Inflated art appraisals cost U.S. government untold millions

An alleged tax-fraud scheme involving donations of overvalued art to four local museums is part of a larger, unchecked problem with inflated art appraisals that has cost the federal government untold millions, a Times analysis has found.

Each year, the Internal Revenue Service audits donations claimed on only a handful of the 100,000 or more tax returns that allow art donors to reap nearly $1 billion in tax write-offs. Half of the donations checked over the last 20 years had been appraised at nearly double their actual value.

FOR THE RECORD:

LACMA: An article in Sunday’s Section A about allegedly inflated appraisals of art said that 10,750 objects had been seized by federal authorities from the Los Angeles County Museum of Art and 12 other locations in California and Chicago. No objects were seized from LACMA. Museum officials say about 60 objects are being investigated as part of a probe into alleged import violations and tax fraud. Authorities involved would not specify how many objects had been seized from the other locations. The article also said that in 1982 two senior LACMA officials had accepted objects with inflated values and signed backdated donation forms. LACMA says that it does not consider one of the officials involved, a registrar, to be a senior official. —

These IRS reviews caught $183 million in exaggerated claims over the last two decades. But that probably represents a small fraction of the total problem, according to a more detailed 2006 study by the agency’s inspector general.

In recent years, the IRS has reduced even further the number of appraisals it checks, part of a broader decline in the number of tax returns audited. If that smaller sample is any indication, overvaluations appear to be getting worse.

In 2004, for instance, the IRS’ appraisers checked only seven of the 108,554 tax returns with donations of art. They found that more than a third of the 184 objects claimed on those returns were overvalued -- on average more than three times their true worth.

“It totally blows me away,” said Ralph Lerner, a tax attorney in New York who represents many art donors. “I didn’t know there was that much abuse.”

The issue was highlighted in January, when federal agents raided four Southern California museums while investigating an alleged tax fraud scheme involving the donation of overvalued Asian and Native American artifacts.

Since the raids, federal agents have seized more than 10,750 objects from the Los Angeles County Museum of Art, the Pacific Asia Museum in Pasadena, the Bowers Museum of Cultural Art in Santa Ana, the Mingei International Museum in San Diego and nine other locations in California and Chicago, authorities say.

It is appraisers, not museums, who determine the value of art for donors. But the U.S. attorney’s office in Los Angeles is investigating whether museum officials furthered the scheme by knowingly accepting donations of overvalued art from suspect dealers and collectors over a decade, according to affidavits filed in January.

The allegations mirror past tax fraud scandals in which museums such as LACMA, the Smithsonian Institution and the J. Paul Getty Museum accepted donations of art whose value was inflated.

The federal government has long sought to balance incentives for art donors with the risks of tax fraud. Some lawmakers are now saying that balance should be reconsidered in light of possibly widespread fraud.

“It may be that some donors submit inflated appraisals because they know they probably won’t get caught,” said Sen. Charles Grassley (R-Iowa), ranking member of the Senate Finance Committee, which is considering legislation that would require additional scrutiny of appraisals.

Other critics are suggesting more fundamental reforms. Robert Reich, an economist and former secretary of Labor in the Clinton administration, recently argued that charitable donations that do not directly benefit the poor, such as art, should be eligible for only half their value in tax benefits.

“We’ve created a giant loophole right now through which the rich reduce their taxes by supporting culture palaces frequented primarily by themselves,” Reich said in an interview. “This is not the way the tax code was intended to be used.”

Museum officials warn, however, that changes to the current system could have serious consequences. For more than a century, tax write-offs have been the economic engine that has built public art collections across the country. More than 80% of acquisitions now come through donations, according to the Assn. of Art Museum Directors. “If something were to happen to the deductibility of art, it would be disastrous,” said Anita Difanis, a lobbyist for the association.

The tax fraud scheme alleged in the recent Los Angeles-area investigation appears petty in scale, but its resemblance to past cases suggests that questionable practices remain pervasive.

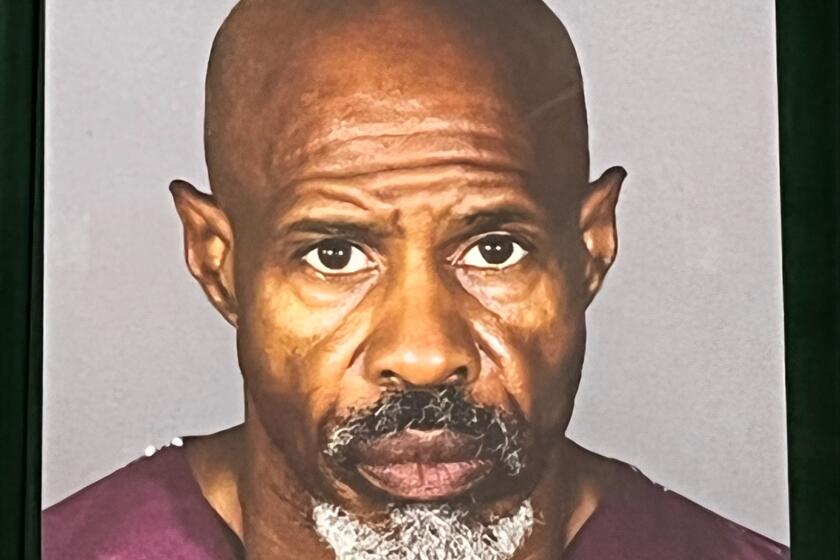

Authorities allege in affidavits that Robert Olson imported shipping containers full of recently excavated Thai antiquities into Los Angeles and sold them to collectors and art dealers with the promise that he could arrange appraisals that would boost their value by four or five times.

In one case, Olson is alleged to have sold an undercover agent $6,000 worth of artifacts that an appraiser later valued at $18,775, citing Olson as an authority on the value, according to the affidavits.

Olson has acknowledged importing recently excavated antiquities but says he did not violate U.S. law.

What has shocked many about the case is the relatively small benefit the scheme probably yielded. A donor in the highest tax bracket of 35% would have received a tax benefit of just $6,571 from the transaction, just a few hundred dollars more than the cost of the art.

Many other donations of items imported by Olson were valued at just under $5,000 -- the threshold at which the IRS requires a formal appraisal. The affidavits suggest that the donors may have used the scheme several times a year over a decade.

“It doesn’t make financial sense to me unless the perception was it was easy to get away with and the service wasn’t going to come after them,” said Sheryl Gillett, a senior member of the American Society of Appraisers.

She said the case shines a light on the lack of government regulation of the appraisal industry. The appraisers society has pushed in recent years for such regulation.

A 2006 law tightened standards and increased penalties on bad appraisals. For donors, it lowered the threshold on what the law considers a bloated appraisal, from 200% overvalue to 150%. It also increased oversight of and fines for appraisers. But because the IRS checks so few appraisals, some believe that overvaluations will continue.

“The government has looked the other way for many, many years,” Gillett said. “I think we’ve reached a point where they can no longer do that.”

A long history

Olson’s alleged scheme was nothing new.

From 1973 to 1985, the Getty Museum accepted at least $14 million in donated Greek and Roman antiquities from a network of wealthy “collectors,” according to news reports, Getty records and interviews with participants in the scheme. Most of the objects had been recently excavated and imported into the United States, where the Getty’s first antiquities curator, Jiri Frel, would inflate their value in forged appraisals, records and interviews show.

Many of the donors never saw, much less owned, the objects they gave, but lent their names to the transactions in return for generous tax write-offs, said Bruce McNall, who admits participating in the Getty scheme.

The donations helped the Getty build its well-known antiquities study collection -- objects not important enough to go on display, but of archaeological interest to researchers.

The scheme was discovered by Frel’s deputy, Arthur Houghton, who raised the alarm internally just as the IRS began questioning some of the appraisals. By the time the controversy was exposed publicly in 1987 by the now-defunct Connoisseur magazine, Frel was on paid leave in Europe and the IRS investigators had moved on, records and interviews show. Frel died in May 2006, and no one at the Getty was ever prosecuted in the case.

“Taking advantage of the whole tax system -- that’s how museums get things,” said McNall, who went on to buy the Los Angeles Kings and produce movies before spending four years in federal prison for his role in a $236-million bank fraud.

Similar schemes have arisen elsewhere.

In 1982, two undercover IRS agents made donations of overvalued Egyptian antiquities to LACMA and UC Santa Barbara.

Senior LACMA officials accepted objects with inflated values and signed backdated donation forms for the agents, who posed as wealthy donors, IRS officials said at the time.The LACMA officials later told The Times it was an “honest mistake” and a “favor” for the donor, and promised to “tighten up procedures.”

LACMA officials said no action was taken against the museum or its staff.

In 1983, the IRS found that gems donated to the Smithsonian Institution had been appraised at five times their true value. The museum pledged to tighten its procedures. But five years later, the museum accepted four Stradivari instruments valued at $50 million. Documents obtained by the Senate Finance Committee showed that the instruments had been appraised a decade earlier at a tenth of that value.

A hamstrung watchdog

The Smithsonian said it was not responsible for the new appraisal, which one expert called “preposterous.” The donor later went to prison for an unrelated tax fraud.

Rampant overvaluations in the 1960s led the IRS to create a panel of art experts to evaluate the accuracy of appraisals.

The Art Advisory Panel -- a group of volunteer curators, dealers and appraisers -- travels to Washington twice a year to assess donations valued at over $20,000 that are found during routine audits. The IRS does not disclose the reasons for its audits.

As scrutiny has declined, the frequency and amount of inflation appear to have grown, figures show.

The panel’s sample is so small that it is hard to draw broad conclusions. But that bigger picture was hinted at in a 2006 study by the IRS’ watchdog, the treasury inspector general for tax administration, whose office looked at a statistical sample of all tax returns with donated art in 2002.

The study suggests that there were at least 200 inflated appraisals that year. The panel found only four. But the study concluded that creating a new program to check more art donations would not be cost-effective because they made up just under 4% of all charitable contributions.

Grassley, who requested the study, is considering new legislation that would require all art donations of a certain value to be checked by the panel.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.