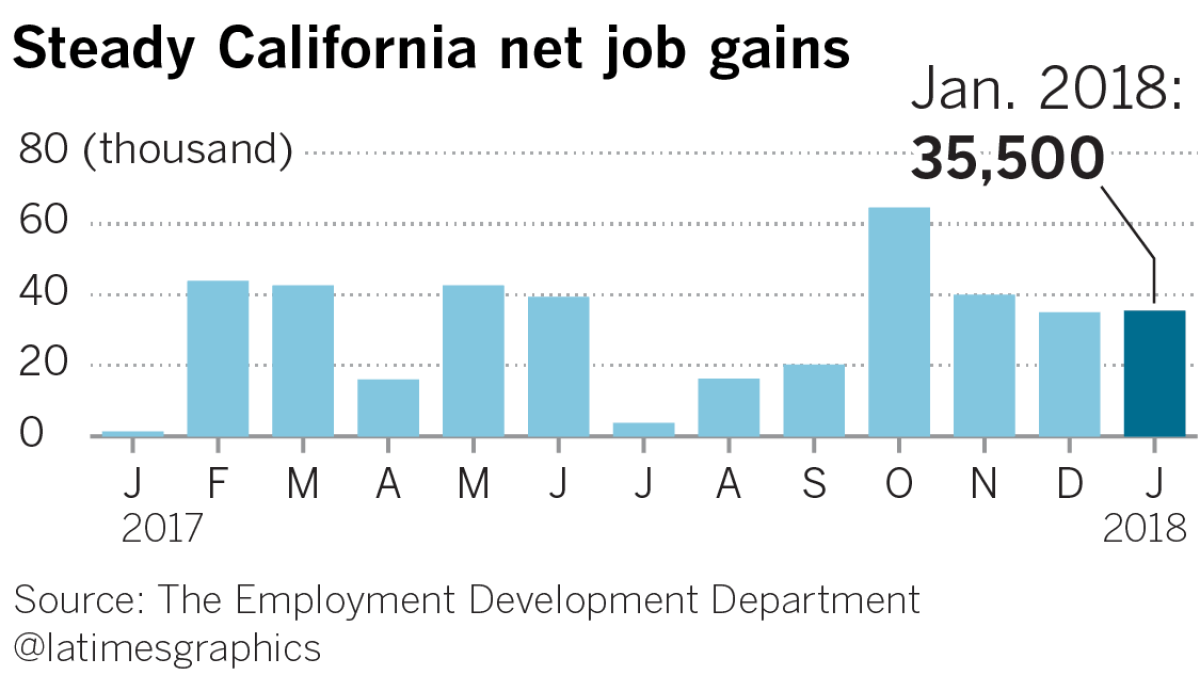

California gains 35,500 jobs, and unemployment falls to record-low 4.4%

Job growth in California was more robust than expected in 2017 and continued on a strong note in January, adding 35,500 jobs as the unemployment rate fell to a record low of 4.4%, according to data released Wednesday by the state’s Employment Development Department.

The report came with an annual revision that showed 2017 job gains surpassed even those in 2016 — a surprising feat for a maturing economic recovery entering its eighth year.

“We are nearing the longest employment expansion since World War II,” said Michael S. Bernick, an attorney with Duane Morris and a former director of the state's employment department. “Each time it looks like the expansion might end it continues going.”

Construction and trade showed the strongest hiring. Builders added 11,100 jobs from December to January, while trade, transportation and utilities employers added 10,800 jobs.

Manufacturing, education and health services, and leisure and hospitality also posted increases.

Early in 2017, there were signs growth was slowing, something economists attributed to high housing costs and an economy that was nearing full employment.

But the annual revisions, released along with January’s numbers, showed the state added 366,000 jobs in 2017, 11,100 more than in 2016.

In Los Angeles County in January, employers added 7,200 jobs. In Orange County, payrolls rose by 4,300; in the Inland Empire they increased 2,000.

Typically, a month’s jobs figures are released the following month, but the EDD releases January jobs numbers in March because of extra time needed by the agency to make its annual data revision.

December’s unemployment rate was revised upward to 4.5%, from 4.3%. That 4.3% had been touted as a record low for the unemployment survey, which started in 1976. Now, the 4.4% recorded in January is the record.

According to a UCLA Anderson quarterly forecast, also released Wednesday and completed before the EDD’s revision, statewide job gains are likely to accelerate slightly this year, in part because of the $1.5-trillion federal tax cut package that took effect in January.

Total jobs should increase 1.9% in 2018, faster than the 1.8% increase the report projected in 2017. The forecast predicts job growth will slow to 1.7% in 2019 and 0.8% in 2020.

A slowdown is to be expected as a natural byproduct of an economy at or near full employment, many economists say.

Experts are now trying to figure out whether low unemployment will finally lead to more robust wage growth, as employers increasingly fight for a dwindling share of possible employees.

“I don’t see how we can avoid decent wage growth, which is a positive thing for workers,” said Dave Smith, an economist at the Pepperdine University Graziadio School of Business and Management.

There are some signs that is happening.

Nationwide, average hourly earnings on a seasonally adjusted basis rose 2.9% in January — the most since 2009.

In December, average hourly earnings in California, not adjusted for seasonal variations, jumped 3.7% from a year earlier, to $30.45, according to the latest state data available from the U.S. Labor Department.

Some of the potential roadblocks to further growth stem from federal policy, experts said. If President Trump imposes sharp steel tariffs that set off a trade war, consumer prices will probably rise and California’s agriculture industry would be a prime target for other countries to target in retaliation. The state’s logistics sector — which posted January’s second-largest jobs increase — would also be hit by any reduction in foreign trade.

That applies as well to Los Angeles County, home to the nation’s largest port complex in San Pedro Bay. “L.A. will benefit more from prosperous trade while it will suffer more from a trade war,” UCLA economist William Yu wrote in the UCLA Anderson Forecast.

Although many experts say the tax cuts will cause at least a slight upswing in the short run, there is fear they could cause inflation to pick up steam by injecting more money into an already robust economy.

“What is going to happen with tariffs and the stock market … those things can be bellwethers of trouble in the future,” Smith said. “But I think the greater danger is overheating with the tax cuts.”

UPDATES:

4:15 p.m.: This article was updated throughout with analysis, comments from economists and additional jobs data.

This article was originally published at 10:45 a.m.