Parsons’ exit is a signal for change

The long-awaited leadership change at Time Warner Inc. announced Monday comes as the world’s biggest media company faces pressure to refocus -- and perhaps discard -- some of its signature assets to get more nimble in a fast-changing media industry.

Among the properties that could be up for grabs are AOL, the pioneering Internet service provider and portal, and Time Warner Cable Inc., the nation’s second-largest cable TV company.

Time Inc., the venerable magazine empire that includes People, Time and Sports Illustrated and carries the company’s original DNA, could also find itself on the block, analysts say.

Sorting out the company’s future is expected to be the top priority for Jeffrey L. Bewkes, the 55-year-old executive who will succeed Richard D. Parsons as chief executive on Jan. 1.

Parsons, who took over as CEO in 2002 and chairman a year later, was credited with stabilizing the company after its disastrous 2001 merger with AOL. But the stock has languished under his leadership. Since he took the helm in May 2002, investors have had a zero return on Time Warner shares.

“Dick’s role was to still the waters,” said veteran media investor Lawrence Haverty of Gamco Investors. “Now Bewkes will maybe get license from the board to stir things up a little.”

Hopes are high for the brainy and acerbic Bewkes, who ran Time Warner’s HBO division for seven years and helped turn it into a powerhouse of original programming, with such celebrated shows as “Sex and the City” and “The Sopranos.”

He took over as president and chief operating officer of Time Warner last year, immediately becoming Parsons’ heir apparent.

Much of the pressure for change is coming from Wall Street. The stock is down 18% so far this year, while the Standard & Poor’s 500 index is up 6%. Time Warner shares closed Monday at $17.81, down 7 cents.

Early last year, Time Warner held off a challenge from activist investor Carl Icahn, who wanted to install new leadership and break the company into pieces. Icahn backed off after Parsons made concessions, including stepping up a stock-repurchase program, but his call to streamline the company still resonates with investors.

In addition to cable TV and publishing, the company’s assets include the Warner Bros. movie studio and such cable channels as CNN, TNT and TBS.

Former HBO Chairman Frank Biondi, who was Icahn’s pick to run Time Warner, said Monday: “Being big, in and of itself, can be a detriment to growth.”

Biondi said AOL and Time Warner Cable “would have greater value as stand-alone vehicles.” Time Warner owns 84% of the cable company but could spin off all or part of it to shareholders. AOL and Time Inc. could be spun off or sold. The idea would be to pare Time Warner down to its core programming units: the movie studio and the cable channels.

Lehman Bros. analyst Vijay Jayant recently rated the stock a “buy,” citing the increased likelihood of such a transformation.

Bewkes, for his part, has yet to publicly commit himself to any such strategy. He gave little hint of his plans in a prepared statement Monday: “I welcome this opportunity to work with my colleagues and the board to lead this company successfully into the future. We have a lot to do, and I’m intensely focused on building shareholder value.”

In any case, experts said, Bewkes won’t have to rush into anything.

Biondi noted that Icahn’s initiative stalled in large part because most Time Warner stockholders didn’t share his urgency.

“I was amazed at how patient they were,” Biondi said.

Moreover, now isn’t a particularly good time to sell, noted Gamco’s Haverty, whose fund has long held Time Warner stock. Cable TV companies are selling at rock-bottom prices due to fears -- which Haverty thinks are exaggerated -- that they could be swamped by competition from telephone companies. The publishing business had attracted a lot of interest from private equity companies, but that interest has fallen sharply, along with print-advertising revenue.

As for AOL, Bewkes was the architect of a major strategic shift there in 2006. The unit ditched its subscription-based business model in favor of one that offered free access to entertainment and news programming and services such as e-mail while relying on advertising for the lion’s share of revenue. Bewkes also chose AOL’s new chief, Randy Falco, and oversaw the relocation of AOL’s headquarters from suburban Washington to New York, emphasizing its new focus on the advertising business.

Analysts said Bewkes may want to give his strategy more time to play out.

After a year of strong and steady online advertising growth, AOL stumbled badly in the three months ended July 31. Analysts will watch closely when Time Warner releases its third-quarter earnings report Wednesday morning to see whether the previous quarter was an aberration or the start of a disturbing trend. If ad sales haven’t picked up sharply, the clamor for Time Warner to dump AOL will increase.

It is clear that Time Warner will see a different management style from Bewkes, who is described as less wedded to company traditions than Parsons and perhaps more willing to sell off historic properties or cut costs aggressively.

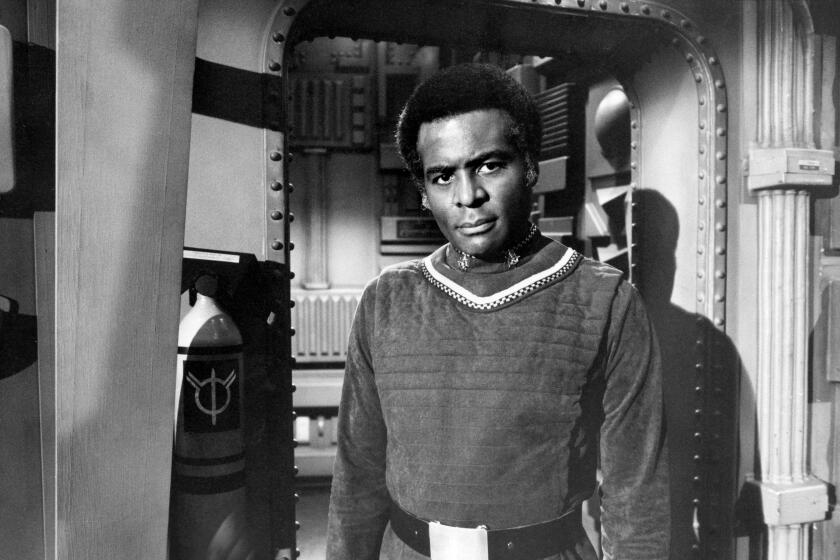

The 59-year-old Parsons will retain his post as chairman of the board. Bearded, avuncular and charming, he has been mentioned as a possible Republican candidate for mayor of New York.

His departure, along with the recent ouster of Stan O’Neal from the top job at Merrill Lynch & Co., leaves only four African American CEOs among Fortune 500 companies.

--

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.