Survival picture improves for TiVo

On Oct. 9, a day the Dow dropped 679 points, TiVo Inc. deposited a check for $104.6 million. The company had just won a hard-fought battle against EchoStar Communications Inc., whose Dish Network digital video recorders were found by a federal jury to infringe TiVo’s patents.

“I think we were the only company doing high-fives that day,” recalled TiVo Chief Executive Tom Rogers.

TiVo, whose name has become synonymous with digital video recorders, is the comeback kid of technology.

Four years ago, the Alviso, Calif., company was on deathwatch, having lost a crucial partnership to provide recorders for DirecTV Group Inc.’s satellite TV customers. Sales of its TiVo boxes were slipping, and the company was fast running out of money.

Today, TiVo is debt-free, has $200 million in cash and is expected to post its first profitable fiscal year -- the one that ended Saturday.

TiVo’s stock price, which dipped as low as $3.51 on Feb. 11, 2005, has rebounded to close at $7.19 on Friday. It hit a 52-week high of $9.43 in February last year.

“Financially, they’re in great shape,” said Alan S. Gould, senior media analyst at Natixis Bleichroeder Inc., an investment firm in New York. “They’ve done a good job of turning the company around.”

Even though TiVo remains vulnerable because of its declining subscriber base, the company is no longer on the brink of collapse. If anything, the nimble outfit has managed to cheat obsolescence by continuing to innovate and adapt to changing viewing habits.

“TiVo has managed to keep itself in the game by focusing on where the consumer demand is,” said James McQuivey, principal analyst at Forrester Research in Cambridge, Mass. “They started the trend a decade ago. Now they’re working hard to stay on top of those trends.”

During its darkest hours in 2005, the company picked a new chief executive, replacing co-founder Mike Ramsay with Rogers. Though a technology newbie, Rogers had extensive experience in the world of television, having founded financial news network CNBC while president of NBC Cable.

Together with TiVo vice presidents Naveen Chopra and Tara Maitra, Rogers lashed together deals to bolster the foundering company. His strategy was two-pronged: Land services to make the TiVo device more useful, and find cable partners to distribute the TiVo service -- which includes its programming guide, search interface and other well-regarded features -- to subscribers for a licensing fee.

He made headway on both fronts, adding RealNetworks Inc.’s Rhapsody music streaming service, Amazon.com Inc.’s Video on Demand service, Google Inc.’s YouTube videos, Viacom Inc.’s Nickelodeon TV shows and Netflix Inc.’s Instant Watch video streaming service. That meant people who bought the TiVo recorder could listen to music from Rhapsody’s library of 6 million songs on their TVs, watch movies or shows on demand and sample videos from the Web.

“Most of what people are watching now is on the major networks and on the Internet,” McQuivey said. “Between that and Netflix, people are getting much of what they need.”

For now, though, cable and satellite are still king. TiVo struck deals with Comcast Corp. and Cox Communications Inc. to license the TiVo service on their set-top cable boxes.

And the relationship with DirecTV, which is now managed by cable mogul John Malone’s Liberty Media Corp., is back on track. TiVo has a contract to provide DVRs for the satellite TV company’s subscribers starting in the second half of this year.

Meanwhile, TiVo put its own finances in order, cutting back advertising and promotions. Last year, it laid off 38 people, about 7% of its workforce, to save $6.5 million in annual costs. The windfall from the EchoStar ruling is expected to help TiVo post its first-ever annual profit.

And its litigation against EchoStar could yield more cash. This month, a federal judge in Texas is set to hear TiVo’s claim that EchoStar has continued to violate TiVo’s patents since the September 2006 verdict that resulted in the $104.6-million award.

Yet TiVo isn’t completely out of the woods.

Its subscribers continue to decline. About 3.5 million paid service fees as of Oct. 31, the end of its third quarter, down from 4.1 million a year earlier. Comcast and Cox have been slow to add subscribers for TiVo. And DirecTV won’t begin to offer TiVo’s device until later this year.

Meanwhile, TiVo is busy trying to convince consumers that its stand-alone device, priced between $150 and $600 (depending on storage capacity and features such as support for high-definition TV and surround-sound audio) with a monthly service fee of $12.95, can help bail them out of the economic doldrums by saving them “millions.”

“By that, we mean millions of pieces of content that families can enjoy for free at home,” Rogers said.

The irony of a company that’s come back from the dead to turn a recession into a marketing opportunity isn’t lost on the CEO.

“There were so many people who counted us out strategically and financially,” he said. “We’ve gone from being a technology pioneer to a commodity and back to an innovator again.”

--

More to Read

The biggest entertainment stories

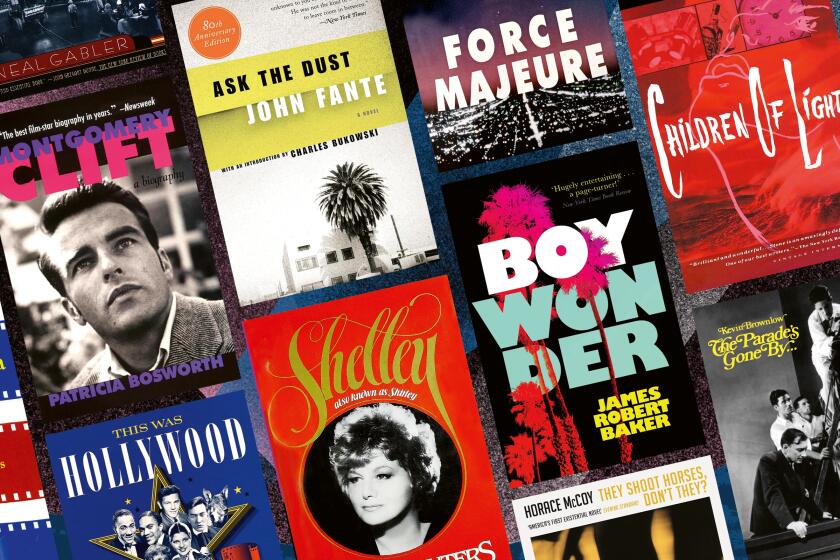

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.