Can Taco Bell’s former chief restore Chipotle’s once-sizzling growth?

CNBC stock analyst Jim Cramer is excitable by nature, but the former hedge fund manager was really frazzled after hearing who was hired as Chipotle Mexican Grill Inc.’s chief executive.

Chipotle — the fast-growing burrito chain that became the anti-Taco Bell with food steeped with fresh ingredients, then was rocked by highly publicized outbreaks of E. coli and other food-borne illnesses in late 2015 — had recruited, of all people, Taco Bell chief Brian Niccol as its next CEO.

Niccol was “the most opposite guy you could possibly find” and Chipotle promptly had set up “a culture clash,” an exasperated Cramer told viewers when Niccol’s appointment was announced Feb. 13. “It’s like naming a guy from the Army to run the Air Force.”

But others thought Niccol was a strong choice, based on his track record at Taco Bell, and Wall Street cheered. Chipotle’s battered stock, which had plunged 67% from its record high reached in mid-2015, soared 15% that day amid hopes that Niccol could restore Chipotle’s sales growth and reputation among consumers.

“We’re hard-pressed to find a better fit for Chipotle’s CEO position than Brian Niccol,” Morningstar analyst R.J. Hottovy said in a note to clients. “Under Niccol’s leadership, Taco Bell has been one of the bright spots in U.S. quick-service restaurants.”

Niccol, 44, succeeded Steve Ells, Chipotle’s founder, who remains executive chairman. Niccol has his work cut out. In one of his first moves, Chipotle announced Wednesday that Chief Marketing Officer Mark Crumpacker is stepping down. Crumpacker, a high school friend of Ells, was responsible for such efforts as recruiting rapper RZA of the Wu-Tang Clan to promote Chipotle’s new menu.

The food-safety woes not only damaged Chipotle’s reputation, they soiled the “Food with Integrity” narrative that the Denver-based chain and Ells carefully had crafted for two decades to fuel its growth. It was branding that portrayed Chipotle as a cut above its rivals with fresh, organic ingredients, strong customer service and pleasing in-store furnishings.

Chipotle’s burritos, burrito bowls, tacos and salads found a sweet spot amid Americans’ growing demand for healthier food. The chain was “once the benchmark by which fast-casual restaurant chains measured themselves,” Hottovy said.

Chipotle rapidly expanded, initially with a major investment from McDonald’s Corp., which eventually took over ownership of the chain. McDonald’s then began unwinding its position in 2006 when Chipotle went public at $22 a share. In early August 2015, the stock hit a peak of $757.77 a share — a 34-fold increase.

Then the food-safety scare hit. Diners stayed away, the stock tumbled and activist investor William Ackman swooped in, amassing a 10% stake in Chipotle. He secured two seats on its board in late 2016 in exchange for agreeing not to lift his stake above 12.9% or to make any disparaging public comments about the company for two years.

The chain fundamentally changed the way it sources some ingredients, including preparing some of it earlier and in central kitchens, away from restaurants. Ells acknowledged in late 2016 that because Chipotle’s employees were so focused on implementing food-safety changes in the aftermath of the disease breakouts, its basic customer service — such as cleanliness and the speed at which customers get through the ordering line — had begun to falter at some restaurants.

“When we invite new or lapsed customers into restaurants that are less than perfect, we believe those customers will return less frequently,” Ells said at an investor conference.

All of which occurred as Chipotle faced increasing competition in the “fast-casual” sector from the likes of Qdoba Mexican Eats and Panera Bread, and while overall restaurant sales are sluggish.

“We have too many restaurants,” said Nicole Miller Regan, an analyst with the investment firm Piper Jaffray Cos. Chipotle’s woes “couldn’t have happened at a worst time, frankly,” she said.

Nonetheless, Niccol — who, with Ells, declined comment for this article because he had just begun his tenure — arrived after Chipotle at least had stopped the decline caused by the food scare.

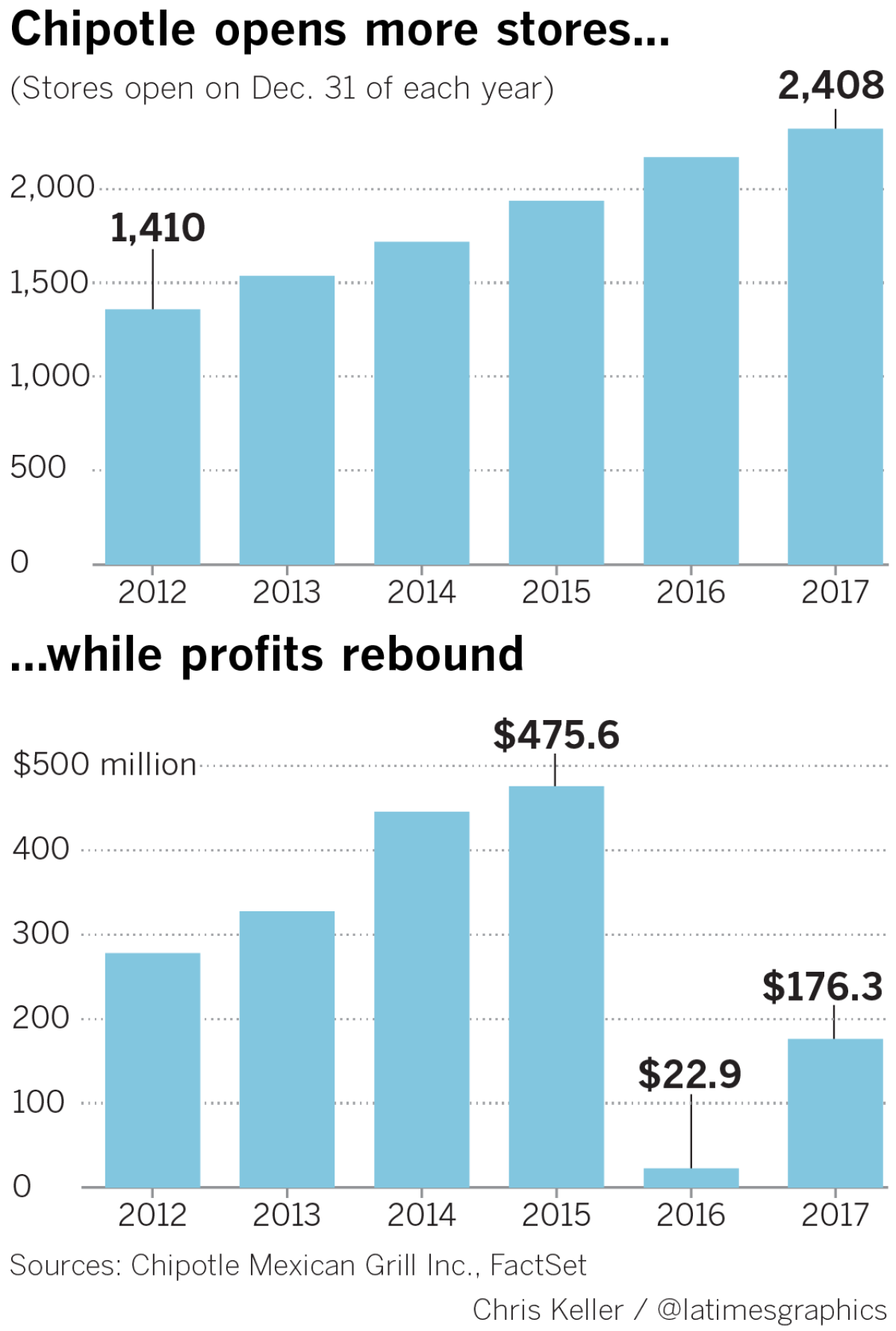

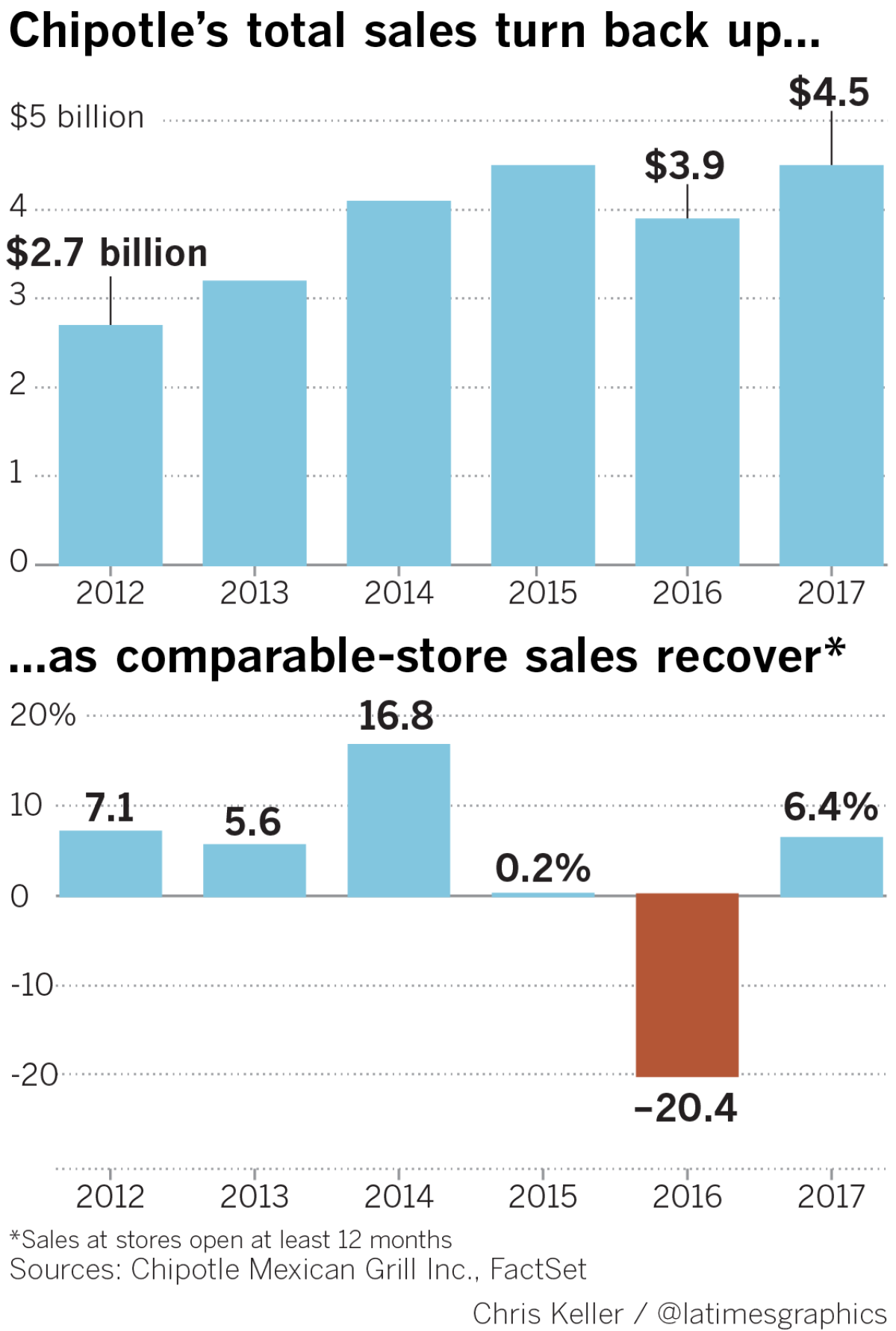

Chipotle’s same-store sales, or sales at stores open at least a year, rose 6.4% last year after they plummeted 20.4% in 2016. The chain’s revenue rose to $4.5 billion from $3.9 billion in 2016, and profit rose to $176.3 million from $22.9 million, in part because Chipotle kept opening new stores. It had 2,408 locations — including 409 in California — at the start of this year.

But last year’s profit was less than half the $476 million that Chipotle earned in 2015, when it had 300 fewer restaurants. And Chipotle’s stock had dropped to $251 a share before Niccol was hired; it closed Tuesday at $326.80.

The chain remains in good financial health, with no long-term debt and $509 million in cash and equivalents as of Dec. 31. That gives Niccol some flexibility as he retools Chipotle’s strategy.

A key challenge for Chipotle is “there’s just nothing new to talk about” in terms of its menu or innovation, Hottovy said. “That’s what Niccol has to take care of right off the bat,” he said. “The perception is that he can start bringing some excitement to the brand that hasn’t been there for some time.”

In fact, Niccol has built a reputation for food service innovation. He worked at Procter & Gamble in brand management — and earned an MBA from the University of Chicago — before joining Yum Brands Inc., which owns Taco Bell, Pizza Hut and KFC, in 2005.

He eventually rose to general manager for Pizza Hut USA before shifting to Irvine-based Taco Bell in 2011 as its chief marketing and innovation officer. He became Taco Bell’s CEO in early 2015.

Niccol was credited for turning Taco Bell into a thriving, youthful brand — he changed the company’s slogan from “Think outside the bun” to “Live mas” — and vastly improved Taco Bell’s digital marketing effort, which appealed to tech-savvy millennials.

“If you let the brand get old, you will die,” he told the Los Angeles Times in 2015. Chipotle also noted that Niccol also “transformed Taco Bell into a social media leader and revolutionized its digital approach through mobile ordering and payment across their 7,000 restaurants.”

During Niccol’s stint, Taco Bell expanded its menu to include items such as Doritos Locos Tacos, the Quesarito and Nacho Fries. “We have been impressed by Taco Bell’s approach to menu innovation, marketing creativity and consistent operations,” analyst Miller Regan said in a note to clients.

Ells, 51, signaled that he expects Niccol to act decisively to improve the chain.

“Brian’s passion and skill-set ideally position him to make the bold moves needed to improve operations and take the company to the next level,” Ells said in a statement when Niccol was hired.

Ells, in turn, deserves praise for showing he “wasn’t too proud” to find the best available CEO, even at a competitor, Miller Regan said.

The question now is “how loose will those reins be?” under Ells for Niccol to manage, she said, adding: “They need to be loose so Brian can do his job.”

Chipotle milestones

- 1993: Steve Ells, a graduate of the Culinary Institute of America, opens his first Chipotle Mexican Grill in Denver with an $80,000 loan from his father.

- 1998: McDonald's Corp. invests in Chipotle, which eventually becomes a McDonald's subsidiary, and Chipotle aggressively expands.

- 2006: Now with nearly 500 stores, Chipotle goes public at $22 a share as McDonald's begins to unwind its ownership of the chain.

- 2014: Chipotle's annual revenue reaches $4.1 billion as its same-store sales, or sales of stores open at least one year, soar 16.8% from the prior year.

- 2015: Chipotle's stock hits record high $757.77 a share on Aug. 5. Three months later, reports start to surface of E. coli and other food-borne illnesses at Chipotle restaurants that eventually spread to 15 states, notably in Washington and Oregon. Sales and customer traffic plunge.

- 2016: The Centers for Disease Control and Prevention closes its probe of the Chipotle outbreaks without determining a food or ingredient responsible. Chipotle overhauls its food-safety procedures and offers discounts to regain lost customers.

- 2017: Chipotle keeps expanding and ends the year with 2,408 restaurants.

- 2018: Chipotle hires Brian Niccol, head of the Taco Bell fast-food chain, as its chief executive while Ells remains executive chairman.

Twitter: @PeltzLATimes

UPDATES:

10:50 a.m.: This article was updated with news that Chipotle’s marketing head is stepping down.

This article was originally published at 5 a.m.