California treasurer sanctions Wells Fargo over fake-accounts scandal

Founded during the gold rush as a place that could be trusted with your money, Wells Fargo & Co. has deep California roots and remains one of the state’s largest and oldest institutions.

But on Wednesday, the state’s treasurer announced he was cutting some business ties to the San Francisco bank over its mushrooming fake-accounts scandal — which may do little to dent its bottom line but is a stark illustration of how the bank with the quaint stagecoach logo has quickly become a symbol of corporate villainy.

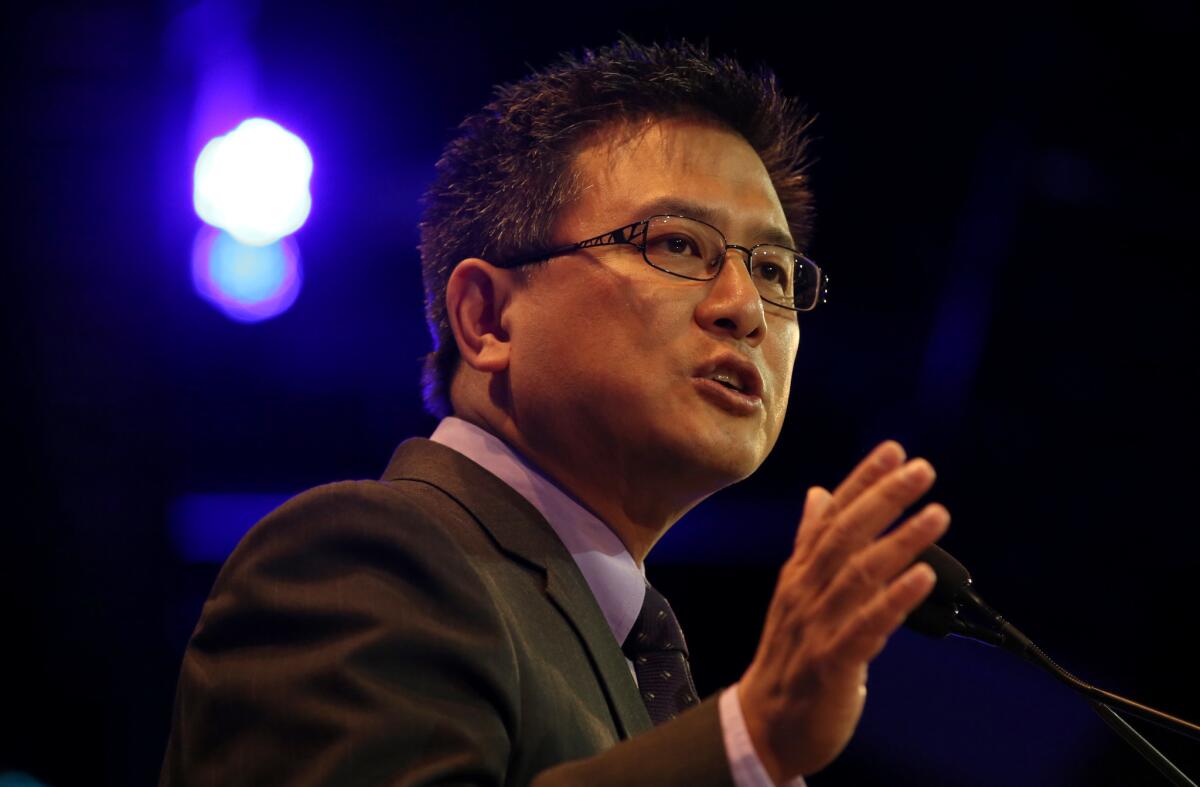

“How can I continue to entrust the public’s money to an organization which has shown such little regard for the legions of Californians who have placed their financial well-being in its care?” Treasurer John Chiang asked in a letter sent to Chief Executive John Stumpf and the bank’s board of directors.

Specifically, Chiang informed the bank that for the next year, his office will not invest in Wells Fargo securities, use the bank to buy stocks or bonds, or appoint the bank to underwrite certain bond offerings.

In response, Wells Fargo spokesman Gabriel Boehmer said that the bank is working hard to rectify any problems at the institution.

“We certainly understand the concerns that have been raised. We are very sorry and take full responsibility for the incidents in our retail bank,” he said. “We have already taken important steps, and will continue to do so, to address these issues and rebuild your trust.”

The stinging rebuke came on yet another difficult day for Wells Fargo — and one day before a Capitol Hill hearing that’s likely to amount to another public pummeling of the bank’s CEO.

Members of the House Financial Services Committee, who will grill Stumpf on Thursday, demanded on Wednesday that Federal Reserve Chairwoman Janet L. Yellen punish Wells Fargo for creating as many as 2 millions accounts without customers’ permission. She declined to commit to any regulatory penalties.

Meanwhile, speaking at a news conference in San Francisco, Chiang, a Democrat who plans to run for governor in 2018, outlined specific sanctions that will remain in place for a year and target Wells Fargo’s “most highly profitable” relationships with his office. Still, the loss of the state’s business in the three areas specified are immaterial to the giant bank.

Deputy Treasurer Tim Schaefer estimated the bank earned about $1.75 million in underwriting fees dating to the beginning of 2015 and perhaps as much as a few million dollars in brokerage fees during the most recent fiscal year. Those are tiny figures for a bank that recorded $22 billion in revenue and $5.6 billion in profit in this year’s second quarter alone.

Chiang also said he will work with the state’s pension funds, which collectively own about $2.3 billion in Wells Fargo stock and bonds, to push for reforms to Wells Fargo’s corporate governance. Chiang sits on the governing board of the nation’s two largest public pension funds — the California Public Employees’ Retirement System and the California State Teachers’ Retirement System.

He said he will push for the separation of the bank’s chairman and chief executive roles, both now held by Stumpf, and for the bank to review its compensation policies and possibly rescind more pay from executives linked to the fake-accounts scandal.

On Tuesday, Wells Fargo said Stumpf will forfeit compensation worth about $45 million, while Carrie Tolstedt, the executive in charge of the division in which much of the activity took place, will give up about $19 million worth of stock. Chiang said those clawbacks don’t go far enough and that it would be appropriate for Stumpf to resign.

As Chiang was detailing his sanctions against the bank, lawmakers on Capitol Hill were pressing Yellen to punish the institution.

“Two million phony accounts. Break them up!” Rep. Brad Sherman (D-Porter Ranch) told Yellen during her appearance before the House Financial Services Committee on the Fed’s regulatory responsibilities.

Sherman said Wells Fargo’s widespread improper sales tactics indicated the giant San Francisco-based bank was too big to manage. He asked Yellen whether she would “at least seriously consider breaking up Wells Fargo” using the Fed’s authority to downsize banks that pose a risk to the financial system.

“We will hold the largest [financial] organizations to exceptionally high standards of risk management, internal controls and consumer protection,” she said.

After Sherman said that the Fed hasn’t been able to do that with Wells Fargo, Yellen responded, “We believe it is possible, even though it is extremely challenging.”

When violations do occur, Yellen said that bank executives should face consequences.

“I think it is very important that senior management be held accountable,” she said.

Wells Fargo agreed Sept. 8 to pay $185 million to settle investigations by the Consumer Financial Protection Bureau, the Office of the Comptroller of the Currency and Los Angeles City Atty. Mike Feuer into an aggressive sales culture that pushed bank employees to open as many as 2 million accounts that customers didn’t authorize.

It also has said it has fired 5,300 employees since 2011 for improper sales practices.

However, that settlement and the bank’s response to the scandal continued to irritate lawmakers Wednesday at the hearing. Rep. Keith Ellison (D-Minn.) said senior executives needed to pay a price for the sales culture they created.

“How can line-level workers be held accountable to the degree they clearly have been and yet nobody in mid-level or upper-level management seems to be taking responsibility for it,” he said. “I mean, they haven’t lost their jobs.”

Rep. Stephen Lynch (D-Mass.) criticized the settlement because the bank did not admit any wrongdoing.

“If it didn’t happen here, how we can even imagine ever that a bank might be required to take responsibility?” Lynch said. “It blows my mind that they’re getting away with this and they’re paying a little slap-on-the-wrist fine.”

The Fed supervises the holding company of Wells Fargo and the largest U.S. banks. Last week, Yellen said the Fed would look into the procedures at those banks to make sure they were complying with consumer protection laws and other regulations.

Yellen recommitted to that review Wednesday.

“We are undertaking a look comprehensively, not only in the consumer area but in compliance generally, because there has been a very disturbing pattern of violations,” she said. Among the areas where those have occurred are mortgages and foreign exchange trading, Yellen said.

Yellen also said she’s hopeful the Fed and other financial regulators soon would finish new rules for incentive-based compensation that would try to reduce risk-taking, such as requiring large banks to defer at least half the bonus payments to executives for four years.

Rep. Michael Capuano (D-Mass.) said Wells Fargo has faced 16 enforcement actions over the last five years, including an $85-million fine from the Fed in 2011 for mortgage lending abuses.

That fine was “laughable” to a bank the size of Wells Fargo, he said.

“Don’t you think it’s time the Fed does something” in light of the recent scandal? Capuano asked. “How long does this stuff go on before you get outraged and take action?”

Rep. Maxine Waters (D-Los Angeles) said “the enormous failure of risk management at Wells Fargo” could pose a threat to the financial system.

“Fraudulent retail banking practices may not, in and of themselves, pose systemic risk, but they surely indicate mismanagement that could be catastrophic in riskier and more complex divisions of a bank holding company,” Waters said. “Supervisors and law enforcement must continue to hold both institutions and individuals accountable.”

ALSO

Lawmakers press Fed Chief Janet Yellen to punish Wells Fargo for fake accounts scandal

Why L.A. City Atty. Mike Feuer knew the Wells Fargo scandal was going to blow up

Michael Hiltzik: Scandal-racked Wells Fargo is docking its CEO $41 million. That’s not nearly enough

UPDATES:

1:10 p.m. This article has been updated with additional details on Chiang’s sanctions, Wells Fargo’s practices and other developments.

This article was originally published at 12:35 p.m.