Apple’s quarterly sales fall for the first time in 13 years

Apple Inc. forewarned investors of its first-ever drop in iPhone sales and its first decline in quarterly revenue in 13 years.

Still, they came away alarmed Tuesday as Apple's latest financial results revealed worse-than-expected sales in China and predicted a second quarter of overall decline.

Shares of the Cupertino, Calif. company plunged more than 8% after hours, sinking to less than $96 and evaporating a two-month rally.

The "challenging" quarter and unfavorable outlook reflect a tough economy worldwide, Chief Executive Tim Cook said. They also show that not every iPhone model can be a hit, now that so many people around the world already own one.

See the most-read stories this hour >>

IPhone sales drove Apple to record revenue and profits in recent years, as interest in the iPod, iPad and other Apple devices waned. Apple's fortunes are now staked on the iPhone, which accounts for two-thirds of revenue.

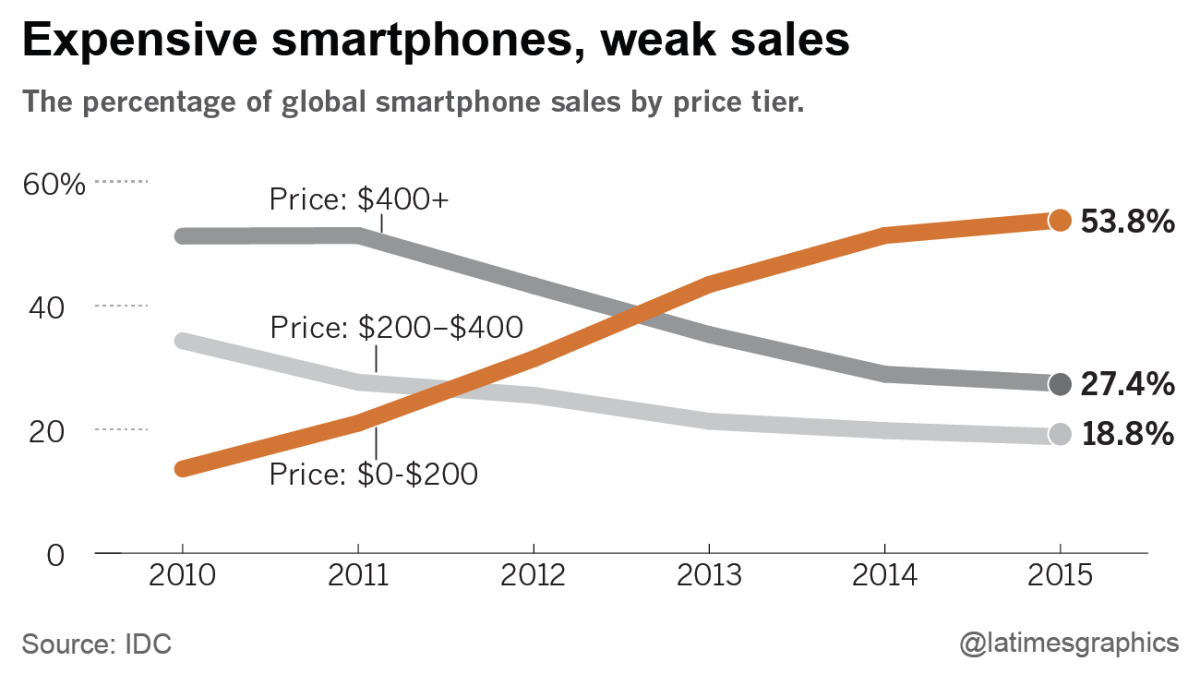

Yet gaining new customers in the United States and Western Europe is proving difficult for the world's most valuable company. And at $640 on average, iPhones are too expensive for new smartphone purchasers in emerging markets.

The trends cut overall first-quarter revenue to $50.6 billion, down 13% from the same period last year. Profit fell 22.5% year-over-year to $10.5 billion. The figures translate to $1.91 in earnings per share, below analyst estimates of about $2.

Apple also said Tuesday that it would increase quarterly dividends by 10% to 57 cents per share and expand its stock buyback plans by $35 billion.

Cook attempted to dismiss many of the worries in a call with analysts Tuesday.

The iPhone 6 and 6 Plus boosted purchases in 2015 because Apple had never before sold smartphones with such big screens. Apple had no chance of matching that pent-up demand this year, especially in a shakier global economy, Cook said.

Apple sold 51.2 million iPhones from January through March, or about 10 million fewer than the same three months in 2015. Analysts on average had estimated 50 million iPhone purchases, according to data compiled by FactSet.

"The market as you know is currently not growing," Cook told analysts Tuesday. "However, my view is that’s an overhang of the macroeconomic environment in many different places of the world. We are optimistic...the market will grow again."

He noted four encouraging signs. Though people might not be scooping up last year's iPhone 6s as fast as they did the iPhone 6, the pace of people upgrading to the 6s is faster than for the iPhone 5s two years ago.

More people also switched to the iPhone from competitors during between October and March than in any prior six-month span. There were still millions of first-time iPhone buyers last quarter, in part because of 56% sales growth in India.

And the iPhone SE, the most affordable Apple smartphone ever, is attracting new customers. The device was released after the last quarter closed.

"The future of Apple is very bright," Cook said.

But analysts are divided on when the iPhone will see a resurgence.

Apple originally had expected January through March to be its worst sales period of the year. But on Tuesday, Apple forecast sales of between $41 billion and $43 billion for the current quarter, below analyst expectations of $47 billion.

"It was a pretty poor quarter and the guidance was much weaker than we expected, but maybe investors have to look at Apple cycles a little differently," said Angelo Zino of S&P Global Market Intelligence, who views the current quarter as the likely bottom.

Some experts maintain hope for blockbuster sales of a new iPhone model this fall. But there is increasing concern that, like last year's iPhone 6s, the newest model won’t be radically different from its predecessors, which could keep prospective buyers on the sidelines. The skeptics have pushed their predictions for a rebound to 2017.

"I view this year as a transition year," said Ryan Reith, mobility research director at research firm IDC. "By no means does it mean doomsday for the company."

For now, the struggles rest on multiple fronts.

The popularity of lower-tier iPhones brought down the average selling price of the iPhone to $642 in the first quarter from $659 a year earlier. The iPhone SE, which sells for about $400, is expected to cut into revenue even further this quarter and leave Apple with its worst quarterly gross profit margin percentage in nearly three years.

Competitors are giving Apple more trouble in Asia. Chinese brands sold 125 million devices in the first quarter, beating the combined total for Samsung and Apple for the first time, market research firm TrendForce said. Apple's revenue in mainland China dropped 11% year-over-year during the first quarter, with steeper declines in regions such as Hong Kong.

"Given that China was expected to be a revenue growth driver for the company for the foreseeable future, it's a bit troubling to see the numbers this quarter," Zino said.

Cook cautioned that its Chinese business is more stable than the numbers and other economic data out of China might suggest, noting the company will open five more stores there by the end of June.

In the United States and elsewhere, consumers are holding onto smartphones longer. They're increasingly satisfied that the features on newer aren't worth the expense, especially as cell phone service providers stop subsidizing handsets, experts say. The increased price transparency also has led to people taking more care of devices.

About 40% of smartphones in the United States are iPhones, but that figure hasn't significantly changed since 2012, according to Deutsche Bank analyst Sherri Scribner. Apple's market share in Europe has been around 22% for the last seven years.

Though iPhones are Apple's marquee gadget, concern about the company go beyond that product. An estimated 91% of Apple’s revenue generators -- everything beside the cut Apple takes when selling apps, insurance and other services -- is in slow-growth mode or in decline, Scribner said.

The company reported sales of 10.2 million iPads in the first quarter, suggesting the new iPad Pro in 9.7-inch and 12.9-inch options is at least helping slow declining tablet sales.

Cook expressed satisfaction with Apple Watch sales, two days after the first anniversary of its launch. But Apple hasn't shared detailed sales figures for the Watch. Analysts are unsure about whether the Watch will ever sell well enough to significantly affect Apple's revenue.

SIGN UP for the free California Inc. business newsletter >>

Shares of Apple closed at $104.35 in regular trading Tuesday before the stark tumble after hours. The stock hasn't taken a one-day hit greater than 8% since Jan. 24, 2013, when it fell 12.4%, or $9.07.

Even one of the bright spots Tuesday for Apple -- 20% sales growth in the services category -- was a bit of a mixed bag. Revenue was down 1% compared to the previous quarter, the first time in two years it hadn't inched up quarter-to-quarter.

In a report last week, Scribner said the company was at "a good starting point" with the App Store, Apple Pay, Apple Music, iCloud and other services but that "it will be difficult for Apple to grow this segment enough to drive top-line growth for the company."

Twitter: @peard33

Times researcher Scott J. Wilson contributed to this report.

ALSO:

Apple's iBooks, iTunes Movies mysteriously suspended in China; customers want refunds

How Disney's video games division benefits from a drop in tech start-up funding