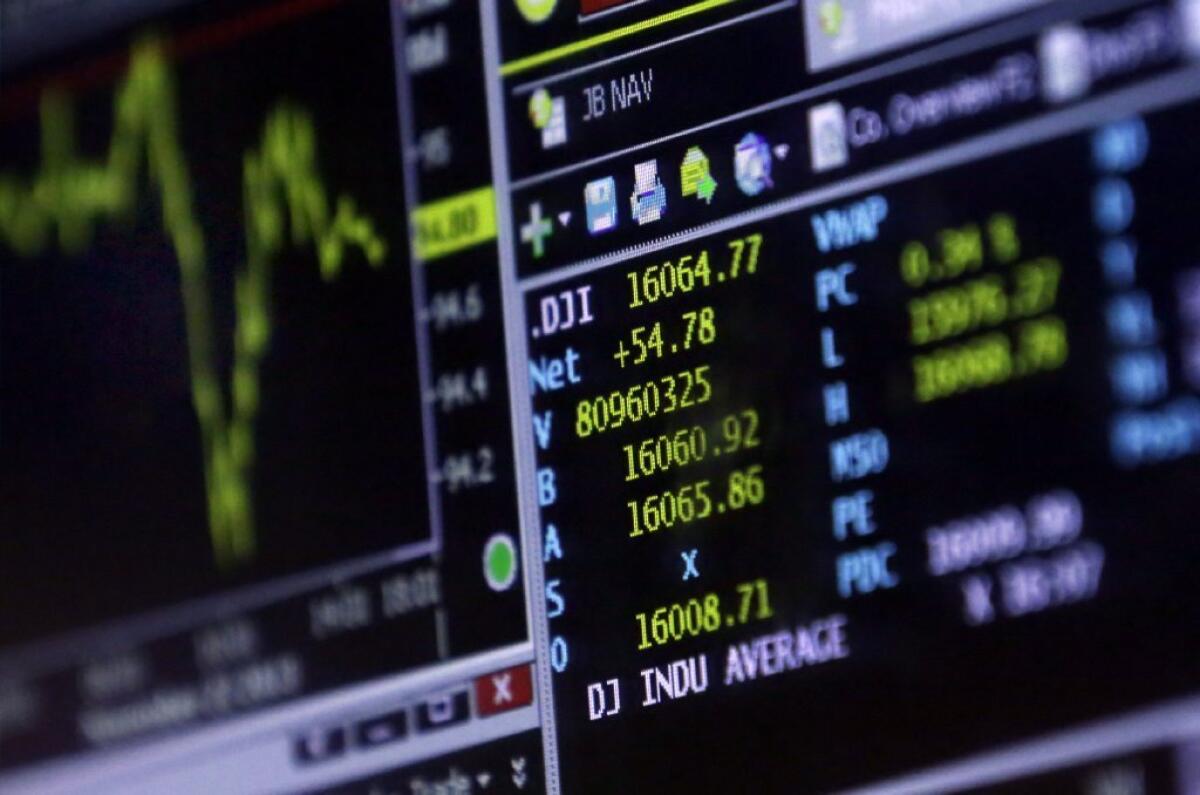

Stock market rally could last two more years, Blackstone manager says

Some investors are expecting stocks to lose ground next year, but not Joseph Baratta, who manages the private-equity business of Blackstone Group.

Baratta said investors could pile up stock-market gains for two more more years, with a little help from the Federal Reserve.

“The fundamentals of the U.S. economy are strong, sentiment is very positive, earnings have been growing, the Federal Reserve is quite accommodating,” Baratta said in an interview with Bloomberg TV. “I think that will last as long as the Fed keeps pumping money into the credit markets.”

Stocks aren’t overpriced when measured against the prices firms are paying to acquire companies, Baratta said. He said he expected stocks to grow between 8% and 10% for the next two years.

PHOTOS: Top 10 most corrupt countries in the world

Further down the road, times may get tough for stocks, especially if interest rates increase, he said.

With the Fed expected to begin scaling back its policy of quantitative easing, Blackstone is seeking deals that require less debt financing when acquiring companies. Blackstone specializes in leveraged buyouts of companies.

“The next buyer will have less access to capital and it will cost more,” Baratta said. “So we need a bigger margin of safety.”

ALSO:

Google study identifies keys to good management

November retail sales weak despite all-out Black Friday efforts

Bitcoin’s value tumbles after China moves to limit its use

Follow Stuart Pfeifer on Twitter