Key regulatory job created at Federal Reserve still vacant after 5 years

In expanding the role of the Federal Reserve in the wake of the 2008 financial crisis, lawmakers created a high-ranking position at the central bank to oversee the new authority and report regularly to Congress about its progress.

Five years after the Dodd-Frank financial reform law was enacted, however, the job remains vacant. President Obama has yet to nominate anyone to be the Fed’s new vice chair for supervision, frustrating some lawmakers and industry officials.

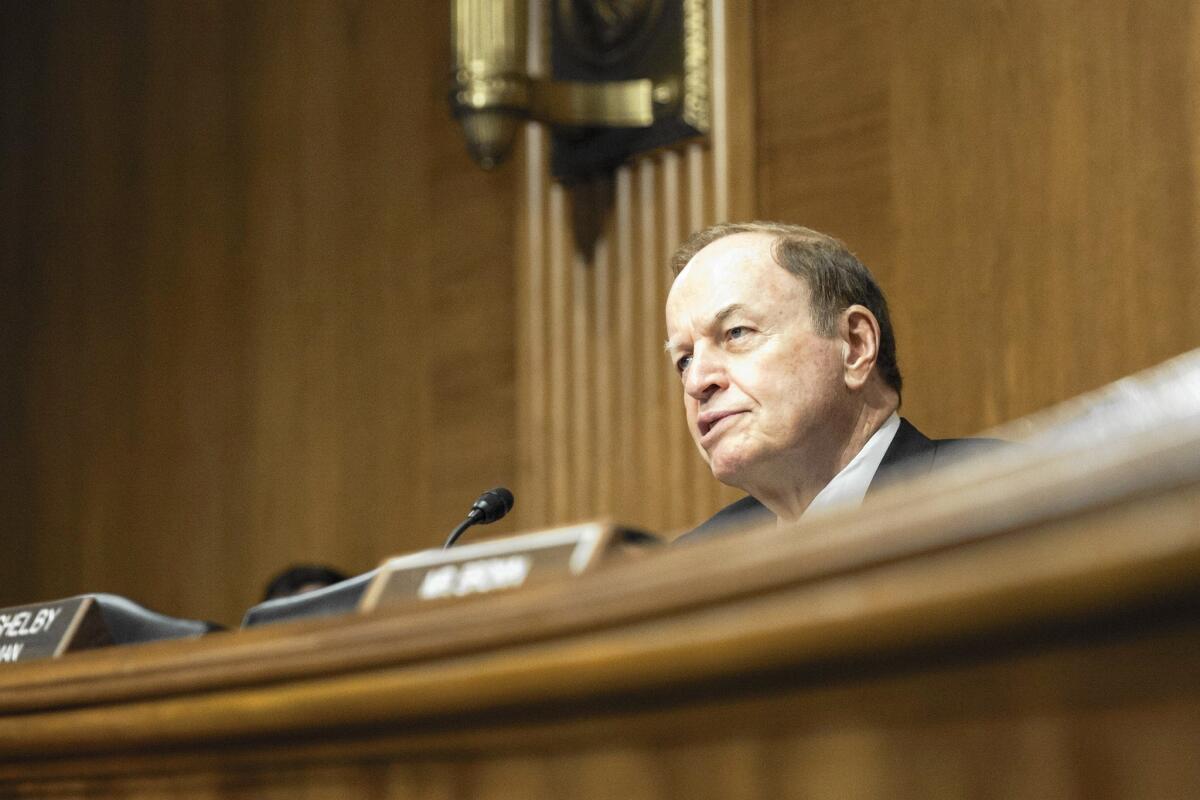

“That should have been filled long ago,” Senate Banking Committee Chairman Richard C. Shelby (R-Ala.) said. “It’s an important position.”

The vacancy hasn’t appeared to hinder the Fed’s drafting of new rules, such as limitations on bank trading of complex financial derivatives and tougher requirements on the amount of capital banks must hold in case of losses.

Still, the Obama administration’s inability or unwillingness to fill the job — the only key regulatory position created by Dodd-Frank that remains vacant — has had political implications that could hinder the Fed’s future operations.

For the Republican majority, a vice chair for supervision would give lawmakers an official who would be the focal point of their anti-regulatory fire.

For some Democrats, the lack of a vice chair gives the perception that the Obama administration doesn’t see financial regulation as a priority for the Fed.

For its part, the White House has declined to explain why the president hasn’t filled the position.

The continued vacancy has helped fuel a push by some lawmakers to require more congressional oversight of the Fed, including audits of its monetary policy decisions, said Aaron Klein, a former Treasury official who worked on the Dodd-Frank legislation.

“Congress wants more political accountability,” said Klein, who heads the

Financial Regulatory Reform Initiative at the Bipartisan Policy Center think tank. “The failure to fill that position coincides with the rise of congressional anger at the lack of that accountability.”

A key responsibility of the Fed vice chair is to appear before House and Senate committees twice a year to testify about financial regulation.

Fed board member Daniel Tarullo has filled that role since 2010, testifying 15 times on Capitol Hill.

But he lacks the authority of the vice chair, who the law says “shall oversee the supervision and regulation” of banks and other financial firms under the Fed’s oversight, as well as develop policy recommendations for the board.

Both parties would like a single official with specific responsibility for the central bank’s regulatory oversight. The Fed’s chair also is responsible for monetary policy and typically not steeped in regulatory details.

Even so, Shelby and House Financial Services Committee Chairman Jeb Hensarling (R-Texas) said they intend to ask Fed Chairwoman Janet L. Yellen to testify until a vice chair is in place — doubling her required Capitol Hill appearances to eight a year.

“The president’s disregard for this particular statutory requirement deprives our committees of an important opportunity to conduct oversight and hold the Federal Reserve accountable as it exercises the extensive supervisory and regulatory authorities it received in the Dodd-Frank Act,” Shelby and Hensarling wrote to Yellen in May.

At a hearing last week, Hensarling asked Yellen if she would voluntarily comply.

“I certainly stand ready to respond to requests of this committee for me to testify,” she said.

The additional time that Yellen will have to spend preparing for and attending the hearings will take away from her other responsibilities, said Wayne Abernathy, who handles regulatory affairs for the American Bankers Assn.

“That’s a heavy burden to carry and … I think can become a distraction,” he said of eight annual trips to Capitol Hill. “Maybe that’s when Yellen finally goes and knocks on the president’s door and says, ‘Name somebody, because I can’t keep doing this.’”

On Monday, Obama nominated University of Michigan economist Kathryn Dominguez to one of two vacancies on the seven-member Fed board. In January, the president nominated Allan Landon, the former chief executive of the Bank of Hawaii, to the other vacancy.

Both await Senate confirmation, and neither is expected to be tapped as vice chair for supervision.

Obama could nominate a current Fed governor such as Tarullo for the job or keep it unfilled until another vacancy opens.

Sen. Sherrod Brown (D-Ohio) has complained that by leaving the position vacant, Obama has sent the message that “financial regulation is secondary” at the Fed.

“It should be filled, and I’m not sure why it isn’t,” Brown said.

Tarullo has long been viewed as a logical choice for the position. But with strong Republican opposition to the financial reform law, Obama probably is trying to avoid “a messy confirmation fight” over the position, said former Rep. Barney Frank (D-Mass.), one of the law’s lead authors.

“Dan Tarullo’s been playing that role very effectively,” said Frank, who did not believe that the vacancy was hindering the Fed’s regulatory responsibilities.

Abernathy said the vice chair position becomes more important as the Fed begins enforcing the rules it has put in place and as bankers seek answers about how they’re working.

“When we get to the point of asking how’s it going, I think it could become frustrating” if the job is not filled, he said.

Despite the possibility of a confirmation battle, Klein of the Bipartisan Policy Center said Obama should at least try to fill it.

“Obviously the president and Congress thought it was important enough to create the position, and it’s surprising they haven’t even gone ahead and nominated somebody for it,” Klein said. “I think the lack of a vice chair for supervision has been a contributing element in Congress’ growing frustration regarding the Federal Reserve.”