More than $1.1 million in taxes, penalties due on controversial Bel-Air mansion

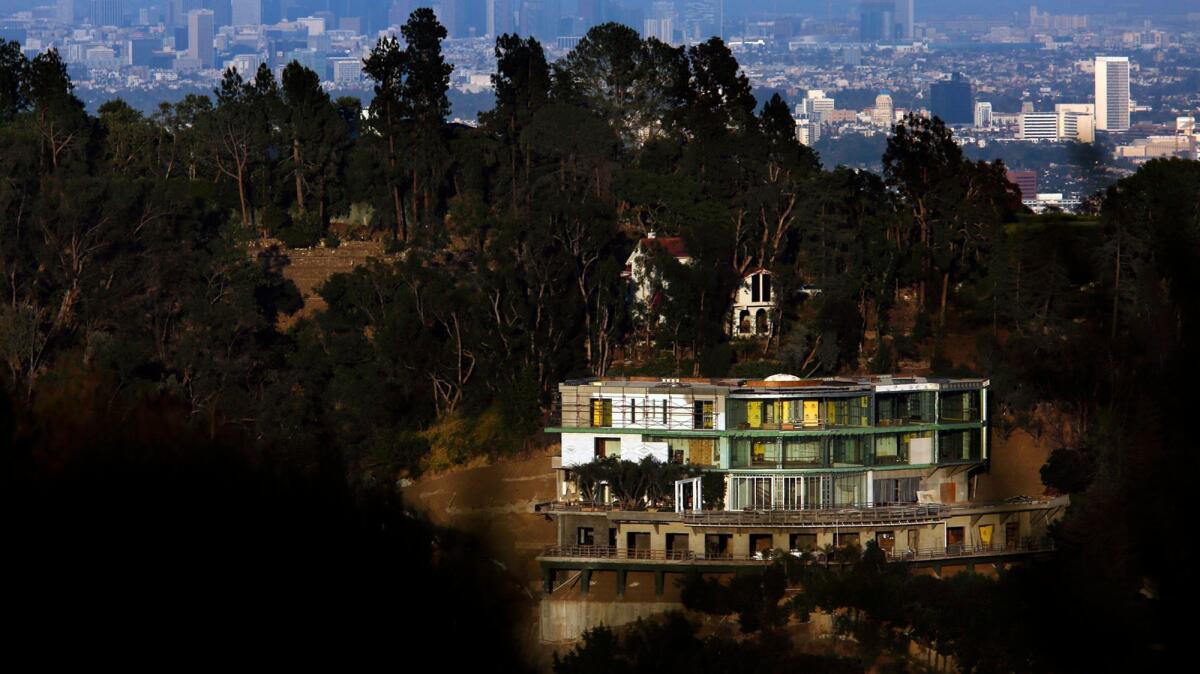

More than $1.1 million in taxes and penalties are owed on the unfinished Bel-Air mansion that spurred criminal charges for luxury developer Mohamed Hadid, according to Los Angeles County records.

Hadid pleaded no contest Tuesday to illegal construction and other misdemeanor charges tied to the controversial project on Strada Vecchia Road. City prosecutors say the roughly 30,000-square-foot building is larger and taller than zoning rules allow and includes bedrooms, decks and an IMAX theater that were never approved by the city.

L.A. officials demanded a halt to construction at the hillside site three years ago and revoked its permits a few months later. Hadid, who was first charged a year and a half ago, has a sentencing hearing later this month.

As the courtroom battle over the unfinished mansion has dragged on, unpaid taxes and penalties have piled up for the property, according to county records.

The Bel-Air mansion is owned by a limited liability company, 901 Strada LLC. Business records filed with the California secretary of State three years ago identified the only member of that company as Virginia attorney James Zelloe.

Both he and the company were also charged in the criminal case over the Bel-Air mansion. But Zelloe, who identified himself as a longtime friend and attorney for Hadid, said in court filings that he had never exercised any control over the Strada Vecchia home.

The Virginia attorney gave up his role with the company three years ago and was replaced as managing member by Hadid, according to an attorney representing Zelloe.

Zelloe “has no control over the property and is not liable for any taxes due on the property,” his attorney, James Spertus, said in an email.

Hadid maintains that the LLC, not him personally, is responsible for the taxes, according to his attorney, Bruce Rudman.

However, he is pursuing an appeal over the tax amounts in light of “the significant increase in property tax during a period in which no work whatsoever was going on at the property,” Rudman said in an email, adding that the idle project had faced ongoing costs including maintenance, security and insurance.

The Bel-Air property’s value, including the land and any improvements, has been assessed at more than $27 million, according to county records.

Twitter: @LATimesEmily

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.