Qualcomm wants some iPhone imports banned, escalating patent fight with Apple

Qualcomm is asking the International Trade Commission to investigate if Apple is infringing on six patents issued between 2013 and 2017 that improve performance and battery life in smartphones. (Fox 5 San Diego)

Qualcomm Inc. fired back at Apple Inc. on Thursday in a fierce legal battle over patents, asking the U.S. International Trade Commission to ban the import of certain new models of iPhones.

The San Diego-based company alleges that Apple is infringing on six patents issued between 2013 and 2017 that improve performance and battery life in smartphones. It filed a lawsuit in U.S. District Court in San Diego and is seeking a limited ban from the International Trade Commission on iPhones made by contract manufacturers in Asia.

Apple has been “infringing these patents knowingly, willingly for quite some time now in their new phones,” said Don Rosenberg, Qualcomm’s general counsel. “We decided — frankly, sparked by all their litigation efforts against us — that we weren’t going to just defend ourselves, which we will do very vigorously, but we were going to have to go on the attack.”

As a practical matter, Qualcomm is seeking a limited ban on iPhone 7s that contain cellular modem chips made by Intel Corp. and run on AT&T’s and T-Mobile’s networks.

Qualcomm supplies Apple with cellular modems for iPhone 7s on Verizon and Sprint, as well as older iPhones on all U.S. networks. It is not seeking to ban imports of iPhones that use its own chips.

Qualcomm also alleges certain iPads are using the six patents without a license.

If the ITC rules in Qualcomm’s favor, an import ban could block some upcoming iPhone 8 models, which are expected to launch this fall.

It is unknown how Apple splits its modem supply between Qualcomm and Intel for the iPhone 8. But given the legal battle between the two tech giants, analysts believe Intel may have won the larger share.

In January, Apple filed a lawsuit attacking the core of Qualcomm’s patent licensing business model — alleging that Qualcomm is collecting patent royalties on technology that it had nothing to do with inventing. Antitrust regulators in the U.S. and South Korea have brought similar legal actions.

Apple’s contract iPhone manufacturers in China and Taiwan have stopped paying royalties to Qualcomm at Apple’s behest, leading Qualcomm to cut its financial forecast for the year.

On Thursday, an Apple spokesman reiterated a statement issued earlier this month when Apple amended its original lawsuit.

“Qualcomm’s illegal business practices are harming Apple and the entire industry,” the company said. “They supply us with a single connectivity component, but for years have been demanding a percentage of the total cost of our products — effectively taxing Apple’s innovation.”

Qualcomm says regulators have been spurred on by Apple in an effort to lower Apple’s costs. According to Qualcomm, without Qualcomm cellular technology, the iPhone is little more than a glorified iPod.

An iPhone 7 sells for $700 or more, and Qualcomm receives about $10 per iPhone for use of its thousands of cellular technology patents, according to estimates from analysts at Canaccord Genuity.

Persuading the ITC to issue a ban could be an uphill battle for Qualcomm. Even if it succeeds, the decision could be vetoed by the Trump administration. Samsung won a ban on iPhone imports in a long-running patent dispute with Apple in 2013, but it was overturned by the Obama administration.

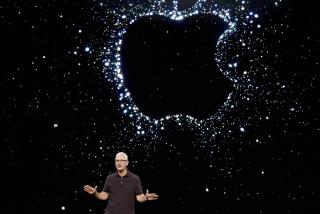

In May, Apple Chief Executive Tim Cook told analysts that he didn’t think the ITC would ban iPhones because Apple has been willing to license Qualcomm’s technology but has not received what it considers to be fair terms.

“I don’t believe anyone is going to enjoin the iPhone based on that,” he said at the time. “I think there is plenty of case law around that subject. But we shall see.”

Rosenberg, however, said there is no case law that helps Apple in this action.

“These are good patents. These are patents that are clearly infringed by the iPhone,” Rosenberg said.

The six patents are not essential to cellular standards and are not included in Qualcomm’s existing license agreements with Apple’s contract iPhone makers, Rosenberg said.

“While not standard essential patents, they are quite important and vital to the functioning of the iPhone and other devices that use them,” Rosenberg said. “They improve performance. They improve efficiency. And all of them reduce the depletion of battery power, which is such an important element for all of us when we use our phone all day long.”

Qualcomm alleges that Apple infringes on the six patents through techniques used in its A-10 graphics processor and its A-10 applications processor — as well as with voltage switching, envelope tracking and other circuitry technology inside the iPhone.

In court documents, Qualcomm contends the six patents represent a small portion of its non-standard essential patent portfolio that it says Apple uses without a license.

The ITC typically takes about 18 months to investigate patent infringement. The lawsuit in San Diego federal court would be put on hold until the ITC issues a ruling.

Bernstein Research analyst Stacy Rasgon said seeking an iPhone ban wasn’t a surprise. Given the length of the typical ITC investigation, Ragson said, it doesn’t change anything in the near term.

Tim Long, an analyst with BMO Capital Markets, said in a research note that the Qualcomm patents in the lawsuit show that its intellectual property is broader than simply 3G/4G cellular radio technology.

“These patents are all relatively new, most issued in the past four years, countering some claims that Qualcomm’s patents are old and outdated,” said Long.

News of Qualcomm’s request came after the markets closed Thursday. Qualcomm shares rose 1% to $55.35 on Friday. Apple shares rose 1% to $144.15.

mike.freeman@sduniontribune.com

UPDATES:

1:35 p.m.: This article was updated with Qualcomm’s and Apple’s stock prices at the close of trading on Friday.

This article was originally published at 10:20 a.m.