U.S. is putting new tariffs on hold while negotiating with China, Mnuchin says

The Trump administration carefully stepped back Sunday from a looming trade war with China, saying that it would refrain for now from applying major tariffs on Chinese goods in the wake of Beijing’s promise to ramp up purchases of American products to reduce the trade deficit.

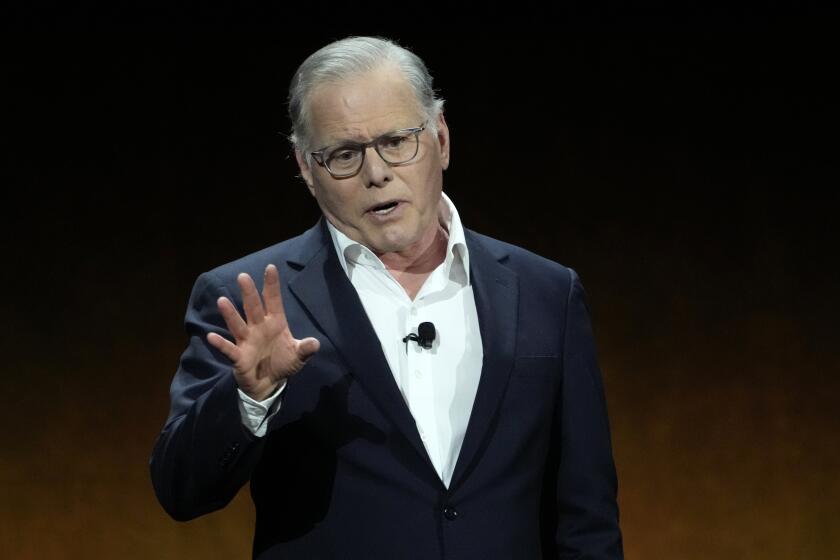

“We’re putting the trade war on hold,” Treasury Secretary Steven T. Mnuchin said on “Fox News Sunday.” He noted that the United States and China, the world’s two biggest economies, had made “meaningful progress” in two days of high-level talks last week.

“We have agreed to put the tariffs on hold while we try to execute the framework,” Mnuchin added.

Mnuchin’s comments appeared to signal a more cooperative path for U.S. trade dealings with China. They are the latest indication that the two sides are trying to ease escalating tensions, and to forestall massive tariffs and counter-tariffs that Washington and Beijing have threatened against each other.

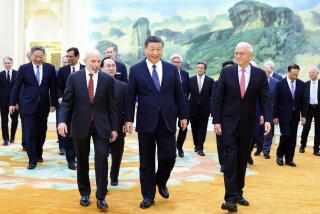

The downshift comes as President Trump has reached out to Chinese President Xi Jinping for greater support in his efforts to persuade North Korean ruler Kim Jong Un to give up his nuclear arsenal. Trump is scheduled to meet with Kim in Singapore on June 12.

Analysts expressed doubts that China’s commitment to “significantly increase purchases” of U.S. agricultural goods and other items would make a meaningful dent in the trade deficit. They also warned that the more cooperative tone may not last long, especially as Trump has given conflicting signals and orders involving China trade and relations.

“While there will be periodic ceasefires, U.S.-Chinese trade relations will remain tense, with more barriers to trade and investments,” said David Loevinger, a former senior Treasury Department official for China affairs.

Mnuchin acknowledged as much, noting that Trump “can always decide to put the tariffs back on if China doesn’t go through with their commitments.”

Trump had threatened to slap hefty tariffs on $150 billion in Chinese goods, with the first $50 billion outlined in detail and ready to take effect soon. China had vowed to retaliate with its own tariffs on U.S. goods and services.

Mnuchin’s climb-down highlights how hard it is to pull the trigger on what could quickly become a punishing trade war, Loevinger said.

“Among U.S. businesses there’s more consensus on getting tough with China in theory than in practice,” he said. “Corporate and agriculture lobbyists have been working overtime to protect their clients’ business. Nobody’s willing to ‘take one for the team’ and sacrifice their own corporate interests.”

Mnuchin’s positive forecast came days after Trump unexpectedly pledged to help the Chinese telecom-equipment company ZTE survive crippling penalties for violating U.S. sanctions. “Too many jobs in China lost,” he tweeted.

Beijing offered its own conciliatory gestures by dropping an anti-dumping investigation into imported U.S. sorghum and unblocking an American firm’s bid to buy a Toshiba business unit.

The easing of tensions, at least for now, was welcomed by investors and other governments who fear a U.S.-China trade war could quickly richochet into economies around the globe.

Mnuchin led the administration’s talks with senior Chinese officials in Washington on Thursday and Friday. In a joint U.S.-Chinese statement Saturday, Beijing agreed to “substantially reduce” the U.S. trade deficit with China.

The statement said China would expand its purchases of American farm and energy exports. The statement did not say how much China would buy, or how much of the trade deficit Beijing would aim to reduce.

Trump and supporters of a hard-line approach to China have repeatedly cited the large trade deficit as a key measure of the imbalance between the two nations. Last year the U.S. exported $130 billion in American merchandise while it imported $506 billion worth of goods made in China.

That resulted in a deficit of about $375 billion, although with trade in services such as tourism and licensing fees, the overall U.S. trade deficit with China was about $337 billion.

The Trump administration had proposed a cut in the deficit of $200 billion or more, and on Friday, Larry Kudlow, Trump’s director of the National Economic Council, had indicated that Beijing had agreed to import “at least $200 billion” more in U.S. goods.

On Sunday, Kudlow backed away from that figure, saying that “maybe I got ahead of the curve.” He also appeared to cast doubt on whether the threat of tariffs had been eased. “I don’t think we’re at that stage yet,” he said on CBS’ “Face the Nation.”

“Tariffs are part of any negotiation, and tariffs maybe have to be part of any enforcement,” Kudlow said. “You cannot do this kind of major change without using everything that’s in your quiver.”

Both Kudlow and Mnuchin said the two sides had made good progress in their talks and, significantly, that Trump had viewed the latest discussions as productive and positive.

Mnuchin said the administration would “immediately” follow up by sending Commerce Secretary Wilbur Ross to Beijing to work out details.

“We expect to see a very big increase, 35 to 45% increases in agriculture this year alone,” Mnuchin said. “In energy, doubling the energy purchases,” he said, adding that “you could see $50 billion, $60 billion a year of energy purchases over the next three to five years.”

Economists and China experts said they doubt the U.S. could export anywhere near the amount necessary to make a substantial change in the trade deficit with China.

“The numbers Mnuchin set forth might keep our deficit from expanding further over the next few years, but they are not likely to reduce it materially in absolute terms,” said Nicholas Lardy, a China economy expert at the nonpartisan Peterson Institute for International Economics in Washington.

The U.S. could certainly export more farm products to China. Total shipments of agricultural goods to China last year were worth about $20 billion, more than half of them soybeans.

“For now, expect the Chinese to go back to buying lots of U.S. soybeans and Boeing aircraft, a big-ticket item that can move the needle,” said Oded Shenkar, a China expert and business professor at Ohio State University. “But what else can the Chinese buy from the U.S.?”

The U.S. has greater potential to export more services to China, especially if Beijing opens its financial and other services markets, as it has pledged to do. “But any change on the services side, where the U.S. is most competitive, will take years,” Shenkar said.

The Chinese proposal to buy more U.S. energy resources such as natural gas also will take years because of a lack of pipeline and other U.S. infrastructure.

The U.S. could improve its trade balance by relaxing export controls prohibiting the sale of various U.S. software, equipment and other sensitive goods. But many in the Trump administration as well as Congress are suspicious of China’s growing military capabilities, and are moving to clamp down on such sales, not the other way around.

“Basically the mutual suspension of tariff threats signals that progress has been made and it is also a trust building measure,” Shenkar said. “This does not guarantee that a successful resolution will be reached.”

UPDATES:

4:40 p.m.: This story was updated with new details about U.S.-Chinese efforts to avoid a trade war.

9:28 a.m.: This story has been updated with reporting from Bloomberg.

This story originally published at 8:45 a.m.