Farmers & Merchants Bank of Long Beach’s strategy pays dividends

Farmers & Merchants Bank of Long Beach just sent shareholders a dividend check — the 477th since the institution began giving them out in 1915. If that seems high, there’s a reason. The bank sometimes gives out extra dividends, or a total of five a year.

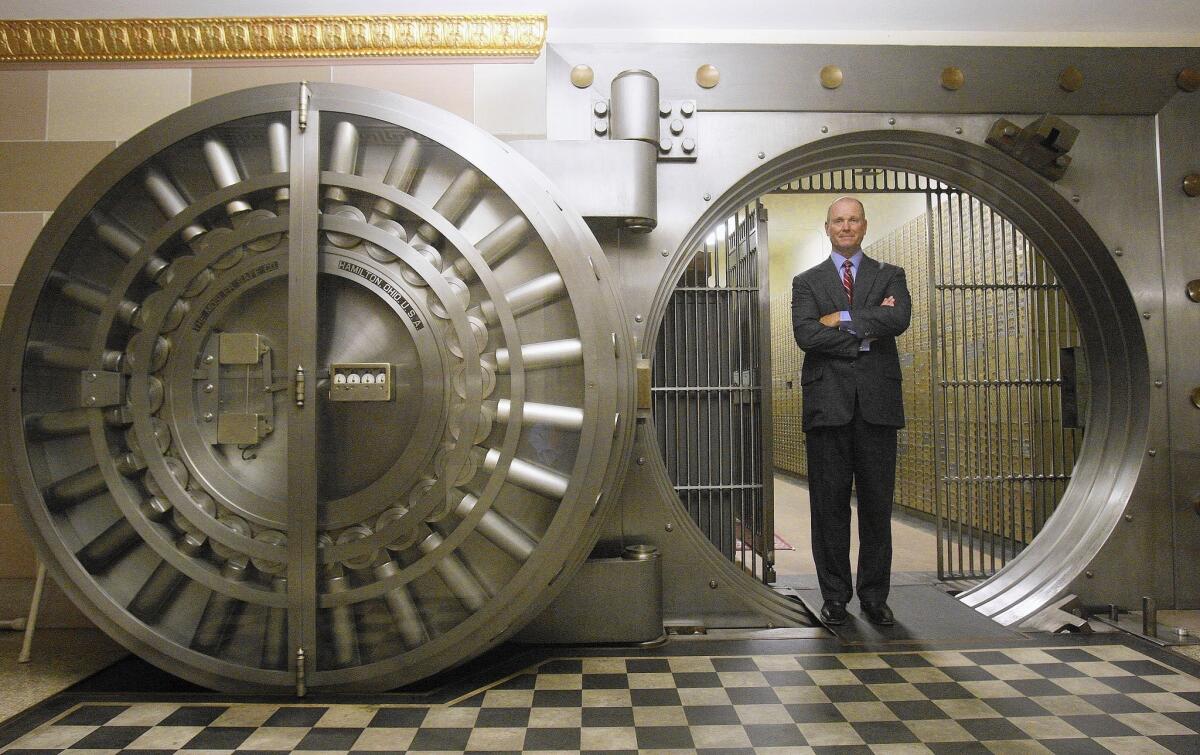

“We have consistently provided a quarterly dividend ever since 1915,” said Daniel K. Walker, F&M’s 60-year-old chairman and chief executive. “We’ve never stopped and we have never lowered the dividend amount,” most recently $22 a share.

Walker is the fourth generation of Walkers involved with Farmers & Merchants. The bank was founded by great-grandfather C.J. Walker on Nov. 23, 1907.

Father Kenneth G. Walker serves as president of the main office in a Pine Avenue building the bank has occupied since the 1920s. Daniel Walker’s younger brother, W. Henry Walker, 48, is F&M’s corporate president.

A fifth generation has also joined the bank in the form of Daniel Walker’s daughter, Christine Walker, and nephew, Nolan Nicholson.

The bank was exclusively a Long Beach institution until 1955, when it opened its first branch in Orange County, in Garden Grove.

The bank currently has 23 branches, most of them in Orange County. F&M added two more branches last year, in Downey and Corona del Mar.

Farmers & Merchants Bank offers traditional services such as consumer banking as well as residential and business lending.

The latest

In July, F&M reported second-quarter revenue of $54.8 million, up from $49.6 million a year earlier. Net income for the quarter was $16.1 million, up from $14.9 million.

Walker said that the bank’s strategy of “cautious growth, prudent loan-making and working with customers during difficult periods” had stood the test of time and turbulent economies.

Accomplishments

F&M assets have hit a record $5.4 billion, compared with $5.2 billion at the end of 2013.

“We grew to $2.2 billion in assets in the first 95 years,” Walker said. “Since then we have more than doubled our assets.”

DepositAccounts.com, which follows 14,000 financial institutions, gives F&M an A+ institutional health rating. The bank gets the highest possible five out of five stars from BauerFinancial Inc. F&M received Bankrate.com’s “Safe and Sound” rating of five stars, the site’s highest.

As an example of why the bank has such strong ratings, Walker said: “We have 3,000 loans on the books. Of those, there are only six loans that are over 30 days delinquent.”

Challenges

Recent consolidations and acquisitions by rivals have heightened the competition.

The recent proposed merger of 1st Enterprise Bank into California United Bank would create an institution with $2.2 billion in assets and $1.9 billion in deposits.

In April, Banc of California agreed to buy 20 Popular Community Bank branches from struggling Popular Inc. in Puerto Rico, adding them to its 18 branches from Los Angeles to San Diego.

Walker said that F&M’s challenges would continue to grow while “maintaining a customer service touch that has been the trademark of the bank for its entire life.”

That has become more difficult, Walker said, as the bank has had to make outside hires because it has grown too fast to rely solely on promoting from within.

Analysts

Farmers & Merchants Bank is an over-the-counter stock that does not receive regular coverage from Wall Street analysts.

Twitter: @RonWLATimes