Early reaction to Apple’s $3.2-billion bid for Beats: Huh?

Less than a day after news broke that Apple was in talks to acquire Beats Electronics for $3.2 billion, many observers were still scratching their heads.

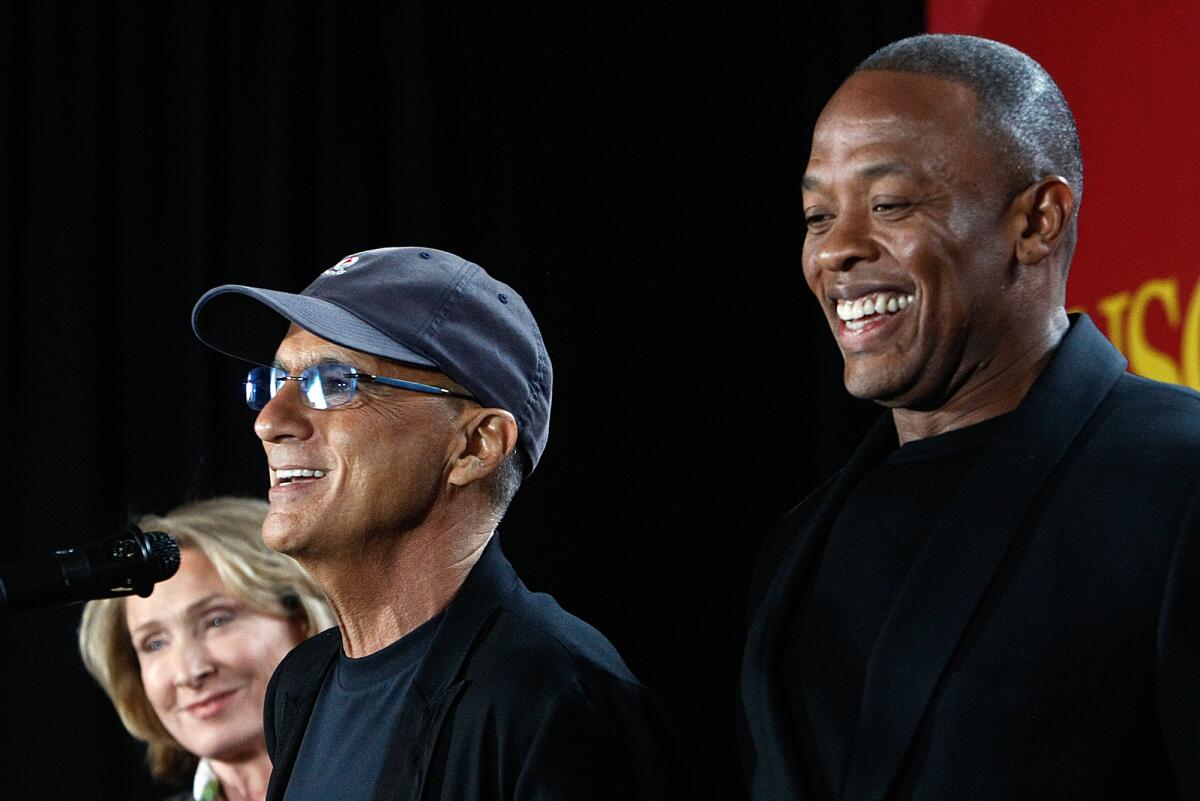

Yes, Beats makes some popular headphones. Yes, it’s launched a streaming music service, though one that appears to be off to a slow start. And yes, Beats has some serious brand buzz thanks to co-founder Jimmy Iovine and Dr. Dre.

That said, it was hard on Friday to find someone who thought the deal for Apple, at that price, made much sense.

In a note to clients late Thursday night, Gene Munster, a Piper Jaffray analysts who is generally bullish on Apple, said the company would be better off spending its considerable war chest on something else.

“We are struggling to see the rationale behind this move,” Munster wrote. “Beats would of course bring a world class brand in music to Apple, but Apple already has a world class brand and has never acquired a brand for a brand’s sake.”

Given Apple’s challenges in areas like Web services, Munster said he’d rather see that kind of money put toward buying a stronger Internet service.

“We view a better use of capital for acquisitions to be in the internet services space given that is, in our view, Apple’s biggest weakness,” he wrote. “This list would include Yelp, Twitter, Square and even Yahoo.”

James McQuivey, an analyst at Forrester Research, said he was skeptical that Apple really needed any new technologies or music industry relationships to create its own subscription music services.

“Streaming music is not that hard to do,” he said. “It doesn’t require technological skills that Apple doesn’t have. It doesn’t require music industry relationships Apple doesn’t have. And it doesn’t require a brand relationship with the customer Apple doesn’t have.”

Om Malik, the founder of tech blog GigaOm and now a venture capitalist, wrote in a blog post that acquiring Beats isn’t likely to help Apple solve any of the problems it faces in the areas of cloud services.

“I am down on this deal,” he wrote. “This is a reactive move — at best. Steve Jobs’ Apple would have pushed to make something better, but even he struggled to come to terms with Internet and Internet thinking. That hasn’t changed.”

Investors had only a mild reaction to the news when trading started on Friday. Apple’s stock was down $5.11 to $582.88, but the tech-heavy Nasdaq was down as well.