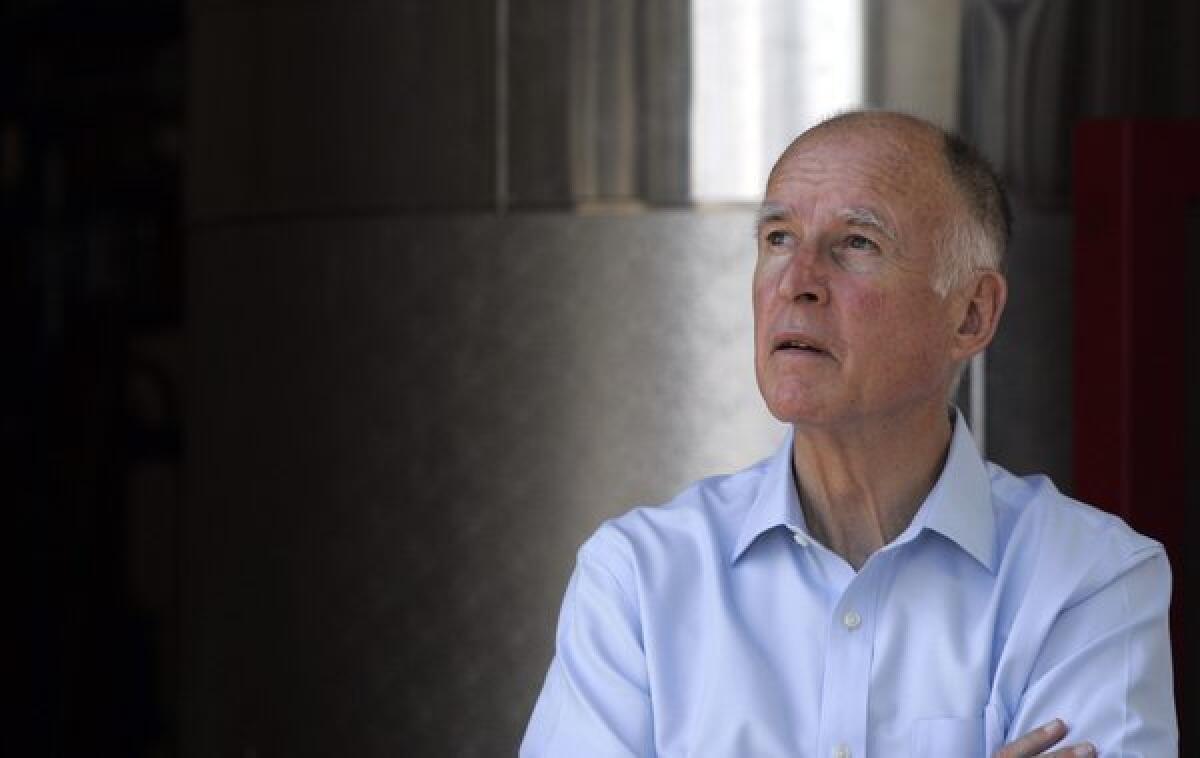

Gov. Jerry Brown signs bills to revamp economic development

- Share via

This post has been corrected. See below for details.

California Gov. Jerry Brown on Thursday signed into law new measures aimed at revamping the state’s incentives for economic development.

The new legislation includes hiring credits for companies in areas blighted with the highest jobless rates, a sales tax exemption on tools for manufacturing and research and development equipment for biotech firms, and tax incentives for companies that create jobs and pay the highest wages.

“I am very glad we are taking money and pushing it in the direction of creative intelligence,” Brown said Thursday in San Diego. “This state is going to thrive not by the lowest-paid jobs but by those that require a lot of intellectual addition, content, skill.”

QUIZ: How much do you know about the federal budget cuts?

The new initiative will replace the fiercely debated enterprise zones, a tax-break program created in the 1980s aimed at boosting investment and creating jobs in low-income areas.

In reality, Brown said, many tax breaks went to companies that hopped from one zone to another and to regions that have become very wealthy. The state’s nonpartisan Legislative Analyst’s Office has also found little evidence that the zones created new jobs.

Brown’s efforts to phase out the zones were met with fierce opposition by some industry groups representing businesses that receive tax breaks and some cities that use the zones to attract businesses. But the state Legislature last month passed a proposal to phase out the enterprise zones in favor of a retooled approach.

On Thursday, at the San Diego headquarters of pharmaceutical firm Takeda California, Brown signed the measures, AB 93 and SB 90, into law.

The new measures will “make a big difference in how we do business,” Takeda California President Keith Wilson said.

“By providing this tax credit and a state tax exemption on innovative research tools, the new law is going to allow Takeda California to pursue staffing levels and collaborations with local universities that we would not have been able to afford otherwise,” he said.

The California Manufacturers and Technology Assn. also lauded the legislation as a useful measure to kick-start the state’s manufacturing sector, which has steadily shed jobs.

“The governor has been looking for ways to make California a manufacturing leader once again,” Jack Stewart, the association’s president, said in a statement. “This is a big move toward that goal.”

Under the new program, a company could earn up to $56,000 per worker in tax credits in the first five years of employment if that worker makes at least $12 an hour. Companies can also negotiate tax credits based on job creation and investment in the state.

Brown said the measures will stop businesses from “gaming” laws by moving to another part of the state without hiring more workers. He said it will also give a boost to manufacturing.

At the end of his remarks, Brown made a pointed dig at his Texas counterpart, Gov. Rick Perry, who traveled to California this year to try to woo businesses into moving to his state.

“Those fellas in Texas, watch out,” Brown said. “California has some new tools.”

[A previous version of this post misquoted Keith Wilson as saying that “the new law is going to allow the state of California to pursue staffing levels.” He actually said “the new law is going to allow Takeda California to pursue staffing levels.”]

ALSO:

Self-doubt hinders career advancement for women, survey says

Saudi prince sues Forbes magazine over his rank on billionaires list

Business majors top list of underemployed college grads, report says

Follow Shan Li on Twitter @ShanLi

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.