Deezer, the French Spotify, targets high end in U.S. with Sonos

San Francisco-based Listen.com launched Rhapsody, the first online music subscription service, late in 2001, long before Netflix had a single customer for its streaming videos. Today, Netflix has more subscribers in the U.S. alone -- 36 million -- than there are paying subscribers to on-demand music services around the world -- an estimated 30 million.

A pessimist might say U.S. consumers, whose appetite for CDs has declined sharply since 2001, aren’t enthusiastic about on-demand services, either. But an optimist might argue that the consumers just haven’t been given the right offer yet.

Tyler Goldman falls into the latter camp.

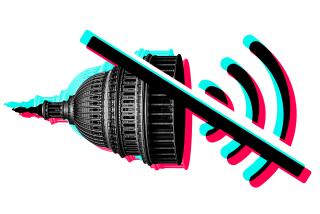

Goldman is head of North American operations for Deezer, the world’s second-most popular music subscription service. The French company, which has about 5 million paid subscribers in 182 countries, announced Wednesday that it plans to enter the U.S. market with a new service called Deezer Elite, whose distinguishing feature is extremely high-quality audio streams. Specifically, Deezer will offer songs from its 35-million-track library in a lossless format called FLAC, which the company says delivers five times as much sonic information as the other services’ streams.

Deezer Elite will be available around the world starting Sept. 15, but the only way to obtain and use it will be through a Sonos networked music player. In that sense, Deezer’s launch is reminiscent of what Microsoft did with its Zune MP3 players and Nokia did with its “Comes With Music” mobile phones. Neither of those services gained enough traction in the United States to stay in business.

Which is not to say that offering a music service without a hardware component has been any easier. Such major brands as Sony, Yahoo and Viacom’s MTV all have tried in vain to sell music on-demand services to the masses.

Goldman contends that the environment is much better now for subscription services, thanks in part to the proliferation of smartphones and tablets, vastly increased bandwidth and more liberal licensing by the major music companies. Deezer also claims an advantage over Rhapsody, Spotify and other predecessors in the on-demand music market: It offers different versions of the service to different segments of the market, rather than trying to serve them all with the same thing.

According to Goldman, Deezer’s research has found a “very large market” of consumers who spend heavily on music and place a high value on sound quality. These consumers “think we’ve gone backwards on audio quality” as formats have shifted from vinyl LPs to CDs to MP3 downloads, Goldman said, adding, “As a result, very few of them have uptaken a paid music service.”

With only about 30 million people around the world subscribing to a paid music service, it’s hard to argue with that latter point. Nevertheless, analyst Russ Crupnick of MusicWatch noted that the early adopters of subscription services have been the same sort of consumers who’ve bought Sonos’ high-quality audio gear. In other words, the customers targeted by Deezer for its first U.S. product have been the most enthusiastic supporters of on-demand services, yet even their enthusiasm has been limited.

Some analysts maintain that the problem is the services, which typically cost $10 a month, are still too expensive for the vast majority of consumers, who spend much less than that on music. But with so much of the monthly fees going to royalties that already strike some artists as pitifully low, it’s hard to see the industry asking for less for the rights to stream an unlimited number of songs on demand.

Again, Goldman argues that the problem has been the services not tailoring their products to the market. The consumers who have made an investment in high-quality speakers, amplifiers and other audio gear feel that the “poor quality” of MP3 streams “sounds even worse on their set-ups,” Goldman said. “It was an obvious choice to produce a service that didn’t have those trade-offs.”

Sonos executives have long argued that streaming services would be the future of music consumption. Eric Nielsen, a company spokesman, said a large number of Sonos users are listening to FLAC files on their home networks, leaving “a lot of headroom” for a subscription service such as Deezer Elite to attract customers with high-quality audio streams.

Sonos, by the way, doesn’t report how many people have its products, which include networked amplifiers, speakers and soundbars. Three years ago the company revealed it was streaming music in more than 1 million rooms worldwide; on Tuesday, Nielsen would say only that the number was significantly higher now. About half of Sonos’ sales are in the Americas and the Pacific, the other half everywhere else, Nielsen said.

Goldman said Deezer would eventually be “rolling out more offerings for the audio enthusiast,” along with “a bunch of other products aimed at other markets.” He expects there will be a number of the latter available in the United States later this year.

In addition to playing songs on demand, Deezer’s service puts a heavy emphasis on playlists and other music programming generated both by humans and by algorithms. The fact that it has so many users around the world -- 16 million, including those who use Deezer’s free, advertiser-supported products -- helps it develop programming and spread costs broadly, Goldman noted. The latter capability comes in handy as it rolls out new products.

“As we’re going after different markets, it’s very important to be at scale,” he said. “Great scale creates great programming.”

Deezer Elite will be sold at an introductory price of just under $120 per year or $15 a month for an unspecified period, after which the price will revert to the standard of just under $20 a month.

Healey writes editorials for The Times. Follow his intermittent Twitter feed: @jcahealey