FOR SALE: Oceanfront condos with drop-dead views. Three bedrooms. Terrace. Professional kitchen. Pools and tennis courts.* PRICE: $350,000 and up. LOCATION: *not Malibu.

For beach house prices last seen in Malibu in the ‘60s, drive three hours south to Tijuana, Rosarito and Ensenada, Mexico. You won’t be alone. Boomers such as Pat and Bob Evans, who bought a three-bedroom, ocean-view condo with relatives in April for $425,000 at Las Ventanas, just south of Tijuana, are among the estimated 1 million American homeowners in Mexico today. That number is expected to swell to 10 million in the next 20 years.

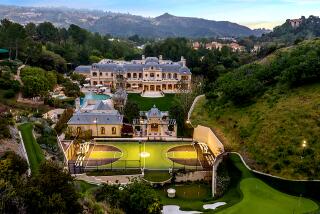

Tony new northern Baja developments such as Terra Sur and Trump Ocean Resort Baja, about 10 miles south of the border, and Porto Hussong in Ensenada, with its marina and private residence club, are attracting those who don’t mind dropping as much as $3 million for a vacation getaway. They’re nice, but they’re not Newport Beach.

So, why northern Baja?

“I couldn’t duplicate my lifestyle in the States if I made 10 times the money,” says Lou Sigur, a 48-year-old former civil engineer and current real estate agent who moved to Baja 15 years ago. “I kayak, fish, ride my Harley.” Also, dollars are welcome, and English is widely spoken.

Many American owners enjoy their Mexican homes just twice a year; some live there year-round. Others straddle the two countries daily. Awhile back, Sigur represented a dual-income married couple with kids who sold their San Diego home, put the cash into a new home in Baja and now are living their dream: She is a stay-at-home mom while he works at his San Diego job, making the short daily commute across the border (a $129 SENTRI pass, good for five years, helps expedite the trip for qualified motorists).

“Life is less expensive and just simpler in Mexico,” Sigur says.

What’s not so simple, however, is buying a house in Mexico. So, before cashing out and heading south, here’s a primer on how it works.

First, handshake and bar-napkin realty deals went out with the macarena. A lawyer is a must. “You use escrow and buy title insurance in the States,” says Diane Gibbs, owner of the northern Baja Realty Executives franchise. “Why wouldn’t you in Mexico?”

Foreigners who buy property within 62 miles of the border and 31 miles of the coastline must do so through a Mexican bank trust called a fideicomiso. Under this system, the bank is the trustee and legal title holder to the property. The foreign buyer is the trust’s “beneficiary”—the actual owner—who can buy, sell and build on the property. It is not the bank’s asset, and no one can take over the property.

The initial term of the bank trust is 50 years; it is renewable at any time for an additional 50 years—in essence, in perpetuity. These trusts are called “50+50.”

Some Mexican property is held in ejidos—ancient communal land agreements—and is owned by the government. Until the ‘90s, foreigners couldn’t buy that land. Today, it may be purchased by non-Mexicans after it’s converted to private property, but beware the Punta Banda scenario: a protracted battle that involved U.S. citizens who built homes on ejido land on a peninsula south of Ensenada, and in 2000 were evicted after the Mexico Supreme Court ruled that the ejido group that sold the land was not the owner.

To avoid that scenario, get title insurance. Stewart Title Guaranty Co., Fidelity National Title Insurance Co. and First American Corp. offer policies in Mexico. “Get good legal advice and you’re safe buying here,” says Guillermo “Mannix” Martinez de Castro, a developer and lead architect at Terra Sur. “Buy title insurance and you’re safe forever.”

No property purchase can be made in Mexico without a notary public, a licensed attorney whose name and seal on documents “is gold,” Gibbs says. The notary, with far more power than a notary public in the U.S., makes sure there are no outstanding liens and that all required permits are pulled but does not secure clear title. All fees go through the notary’s office, which also records the documents with the proper government agencies. It’s customary to purchase Mexican land with cash. Closing costs are steep. If your total budget is $300,000, it’s best to buy a $288,000 home and allow $12,000 for the closing. Costs include a 2% acquisition tax. Property taxes are about 0.5% annually, based on the assessed value of the land only.

Some foreigners prefer leasing land to buying it, which is legal as long as the lease is for less than 10 years. The safest lease is one that lasts for nine years and 11 months; when it expires, ask for an additional nine years and 11 months.

Is it worth it?

“You have to get used to the slower pace of doing business in Mexico,” part-time expat Pat Evans says. “Once we did, we loved it.”

---------

More to Read

Sign up for our L.A. Times Plants newsletter

At the start of each month, get a roundup of upcoming plant-related activities and events in Southern California, along with links to tips and articles you may have missed.

You may occasionally receive promotional content from the Los Angeles Times.