Capitol Journal: Donald Trump and Ronald Reagan have just one thing in common: Both dodged their taxes

As California’s governor, Reagan avoided state income taxes for one year, while Trump may have escaped federal income taxes for nearly two decades.

Finally we’ve found a similarity between the ignoramus Donald Trump and the iconic Ronald Reagan. Both dodged paying income taxes.

Reagan, of course, was a relative piker. As California’s governor, he avoided state income taxes for just one year that we know about. Billionaire developer Trump, however, may have escaped federal income taxes for nearly two decades. We don’t really know.

Trump isn’t talking. Reagan fessed up immediately. And that helped him contain the political damage.

Other than their mutual tax avoidance, Trump and Reagan are as similar as night and day. Trump is a dark and negative demagogue who bellows that America is failing. Reagan was a positive and optimistic statesman who heralded the U.S. as the “shining city upon a hill.”

Trump is dragging down the Republican Party. Reagan uplifted it.

You hear a lot of Reaganites denouncing the current presidential nominee.

Conservative Michael Reagan is one recent example: “My father would not support this kind of campaign. If this is what the Republican Party wants, leave us Reagans out. Nancy would vote for” Hillary Clinton.

We may never know the real tax story about Trump. All he’s really saying is that avoiding a tax liability makes him “smart.” Even “brilliant.” Come on! If anyone deserves credit for outflanking the IRS, it’s his tax accountant.

What we do know came from the New York Times last weekend.

Citing leaked documents, the newspaper wrote that Trump claimed nearly a billion dollars in business losses on his 1995 tax returns. That huge write-off was probably enough to wipe out Trump’s personal income tax liability for 18 years, the Times said.

There was nothing illegal about this, assuming the losses were legit.

Reagan’s tax avoidance was much smaller. But it was a big story in California, where he’d just been reelected governor the year before.

What made Reagan’s tax dodge so eye-catching and irresistible was the element that often causes political damage: hypocrisy.

It seems unbelievable today, but in 1971 California still did not have payroll withholding of the state income tax. Everyone just paid in full on April 15.

Democrats and Republicans alike wanted to adopt withholding. For one thing, there’d be a one-time windfall of expedited revenue flowing into the Capitol.

But Reagan stubbornly resisted.

“Taxes should hurt,” the governor asserted. If taxes were withheld, he said, people would get comfortable paying them and lawmakers could raise them slightly without citizens noticing. “My feet are in concrete on that.”

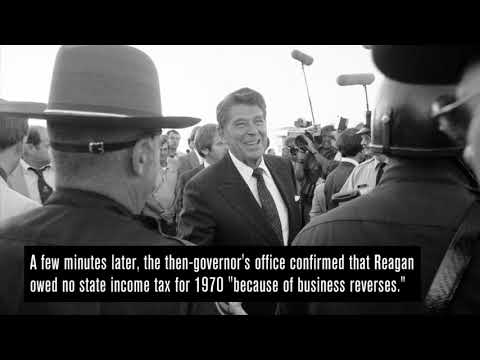

That “taxes should hurt” philosophy, however, really hurt Reagan in May 1971 when a reporter asked him at his weekly news conference whether he had paid state income taxes for 1970.

Uncharacteristically, “the great communicator” hemmed and hawed. “You know something, I don’t actually know whether I did or not,” he muttered, his face becoming flush.

The governor soon adjourned the news conference. A few minutes later, his office confirmed that “because of business reverses,” Reagan had owed no state income tax for the previous year.

The business reverses turned out to be a loophole cattle herd.

When reporters caught up with him later and asked for a clarification of his federal tax status, the normally charming governor shot back angrily: “Why should I have to clarify the status?

“Frankly, I think the Capitol news corps demeaned itself a little by engaging in invasion of privacy. They knew that someone illegally provided the information from the Franchise Tax Board.”

Yes, that news conference question wasn’t just a blind shot in the dark.

An employee at the tax board had come across Reagan’s return and, being human, she glanced at it and noticed he hadn’t paid a tax. That was too juicy to keep secret. And she told an acquaintance at lunch.

The acquaintance told her daughter, who was a journalism student at Cal State Sacramento and had a campus FM radio show. The daughter, Rose King, reported the no-tax news on air.

The radio report didn’t get much attention. But King also was an intern for state Sen. Mervyn Dymally (D-Los Angeles), the Democratic Caucus chairman. The student journalist showed Dymally her radio script. A Capitol TV reporter soon was tipped off, and Reagan was queried at his next news conference.

“He never could again take the position that taxes should hurt,” remembers King, who became an advocate for mental health causes and still is.

King says Reagan later talked to her about the episode.

“He was his usual affable self,” she recalls. “He told me I needed to understand a lot more about the world of financing. Sometimes you have losses. That’s why he didn’t pay any income taxes.”

But Reagan instructed his lawyer, William French Smith, to make sure that in the future he always paid some income taxes. Later as president, Reagan named Smith his attorney general.

“The person who took the hit inside was Smith,” says veteran lobbyist George Steffes, who was Reagan’s top legislative aide. “He never thought it was necessary to tell us about the taxes. He acted like citizen Reagan’s lawyer, not Gov. Reagan’s lawyer.”

The governor’s popularity took a hit. His job approval fell from 57% in 1970 to 46% in summer 1971. But being a likable guy, Reagan rebounded enough to win the presidency by an electoral landslide in 1980.

Trump doesn’t have that cushion of broad support that Reagan enjoyed. But his worshipers probably couldn’t care less. They’ll follow him blindly.

Follow @LATimesSkelton on Twitter

ALSO

Donald Trump on $1-billion tax write-off: ‘I did a great job’

Asian American voters are spurning Trump — and threatening to spurn the Republican Party

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.