Killing state and local tax deduction hits many Californians hard. Limiting it only affects top 1%

Limiting instead of scrapping the federal income tax deduction for state and local taxes would preserve the benefit for all but the top 1% of earners, but would raise only about a quarter of the revenue for lawmakers looking to offset broader proposed tax cuts, according to a new analysis.

The nonpartisan Tax Foundation estimated that a full repeal of the deduction — a key and controversial component of the sweeping Republican tax cut plan — would increase federal revenue by $1.8 trillion over the next decade.

Limiting the state and local tax deduction to individuals with adjusted gross incomes of no more than $400,000 (or $800,000 for married couples) would slash those revenue gains to $481 billion over the same period.

The trade-off would be that all but the highest income households would continue to have access to the break, which is coveted in high-tax states like California and New York.

The top 1% of earners have adjusted gross incomes above about $465,000. If they lose the deduction, they would see an average reduction in their after-tax incomes of 1.8%, the Tax Foundation said.

Many lawmakers from high-tax states oppose eliminating the deduction because it would disproportionately effect their residents.

The deduction allowed Californians to reduce their combined taxable income by $101 billion in 2014 — one fifth of the total value of the deduction nationwide, according to the Tax Foundation.

Most of the states that would be hit hard by the loss of the deduction are Democratic strongholds.

Republicans from those states, whose opposition could derail the tax overhaul legislation, have called for saving the deduction with new limits and are talking with Republican leaders drafting the legislation.

“I think they are looking for a deal,” said Rep. Peter King (R-N.Y.), who has proposed the $400,000 cap. “To me, this is life and death for my district.”

In unveiling a framework for the tax-cut plan last month, the White House and key congressional Republicans proposed eliminating the state and local tax deduction. They have argued the break most helps the wealthy and is unfair to residents in lower-tax states.

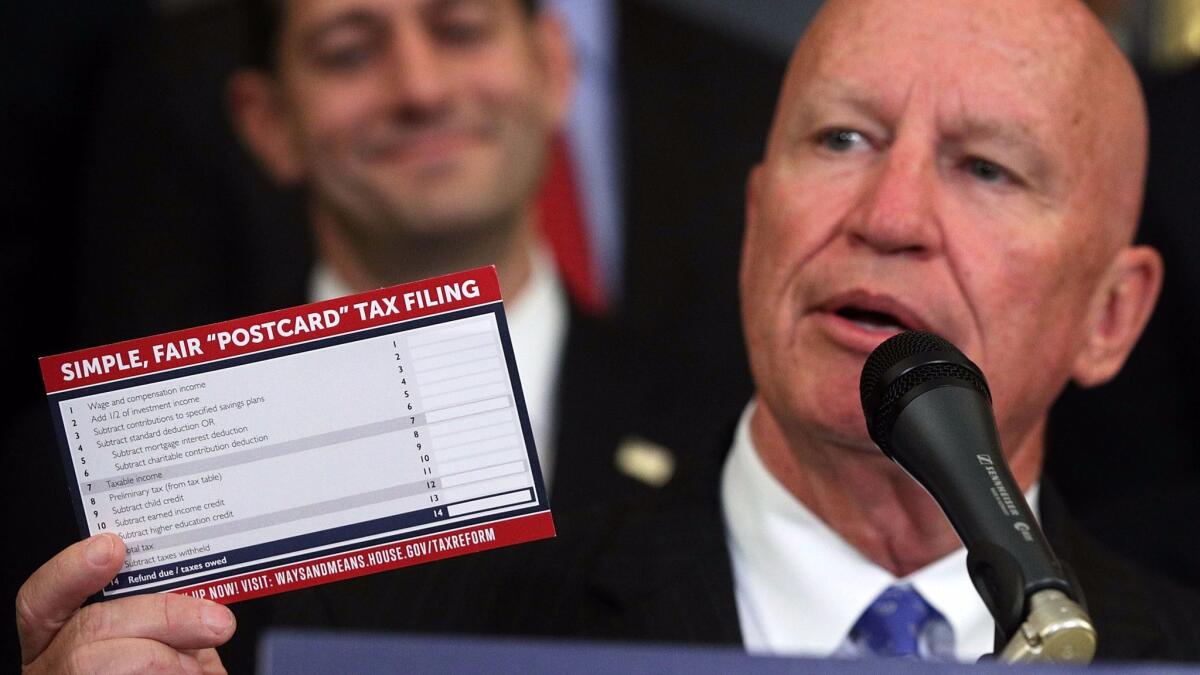

“Every American — poor, middle class or otherwise, whether they itemize or not — pay artificially higher federal taxes so some can get a tax break,” Rep. Kevin Brady (R-Texas), told reporters Thursday.

“So the construction worker on the street is taxed higher so that the investment banker in the penthouse can get a break,” said Brady, chairman of the tax-writing House Ways and Means Committee. “I don’t think that’s fair. I think we ought to lower tax rates for every American so they can keep more of what they earn and treat everyone equal.”

Republicans need the additional revenue that would come from eliminating the break to offset proposed large tax cuts, which go mostly to corporations and the wealthy.

Even with that revenue, the plan is estimated to increase the federal budget deficit by $2.4 trillion over the next decade, according to the nonpartisan Tax Policy Center.

The Tax Policy Center has estimated a smaller gain in federal revenue — $1.3 trillion over the next decade — from ditching the state and local deduction.

Brady met with some Republicans from high-tax states on Thursday as part of ongoing talks about the deduction.

“Lawmakers from high-tax states want to make sure their families are better off under tax reform and so do we,” Brady said. Asked about a $400,000 limit, he said it was too soon to talk specifics.

“I’ve heard a number of ideas floated in the press on this, but it’s premature,” Brady said. “We’re nowhere close to any decisions on issues like that.”

Republicans drafting the legislation still have not figured out the income levels for the three new individual tax brackets — 12%, 25% and 35% — that would replace the existing seven brackets, Brady said.

Those are key details for Republican leaders as they try to make the case to lawmakers from high-tax states that their constituents will be better off overall under the new tax regime even without the state and local deduction, he said.

Twitter: @JimPuzzanghera