of those plans may be considerably less.

Pharmacy networks and pricing for prescription drugs change from year to year as well. As has been the case for years, generic drugs will be promoted over expensive brand-name medications.

And, if you take a high-dollar specialty pharmacy medication, expect tighter controls over how you get your medications.

“You might have to get your injections or specialty pharmacy products through a different source than usual,” Wojcik says.

Prepare to get well

With health costs going up, employers are finding that it pays to keep employees healthy.

Wellness programs, a fixture for some time in work-based health benefits, continue to gain traction. According to the Kaiser Family Foundation, 77% of firms offering employee health benefits also provide at least one wellness program.

If you participate in health improvement programs, such as anti-smoking and weight-loss plans, you may have a chance to earn back some of your increased cost-sharing. Employers these days often reward participation with lower insurance premiums, cash and gift cards.

But you’ll have to make good on your promise to get healthy if you want your reward. Many employers require that you take action, and in some instances measure the outcomes of those activities, before paying up.

Getting care at work

Many large companies either have or are considering health clinics on their work site where employees can get preventive tests and screenings, health coaching, monitoring for chronic health conditions such as diabetes, and, in some cases, low-cost medications.

Almost a third of employers with 500 or more workers offer a work-based health clinic, according to a survey by the consulting firm Mercer.

Sibrian says a number of his clients have built on-site clinics. American Apparel Inc. in downtown Los Angeles has one, and Farmer John plans to open one staffed with a physician, nurse and health educator early next year.

The key is to get people engaged in their health and to change behaviors that lead to chronic illness, he says. “It will make it easier for employees to get access to preventive care during work hours.”

Zamosky writes about healthcare and health insurance. She is also the author of a new book, “Healthcare, Insurance and You: The Savvy Consumer’s Guide.”