Justices examine energy crunch

Supreme Court justices on Tuesday heard a recounting of what lawyers called “the worst electricity market crisis in history.” And they heard the story of how Enron Corp. and others helped create the spike in electricity prices in California and the West during 2000 and 2001.

Yet some of the justices said they were reluctant to overturn the costly long-term electricity contracts that were entered into at the time by big power suppliers and local electric utilities in California, Washington and Nevada. The market meltdown loaded the investor-owned utilities with huge debts and helped sweep California Gov. Gray Davis out of office.

Justice Antonin Scalia led the way in arguing that the long-term contracts must be honored. “What has changed? Did you not know that the market was chaotic?” he pressed a lawyer for the utilities. “Wasn’t that the very reason you entered into the long-term contract?”

Justice David H. Souter picked up the theme: “It seems to me you’re really saying, ‘Ditch the contracts if they were entered into in a period of high volatility.’ ” Souter said he feared that this view, if adopted by the high court, would mean “no contracts are enforceable” if prices fluctuate.

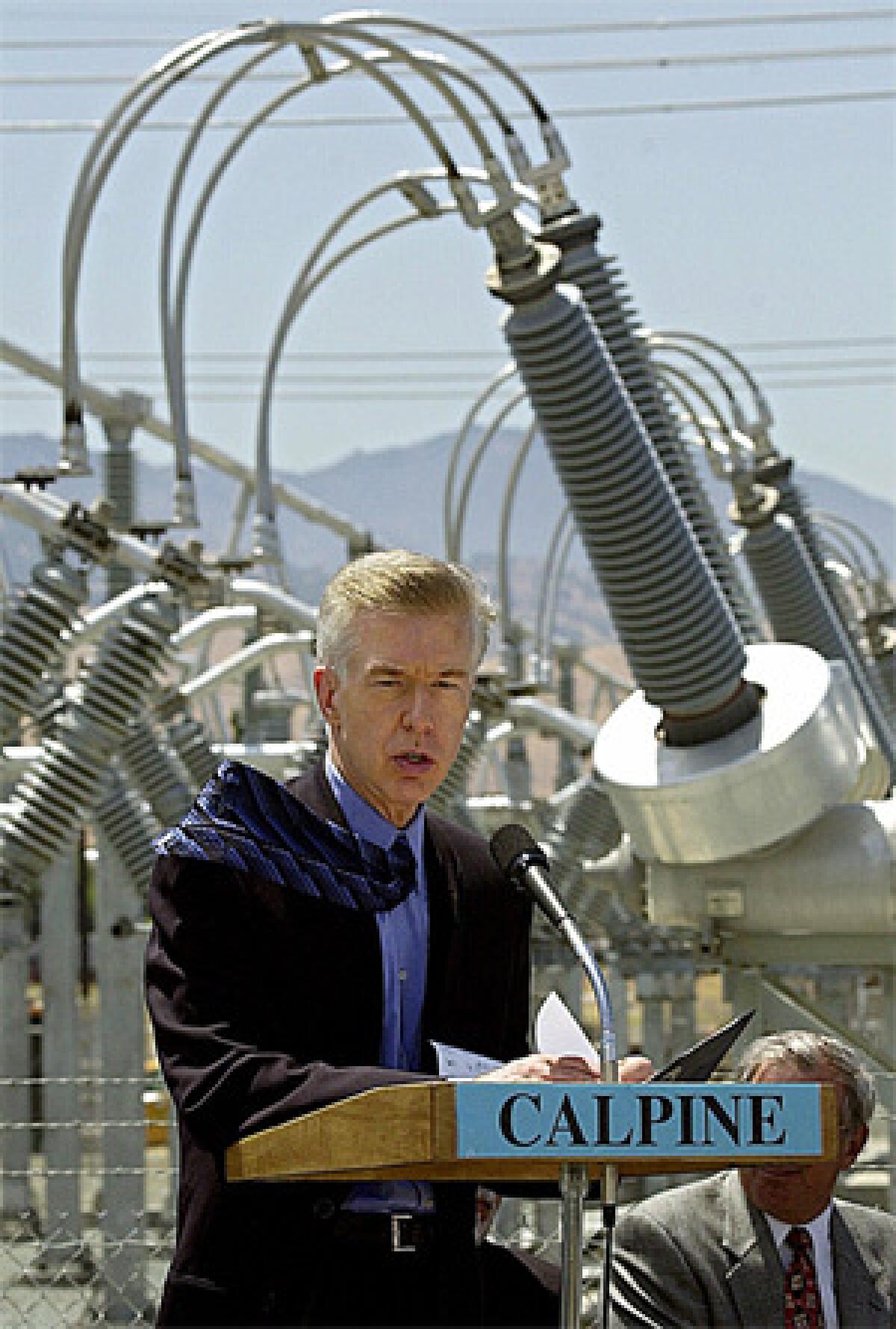

In 2002, after electricity prices fell in the West, the utilities asked the Federal Energy Regulatory Commission to review and reject some of the long-term contracts signed with companies including Calpine Corp. and Sempra Energy. FERC refused their request.

The Federal Power Act requires that power rates be “just and reasonable.” During Tuesday’s argument, the justices and the lawyers spent much of the time debating what that phrase meant.

Lawyers for the Justice Department and power suppliers said the rates set by contract were just and reasonable. “You had sophisticated buyers and sophisticated sellers dealing in a situation in which both knew there was chaos in the spot market,” said Deputy Solicitor Gen. Edwin Kneedler. The Bush administration backed FERC’s decision.

Taking the opposite view, a lawyer for the utilities said the companies were forced to accept a bad deal. “We had a choice of a variety of rates -- so long as they were unjust and unreasonable,” said Christopher Wright, who represented a utility district in Washington state. “We didn’t have any alternative because of market manipulation.”

He urged the court to send the case back to FERC to take a second look at the contracts.

Justices Ruth Bader Ginsburg and John Paul Stevens made clear they were on the side of the utilities and their customers.

“This act was meant to protect the consumer, to make sure the consumer wasn’t going to be overcharged,” Ginsburg said. She said federal regulators failed in their duty to see to it that the long-term rates were just and reasonable.

Lawyers say about $1.4 billion is at issue for the utilities in California. Smaller amounts are at stake in the other states.

Two members of the court -- Chief Justice John G. Roberts and Justice Stephen G. Breyer -- withdrew from the case, apparently because they own stock in one or more of the several companies involved.

While most of the justices sounded skeptical of sending the case back to FERC, the outcome may rest with Justice Anthony M. Kennedy, a Sacramento native, who said little during the argument.

Erik Saltmarsh, former chief counsel for the California Electricity Oversight Board, said he remained optimistic after reading the transcript of Tuesday’s hearing.

“Each side got the vulnerability of their arguments brought back on them,” he said. “But to me, it didn’t telegraph the outcome of this case.

“I’m hopeful.”

It will be several months before the court rules on the issue.

Times staff writer Elizabeth Douglass in Los Angeles contributed to this report.