Slackening demand from China hurting a variety of U.S. industries

Between the work stoppages at West Coast ports and the strong dollar, export businesses in California and across the country have had a tough few months. But for some, the biggest sucker punch has come from China.

With its economy slowing amid a global glut of commodities, China is ordering less and driving steep price cuts for many goods — hurting a range of American industries such as scrap-metal dealers in Los Angeles, manufacturers in the Midwest and cotton farmers in the Mississippi Delta.

U.S. exports of merchandise to China, America’s third-biggest overseas market, rose just 1.6% last year after a 10% increase in 2013. Meanwhile, imports from China grew 5.7% last year, resulting in the largest-ever U.S. trade deficit with the Asian nation.

China’s economic momentum is expected to slow further. Chinese leaders Thursday lowered the country’s economic growth forecast to 7% for this year. That’s after the world’s second-largest economy expanded 7.4% last year, the lowest rate since 1990.

After decades of near double-digit growth, Beijing is trying to steer its economy toward a more sustainable path, away from property investments and exports to more personal consumption and services.

Yingying Xu, an economist at the Manufacturers Alliance for Productivity and Innovation in Virginia, said some of her trade group members, especially heavy manufacturers, had depended on China for as much as 50% of their sales growth. Now they’re considering Plan Bs.

“China’s economic re-balance is going to take some time, not one or two years but four, five years,” she said.

“They’re not going to do one big shock treatment to transition the economy,” Xu said of leaders in Beijing. “It will be a gradual change. They will tolerate slower growth for a long time.”

So far, the economic hit from China has been cushioned by strong U.S. domestic demand and a pick-up in exports to a few other countries, including the top two export destinations, Canada and Mexico. The Obama administration, which is pushing an Asia-Pacific free-trade pact, has been highlighting the record U.S. exports to the world last year.

But trade, which had accounted for a third of the U.S. recovery since the recession, is now a drag on American economic growth. With the dollar up sharply against other major currencies, U.S. goods have become more expensive in foreign markets.

Factory managers reported this week that new export orders fell in January and February, the first back-to-back monthly decline since 2012, when the euro area’s debt crisis darkened the world economy.

At 7%, China would still be growing quite fast. Among major economies, only India may surpass that rate this year, while the U.S., the fastest of the advanced economies, will do well to notch 3% growth. And over the long haul, experts said, a slower-growing but more stable Chinese economy will be good for the world and for America in particular.

“If there was ever easy money to be made in China, those days are gone,” said David Loevinger, a former China specialist at the Treasury Department and now a top Asia strategist for the Los Angeles investment firm TCW.

Even as most American companies are making profits in China, they are finding the country an increasingly difficult place to do business. And they also face stronger competition from private Chinese companies.

Still, Loevinger said American firms are well positioned as China shifts from a manufacturing-led economy to one driven more by services. “The U.S. is a global leader in services — financial services, healthcare, accounting, entertainment,” he said.

That’s cold comfort for companies like Letvin Scrap Metal in Los Angeles, which has been doing business since 1947.

Mark Steckler, Letvin’s vice president, said it was frustrating enough that his containers of titanium scrap sat for weeks because of the labor strife at the ports. But then he has had to watch helplessly as prices of steel waste plunged by almost half since August.

“There’s a big glut of scrap iron. And the dollar being strong doesn’t help,” Steckler said, though he predicted that business from China will bounce back. “Absolutely, it’s just a down cycle.”

Letvin is one of scores of scrap metal dealers in Southern California, the hub of the multibillion-dollar industry. Trade data show U.S. shipments of copper, aluminum and iron scrap sank 26% last year to $4.6 billion.

Many farmers also have taken a beating in recent months.

California exports of agricultural products to the world fell 9% in the fourth quarter last year compared with a year earlier, and China was a leading factor. The state’s farm shipments to China alone plummeted 30% in the fourth quarter, with nuts, grapes and some other fruits down sharply.

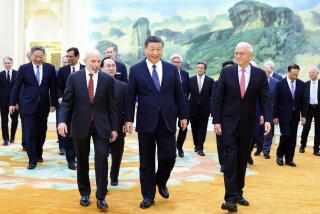

American exporters of fancy nuts, as well as wine and premium fruits, have been hit with a double whammy in China. Besides the economic slowdown there, demand for such goods has plunged because of the Chinese president’s anti-corruption campaign, which has officials cutting back on parties and gifts.

“There’s nothing really much I can do,” said Ben Zhang of Bellevue, Wash., who spent the last four years developing a wine distribution business in China. With orders down dramatically, he said, he has 50 cases of premium wine stacked up in a warehouse in Shanghai.

Zhang also runs a contract manufacturing operation in China, a 20-year-old business that is doing just fine, he said. Mainly for U.S. companies, he makes products such as golf towels and backpacks with company logos on them.

“The U.S. economy is steady,” he said, noting that he just opened a sales office in Philadelphia.

Bowen Flowers, a fourth-generation cotton farmer in Clarksdale, Miss., blames the plunge in cotton markets on Chinese stockpiling and government subsidies for its farmers. He’s dealing with it by shifting production to other crops. Only problem, he said, is that prices of most other commodities have fallen too.

“We got the same problems with soybeans, corn and rice,” he said. “We’ll just have to cut our costs back as much as we can and wait it out.”