How Washington can improve the lives of ordinary Americans

Obstruction is easy; governing is hard.

This may become the watchword of the new Republican majority in Congress in 2015, as the House and Senate try to work with President Obama to confront numerous economic issues that either can’t be put off or on which the voting public desires action.

“I think, talking to Speaker Boehner and leader McConnell, that they are serious about wanting to get some things done,” President Obama said at his recent year-end news conference. He specifically mentioned the tax system, in which he wants “more simplicity” and “more fairness” and an end to corporate tax avoidance by “parking money outside the country.”

Incoming Senate Majority Leader Mitch McConnell (R-Ky.) acknowledged in an interview with the New York Times that the Senate “basically didn’t do squat for years.” For that he blamed, in part, the extreme tea party wing, which has stood adamantly against government spending of almost any sort.

“One of my challenges is to try to convince some of my members that passing an appropriations bill is a good thing, not a bad thing,” he said. He added that “there are two kinds of people in politics. Those who want to make a point and those who want to make a difference. All of us from time to time make a point. But it is time now to make a difference.”

Many Republican members of Congress ran on a promise to make a difference in the lives of the middle class, perhaps the most disaffected segment of the American public.

The question is whether they were merely telling voters what they wanted to hear, or are genuinely committed to change. So here’s a brief rundown on how Congress, working with the White House, can improve the lives of ordinary Americans.

The Affordable Care Act: McConnell said that the Senate will take at least one more vote to repeal the act — the very definition of a waste of time as long as Obama remains in office. The Supreme Court will take up the question, raised by conservative opponents, on whether the act’s language bars federal tax subsidies for low- and middle-income residents of states that relied on the federal government to run their insurance exchanges. Oral arguments in the case will be heard in early March, with a decision expected in early summer.

A ruling against the subsidies — one of the act’s crucial provisions — could deprive as many as 13.4 million residents of 37 states of $65 billion in aid that makes their health insurance affordable, according to an estimate by the Kaiser Family Foundation. They live in 283 congressional districts, mostly represented by Republicans.

The easiest way to stave off this $65-billion disaster would be for Congress to pass a corrective amendment of a few words, removing the ambiguity that opponents have seized upon to undermine Obamacare. To do so, however, the majority will have to recognize that the act has brought health insurance to more than 10 million working-class and middle-class Americans who didn’t have it previously. Is the Republican Congress willing to rip health insurance out of these families’ hands?

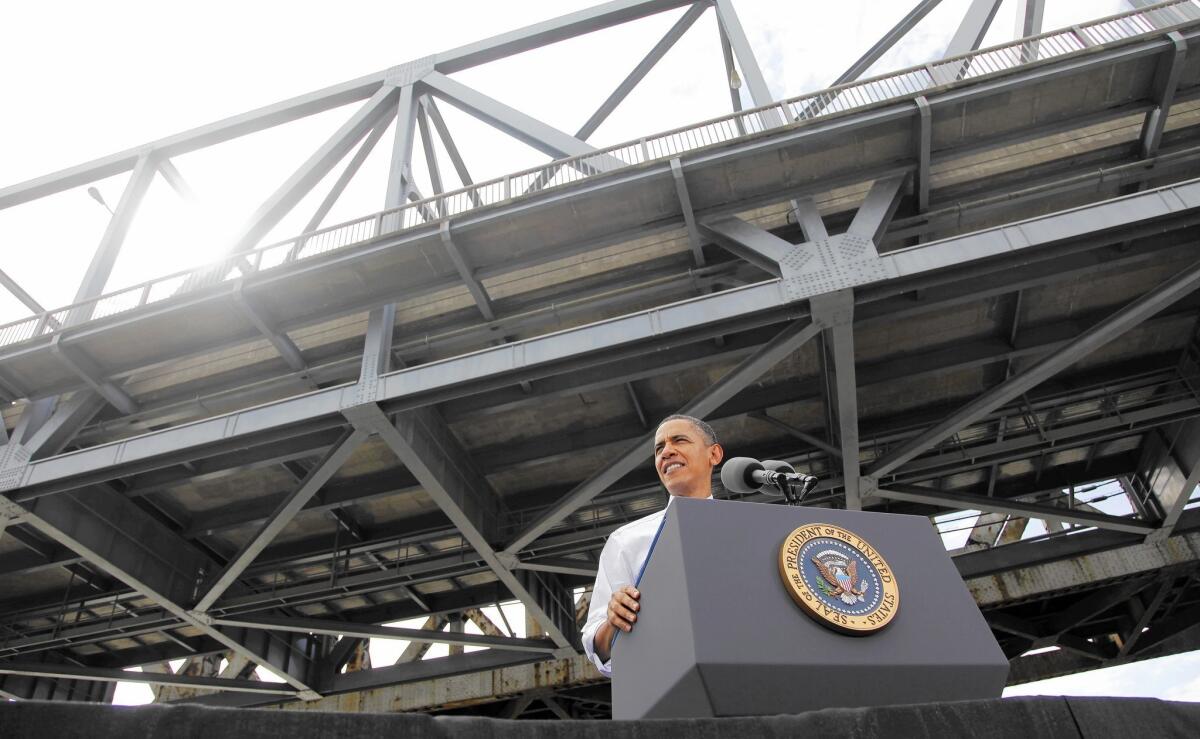

Infrastructure spending: At age 50, the Brent Spence Bridge, which connects McConnell’s home state with neighboring Cincinnati, is desperately in need of a $2.6-billion repair. It has outlived its normal life span, lacks an emergency shoulder and is carrying twice the traffic it was designed to handle. Yet so far neither the Kentucky nor Ohio legislatures have figured out how to come up with the money, and McConnell has been unable, or unwilling, to help.

That defines the quandary facing America’s greatest investment — its physical infrastructure. A large construction program would fix crumbling bridges, tunnels and roads while bringing the unemployment rate sharply down and establishing a base for strong economic growth. Yet our cheeseparing Congress has been unable to see the difference between “spending” and “investment.” In the name of “making a difference,” they should enact an infrastructure spending bill in 2015.

Infrastructure spending has broad public and bipartisan support; the absence of a program is a symptom of dysfunction on Capitol Hill. Conservatives loathe tax increases, and one leading option is to raise the federal gas tax to shore up the Highway Trust Fund. Saddling motorists and truck owners with the burden may not be the fairest way to fund highway repairs, since a more efficient road network benefits society as a whole by reducing the cost of transported goods.

Indeed, there’s no time like the present for funding infrastructure repairs through borrowing, which imposes some of the cost on future users. As former Obama economic advisor Lawrence Summers said in September, “We can borrow money for the long term in a currency we print ourselves at just about 2.5%. If now is not the time to repair our infrastructure, I don’t know when that time will come.” Since then, government borrowing rates have drifted even lower.

Income Inequality: This could become the issue of the year. The U.S. economy appears finally to have shifted into high gear, judging from the latest Commerce Department estimate that gross domestic product grew at a healthy 5% annual rate in the third quarter.

If the benefits continue to flow almost exclusively to the top 1% — as has been the case in this recovery through 2012 — pressure may mount on Congress and the White House to address the economic consequences. “Even higher GDP growth isn’t a cure-all if most of the benefits go only to a few,” conservative commentator James Pethokoukis wrote last week after the Commerce Department released its estimate.

The malady of income inequality may be recognized, but the remedy is where the White House and a putatively results-oriented GOP will be crossing swords. Broadening the income tax and making it more progressive isn’t a panacea, but would help communicate the government’s conviction that too much of the growth harvest has gone to owners of capital and not enough to labor.

Edward Kleinbard, the veteran tax expert at USC, advocates for the restoration of all pre-2001 tax rates and returning the estate tax, which is now 40% with an inflation-indexed exemption of nearly $11 million per couple, to its 2009 rate of 45% after a couple’s exemption of an inflation-indexed $7 million. He also recommends capping the standard and itemized deductions to eliminate the advantages enjoyed by wealthier taxpayers through such breaks as the mortgage interest deduction.

Obama told the media before leaving for his Christmas vacation that “the tax area is one area where we can get things done.” Genuine tax reform has been hampered in recent years, though not entirely blocked, by the Republican defense of the Bush-era tax cuts.

Washington must address the unanswered question: What kind of country will America be: a nation that treasures its middle class, or one that serves only its wealthiest citizens? The legislative blockade that Congress has erected for years, as McConnell acknowledged, benefited the latter. “Getting things done,” however, will serve everyone.

Michael Hiltzik’s column appears Sundays and Wednesdays. Read his blog, the Economy Hub, at latimes.com/business/hiltzik, reach him at mhiltzik@latimes.com, check out facebook.com/hiltzik and follow @hiltzikm on Twitter.