EBay agrees to spin off PayPal after pressure from activist investors

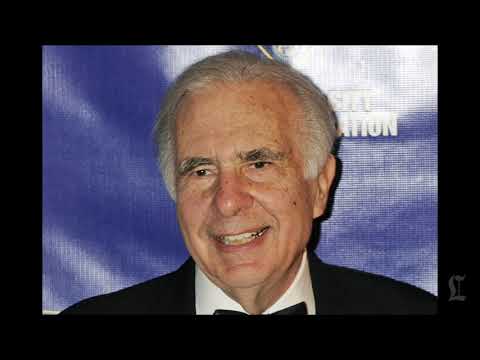

PayPal and EBay will split into separate, publicly traded companies by 2015 amid pressure from activist shareholder Carl Icahn.

In the 1980s, the heyday of the corporate raiders, Carl Icahn made a name for himself as a persistent aggressor.

He went after stodgy, old-line companies — Gulf & Western, Western Union, Phillips Petroleum, TWA — hellbent to break them up and “unlock value” where plodding managers and boards had failed.

Now 78, Icahn targets what he sees as the latest pool of stodge — aging technology companies.

On Tuesday, online marketplace EBay Inc., now nearly two decades old, agreed to spin off online payments king PayPal by the end of 2015 after heavy pressure from Icahn and other activist investors, who expect to profit from a higher post-split market value.

“It’s almost a ‘no brainer’ that these companies should be separated to increase the value of these great assets,” Icahn said in a statement.

EBay Chief Executive John Donahoe, who had resisted the move for months (and who will step down as CEO after the spinoff) said in his own statement: “A thorough strategic review with our board shows that keeping EBay and PayPal together beyond 2015 clearly becomes less advantageous to each business strategically and competitively. The industry landscape is changing, and each business faces different competitive opportunities and challenges.”

That review, however, followed a big battle.

After EBay resisted Icahn’s calls for heavy restructuring, including a PayPal spinoff, Icahn launched a proxy fight to control the San Jose company’s board. In April, after much drama, Icahn and EBay reached a truce. Icahn dropped the proxy fight and agreed with EBay to add business leader David Dorman to the board — which later conducted the strategic review.

“Icahn is considered Wall Street’s smartest manipulator,” said Gary Lutin, chairman of the Shareholder Forum, which supports long-term investor interests. “But in the EBay-PayPal situation, his proposed split-up might go beyond short-term stock pumping to work just as well for long-term enterprise value. Many people view EBay as a pretty mediocre company.”

Venture capitalist Peter Thiel, a PayPal co-founder who left the company after EBay bought it in 2002, said the spinoff makes sense.

“The last few years there have been a number of new payment systems, so having [an independent] focus on the product will be critical to PayPal,” he said on a radio talk show Tuesday.

PayPal, founded in 1998, had the online payment market pretty much to itself for years, but the popularity of smartphones and a venture capital boom has attracted new competitors.

Apple Inc. introduced its Apple Pay mobile payment service Sept. 9 with its new iPhone 6 offerings. In his statement, Icahn took note of the “strong competition” from Apple’s new payment system, and tech analysts said Apple Pay’s entrance undoubtedly played into EBay’s decision to say goodbye to PayPal.

“I think they realized they had to step up their game a lot, and PayPal needed to be separate,” said Rob Enderle, principal analyst at Enderle Group. “The reality is EBay probably wants to engage Apple as well, so they get access to all those Apple customers. This frees up both companies to make the alliances that they kind of have to make “

EBay is hardly Icahn’s only target. He’s pestered other technology companies, with mixed success.

In April 2013, Apple agreed to return $100 billion to shareholders by the end of 2015, after pressure from Icahn and other shareholders, including David Einhorn of Greenlight Capital. Later the same year, while under Icahn’s fire, computer maker Dell took itself private for $24.9 billion, a deal that displeased Icahn.

Icahn isn’t the only one applying pressure. As huge technology companies have built up immense piles of cash, expanded into arguably unrelated businesses or lost market share to younger, scrappier companies, activist investors are increasingly taking action.

“Historically, Silicon Valley has not been a bastion of strong corporate governance because they’re founder companies, where founders believe they have the answer and no one else does,” said Charles Elson, a corporate governance expert at the University of Delaware. “Performance issues, plus governance issues, equals target.”

In August 2013, Hedge fund ValueAct Capital, unhappy with the performance of its Microsoft Corp. stock, won the right to a seat on Microsoft’s board of directors. A week earlier, Steve Ballmer announced that he would soon step down as Microsoft’s CEO.

Currently, Elliot Management Corp., with a stake of more than $1 billion in EMC Corp., is agitating for a spinoff of the computer storage company’s VMware software business.

Daniel Loeb, who runs Third Point Management, said the firm bought 6.5% of Sony Corp. and seeks a breakup. He contends that splitting the Japanese electronics and entertainment conglomerate into pieces could raise its stock price as much as 60%.

At Yahoo Inc., activists aren’t seeking a breakup — beyond the website’s large user base, they don’t see much value in Yahoo properties, said Eric Jackson, managing partner at Ironfire Capital. “The best thing that could happen is if [a company like] SoftBank buys Yahoo and takes it over,” he said.

Another investor, Starboard Value, is urging Yahoo to merge with AOL.

Meanwhile, some tech companies — most notably, Google Inc. and Facebook Inc. — have protected themselves from activists by issuing separate classes of shares, with majority voting rights going to company insiders. It upsets the activists but gives the companies more freedom to run their companies or sit on cash as they see fit.

In Silicon Valley, aggressive activist moves almost always are considered unwelcome by tech giants that want to be left alone. But in many cases, the companies need a shake-up, Elson said.

“The issues the activists raise were there whether Icahn raised them or not,” he said. “Don’t blame the messenger.”

Twitter: @russ1mitchell @byandreachang