State arts agency loses chance to raise money via tax returns

A feature allowing California taxpayers to use their income tax returns to make donations toward arts programs will disappear in 2013.

Forms for the 2010 and 2011 tax years had a checkoff box for the California Arts Council as one of 18 options for targeted giving to various state-funded causes.

But it won’t be an option any longer. The state law that added the grant-making Arts Council to the mix for the two years specified that the box would vanish if the option didn’t bring in at least $250,000 from tax returns filed for the 2011 tax year.

Through the end of November, the yield was $164,330 chipped in by 15,940 taxpayers, according to the Franchise Tax Board’s running, month-by-month tally of taxpayers’ “voluntary contributions.”

That’s $93 ahead of last year’s pace, but it comes from more than 1,000 fewer donors.

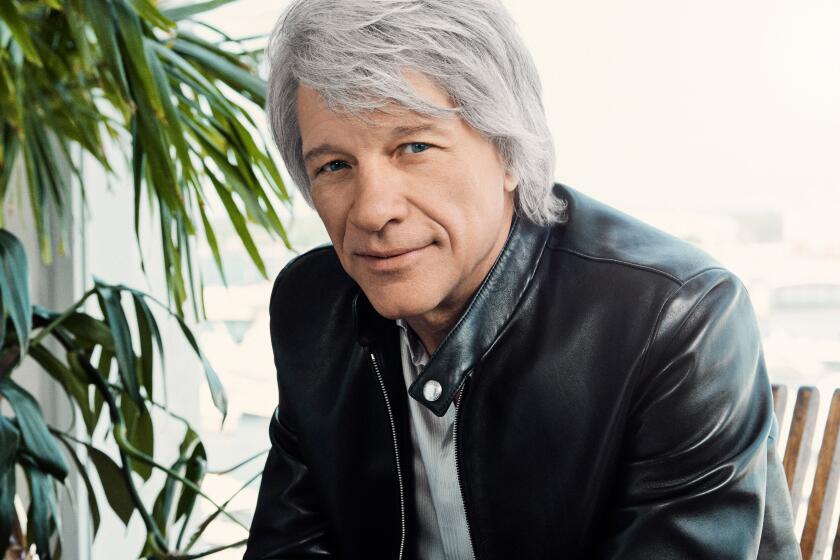

Craig Watson, the arts council’s director, says it’s not surprising the checkoff yield fell short of the bar it was required to meet.

Next to the checkoff box it said “Arts Council Fund,” and in his view, a box by almost any other name would have smelled more sweet to potential donors.

“You say ‘Arts Council Fund,’ and it’s ‘who’s that and why would I give to that?’ Not everybody knows what the Arts Council is or what it does,” said Watson, who stepped up from directing Long Beach’s arts council to the statewide job in July 2011, long after the tax checkoff legislation was written and passed.

Watson said there’s nothing stopping the arts council from trying to get back on the tax form checklist after sitting out a year, although it would take passing a new bill to accomplish that.

The next time around, he said, the label next to the box should say something like “Arts for Kids,” with a provision that all the money raised from tax form checkoffs would indeed go to children’s arts education.

Meanwhile, he said, arts council officials are brainstorming new ways to make it easier for California motorists to sign up for the specialty arts license plates that are the agency’s real donor-funded meal ticket. The plates cost $50 extra for new ones and $40 for renewals, with most of the money going to the arts council, which is depending on them for half its $5.6-million budget for the current fiscal year.

As its stands now, Watson said, people can only buy the license plates for their own vehicles. Making them a gift option would be helpful, he said, adding that’s not the only tweak being studied. Watson said he couldn’t give specifics yet, “but we think it will be significant and will benefit all the specialty plates,” which, like the tax checkoff boxes, provide funding for an array of different causes.

Watson said it was too soon to comment on whether the state budgeting process that begins early next year might help the arts council get money the old fashioned way -- with actual tax dollars rather than voluntary giving. Once a $30-million-a-year agency that carried some real grant-making clout, the arts council got butchered in 2002 and 2003 while Gray Davis was governor, and never recovered. Since then, state taxpayers have kicked in just $1 million a year, with the National Endowment for the Arts providing a $1-million match from federal coffers.

The state’s share comes to pennies per citizen, which reliably left California in last place in per capita taxpayer support for its state arts agency until this year, when Kansas claimed the bottom spot by axing all arts funding.

ALSO:

Stars to help fund state arts grants via license plate sales

State arts council could lose the OK to raise money via tax forms

Lobby group highlights how Obama and Romney stand on the arts

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.