American Greetings, owner of Papyrus cards, goes private

American Greetings Corp., one of the key companies responsible for all those “Gotcha!” greeting cards you’re getting for April Fools’ Day, will be taken private by its founding family in an $878-million deal.

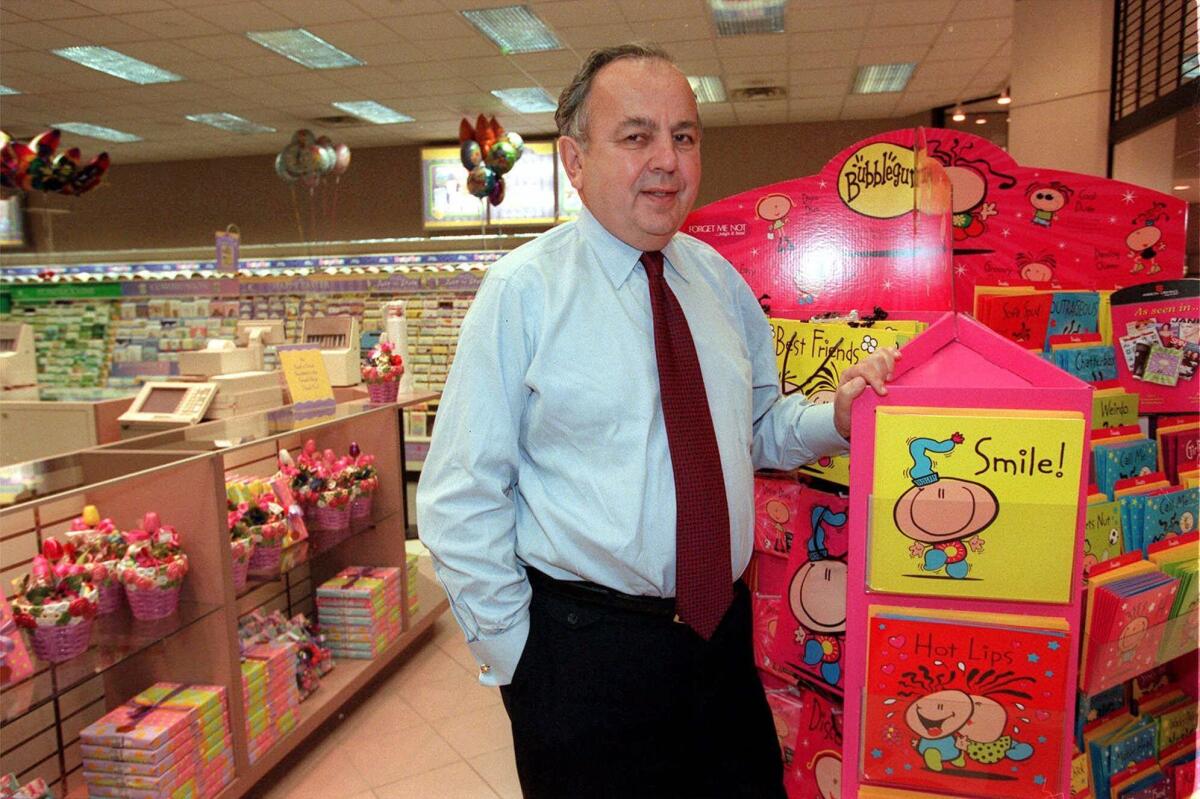

The agreement with the Weiss clan, involving company chairman Morry Weiss, Chief Executive Zev Weiss and President Jeffrey Weiss, still needs to be approved by shareholders.

Extended members of the Weiss family have run the Cleveland company since it was launched more than a century ago. It became an over-the-counter stock in 1952, and pulls in about $1.7 billion in revenue a year, according to the company website.

But technological advances and a changing consumer base have not been kind to mass-produced paper greeting cards, as companies rush to offer digital options and physical selections printed on premium card stock using custom designs.

American Greetings, which owns brands such as Carlton Cards, Gibson, Recycled Paper Greetings and Papyrus, now tops its website by promoting its ecards before mentioning its more standard alternatives.

Quiz: Do you know your premium jeans?

To take the company private, non-family stakeholders will get $18.20 per share and, if declared by the board, a 15-cent dividend per share. That’s a 27% premium on the stock price on Sept. 25, when the Weiss first announced their intentions, and a 13% premium on Thursday’s price.

The board convened a special committee of independent directors in the fall to mull over the Weiss’ proposal and concluded unanimously that the transaction “was fair and in the best interests” of shareholders, the company said.

The takeover is scheduled to close in July and will be financed through a combination of Weiss shares, cash funded by a $240-million non-voting preferred stock investment committed by a Koch Industries Inc. subsidiary, $600 million in committed debt financing and cash on hand.

ALSO:

Twitter ad revenue could reach $1 billion in 2014

Bill would make police get search warrants for email

Online options multiply for holiday greeting cards, party invites