How Trump’s tax reform is costing some actors thousands of dollars

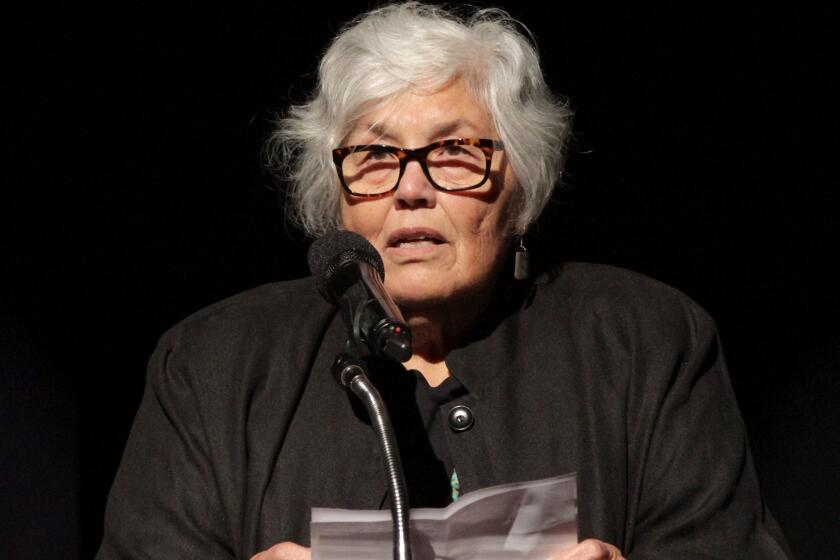

The tax reform legislation signed by President Trump was meant to provide a big tax cut to Americans, but it didn’t for “Gilmore Girls” actress Emily Kuroda.

The 2017 law ended Kuroda’s ability to deduct from her taxes thousands of dollars in travel, costume and other work expenses. Instead of receiving her typical refund, she and her husband had to pay the government $7,000 earlier this year.

“Before I was breaking even, but now I’m losing money if I were to take a job out of town,” the 66-year-old L.A.-based actress said. “I have to think twice before I can commit myself to these projects because ... I can’t write anything off.”

Unlike many other professionals, actors say they have to spend a lot of money upfront before they land jobs. Often they pay for their own head shots, costumes, acting coaches and travel for auditions — even if they don’t get the role.

In the past, many actors would list these expenses as miscellaneous itemized deductions on their taxes. But the 2017 tax reform law eliminated that provision, affecting thousands of performing artists who had used those deductions for work-related expenses. Now unions representing Hollywood performers are pushing Congress to fix the problem.

“Many of them can’t afford the tax hike,” said Sandra Karas, secretary/treasurer on the national council of Actors’ Equity Association, a labor union that represents 51,000 American theater actors and stage managers. “They don’t know what to do with these expenses that they have, that they must spend, to continue their careers.”

Part of the intention behind the 2017 tax reform law was to encourage more companies that have money overseas to invest in the U.S. by lowering the amount of taxes they would have to pay to repatriate the funds. Backers said the new law would help simplify the complex tax code.

But critics said the law didn’t significantly help American workers and mostly benefited corporations and the wealthy.

It removed a provision in the code that for decades allowed actors and other workers to deduct work-related expenses that exceeded 2% of their adjusted gross income (the deduction is set to be restored in the 2026 tax year).

Eliminating miscellaneous itemized deductions has affected all kinds of employees who claim mileage, supplies and other work-related expenses, said Gary Q. Michel, a partner and chair of the tax department at law firm Ervin Cohen & Jessup LLP in Beverly Hills.

“It hits every employee,” Michel said.

Actors have been especially squeezed.

That latest change was disastrous for L.A.-based actor and producer John Downey III. The 51-year-old actor portrayed Kato Brady on the soap opera “Days of Our Lives” from 1997 to 2005 and was nominated for a Daytime Emmy in 2018 as a producer on “Justice With Judge Mablean” for outstanding legal/courtroom program.

As part of his job, he routinely buys outfits for his various auditions. He recently paid $150 out of pocket to buy fishnet stockings, clothing, a wig and other accessories to audition for a part in a TV show that he didn’t get.

Until 2017, Downey would typically receive an annual tax refund of $1,300 because he could deduct such expenses. Last year, however, he ended up owing the IRS $4,175 for his 2018 taxes, he said. That forced him to drastically cut his expenses, including firing his acting coaches and scrapping a $100 annual membership in a trade association.

“The trickle-down was trickle away from the people I was paying,” said Downey. “We pay whatever it takes to get to where the work is if we have to, but now we can’t deduct the expenses around it.”

Karas with Actors’ Equity Association said some actors are taking out loans or using their credit cards to pay the additional expenses.

“People sit with me and just break into tears because they didn’t know what to do,” said Karas, an actress and tax attorney.

To provide relief for Downey and others, Actors’ Equity and SAG-AFTRA are pushing Congress to update a provision in the tax code that would allow performers to deduct work expenses if it’s above 10% of their gross income from the performing arts.

The Qualified Performing Artist provision hasn’t been updated since 1986, and only performers who make an adjusted gross annual income of $16,000 or less qualify.

In a rare moment of bipartisan support, Rep. Judy Chu (D-Monterey Park) and Rep. Vern Buchanan (R-Fla.) in June introduced a bill that would raise the ceiling on the amount of money actors can earn to qualify for the Qualified Performing Artist provision, to $100,000 annually for single people and $200,000 for married couples. The bill is before the House Ways and Means Committee.

Chu, who voted against the 2017 tax reform act, said she filed the bill after actors reached out to her and shared their plight.

“They take the risk of applying for jobs that they never get ... and yet they may not be able to get the money through that job that would actually pay for it,” Chu said. “It’s only right that they are able to get some tax relief for their high-risk business.”

Kuroda, for example, recently performed in the play “The Brothers Paranormal” in New York, which ran for four weeks; she was paid $3,000. But when she factored in expenses that she can no longer deduct — including rent, airfare and meals — her profit was only $200.

“I get to write none of that off,” said Kuroda, who played Mrs. Kim on “Gilmore Girls.” “I was paying to do this show.”

An additional challenge is that there aren’t that many roles available for older, Asian American actresses in Los Angeles, said Kuroda, who is Japanese American.

“There is not a lot of stuff out there for 60-year-old women,” Kuroda said. “I take the roles I am offered regardless of where they are because I love working so much.”

Kuroda declined to say how much she earns but said she would qualify for the update Rep. Chu is proposing.

If the Performing Artist Tax Parity Act passes, more than 75% of the membership of Actors’ Equity and actors guild SAG-AFTRA, which has 155,000 members, would be eligible, union officials said.

The act “is vitally needed legislation that restores the right of lower and moderate income performers, including many SAG-AFTRA members, to deduct these unusually high expenses,” Gabrielle Carteris, president of SAG-AFTRA, said in a statement. “This bill provides tax fairness across the performing artist spectrum.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.