City National, L.A.’s ‘bank to the stars,’ sold for $5.4 billion

Los Angeles’ “bank to the stars” is going Canadian.

The parent of City National Bank, the largest bank with headquarters in Los Angeles and a fixture in the wealth-management and entertainment industries, has agreed to be purchased by Royal Bank of Canada for $5.4 billion, the firms announced Thursday.

The cash-and-stock deal helps RBC expand its presence in the U.S., where it is the eighth-largest wealth-management firm. City National will remain a separate brand under RBC, with headquarters in L.A.

The Toronto bank said it has been working to acquire City National Corp. for two years because of its high-end clientele -- including many in Hollywood -- and its location in wealthy markets such as L.A., Orange County and the San Francisco Bay Area.

“City National serves high net worth and commercial client segments in select high-growth markets, and represents a unique opportunity to complement and enhance our existing U.S. businesses and product offering,” said RBC Chief Executive Dave McKay.

------------

FOR THE RECORD

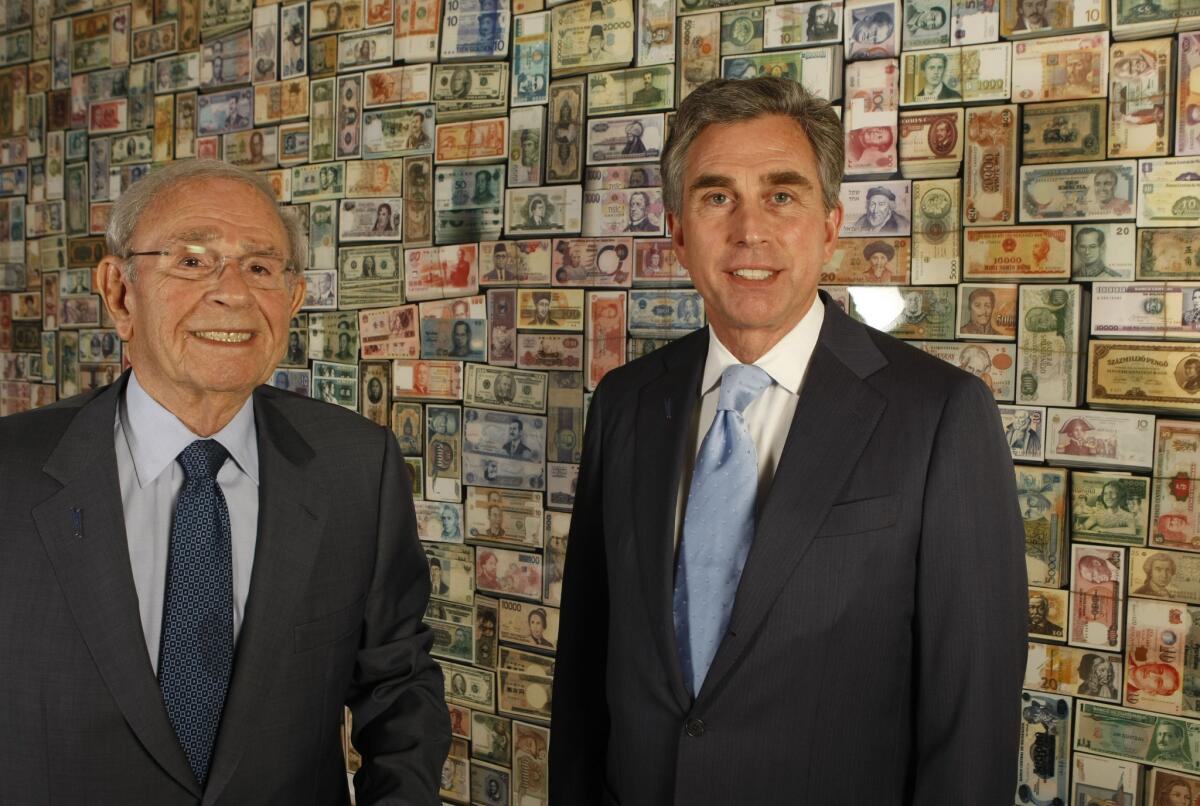

Jan. 22, 8:21 a.m.: An earlier version of this article contained a photo caption that said Bram Goldsmith was the founder of City National Bank. He was the longtime chairman of City National Corp., the bank’s parent.

------------

RBC will purchase City National for $2.7 billion in cash and 44 million RBC shares, the firms said. City National shareholders will get $47.25 in cash and .7489 shares of RBC common stock for each share of City National common stock.

The deal values City National stock at $93.80 a share, a 26% premium above Wednesday’s closing stock price of $74.57.

“We’re very enthused about merging with RBC,” said City National Chairman and Chief Executive Russell Goldsmith. “This combination is a compelling opportunity.”

Goldsmith’s family helped found City National more than 60 years ago. After the deal, he will remain as chairman and CEO of City National and will also be responsible for RBC’s U.S. wealth-management unit.

The sale comes at a time when banks that survived the Great Recession are being pinched by low interest rates, which cut into their profit on lending.

Shares have declined over the last year at publicly traded California regional banks, including East West, Cathay, Pacific Western and Citizens Business in Southern California, and Silicon Valley and First Republic in Northern California.

City National stock had fared worse than most, falling 8% in the 12 months that ended Wednesday. It shot up $14.11, or 18.9%, to $88.68 on Wall Street on Thursday.

The sale is the latest in a series of high-profile mergers involving California regional banks. PacWest Bancorp and CapitalSource Inc., both based in Los Angeles, struck a $2.3-billion deal to combine in 2013, and last year OneWest Bank in Pasadena agreed to sell itself for $3.4 billion to CIT Group in New York.

In a conference call with analysts Thursday, McKay said RBC identified City National as a prime acquisition to expand its U.S. footprint even though the L.A. bank wasn’t for sale.

RBC was attracted by what it called City National’s “market-leading position in the entertainment industry and an emerging presence in the rapidly growing technology and healthcare segments.”

“I actually mystery shopped New York and L.A. branches and found the experience was very, very consistent,” McKay told The Times.

McKay said he first approached Goldsmith about two years ago. The two had never met.

“We talked about how the two companies together could do something special in the U.S. market,” McKay said. “He said, ‘But I’m not for sale.’ ”

McKay said he asked Goldsmith to consider it.

“The more we talked, I saw a compelling value proposition and exciting growth trajectory,” McKay said.

City National Corp. Chairman Emeritus Bram Goldsmith, 91, called the sale a “win-win deal.”

“Apparently they had been looking to expand and decided that we were the only bank they could find that had the same direction and desires that they have,” he said.

“They wanted an organization and our management, so we’ll continue to do what we do, with greater support from the 12th-largest bank in the world.”

Meanwhile, the Goldsmith family and City National will continue to support the community, Russell Goldsmith said.

“As the bank grows and prospers, we’ll be able to expand, hiring more people in California,” he said.

City National, with 75 offices in five states and $32.6 billion in assets, was launched in 1954 by a group that included Goldsmith’s grandfather, Ben Maltz, and his partner in a wholesale liquor business, Alfred Hart.

City National, based in Beverly Hills, became known as the “bank to the stars” with Hart as its president. It even provided ransom money to Frank Sinatra when his son was kidnapped in 1963 from Harrah’s Lake Tahoe.

Sinatra repaid that and other favors from Hart in 1975 by performing at a benefit that raised $3.5 million from hundreds of Hollywood A-listers to help build the Alfred and Viola Hart Tower at Cedars-Sinai Medical Center. At the event, Sinatra thanked the bank.

City National remains a top provider of financial services to Hollywood and the broader entertainment industry, catering to the hip-hop scene in Atlanta, country music in Nashville and serving as the banker for Broadway shows, including the hit “The Book of Mormon.” It also is the official bank of the Tony Awards.

For breaking economic news, follow @JimPuzzanghera on Twitter