Council committee wants to pressure banks to lower rates on bond deal

Los Angeles officials moved Monday to get out of two Wall Street bank contracts that they say soured after the economic crash of 2008.

In 2006, the city entered into an interest rate swap deal with Bank of New York Mellon and Dexia, a Franco-Belgian institution, for its Wastewater System Revenue Bond issued in 1988. The rate swap was done to take advantage of what were at the time historically low interest rates.

But rates dropped even lower when the economy crashed. This left the city paying more than the market rate, while the banks paid variable rates that were kept low by the Federal Reserve. The 2006 deal had locked in the city’s interest rate for 22 years.

On Monday, the City Council’s budget and finance committee unanimously voted to push the banks to renegotiate or terminate their contracts at no cost. Otherwise, the city would consider ceasing all business with the banks. The motion was introduced in May by Councilman Paul Koretz.

Koretz said Monday that renegotiating the contracts was in the “moral, ethical and operational interest of our city.”

Officials agreed the city did not save as much money as it expected because of how low rates fell. But they differed on how to remedy that problem.

Natalie Brill, the city’s chief of debt management, said Monday that although the city didn’t save as much as it had expected, the deals are still saving some money.

A report from the city said the swap has saved $21.7 million so far and will save another $22.9 million by the time the contract reaches maturity in 2028.

“There’s no reason to terminate the swap,” Brill said. She said that termination of the deals would cost the city more than $25 million in fees, which “doesn’t make financial sense.”

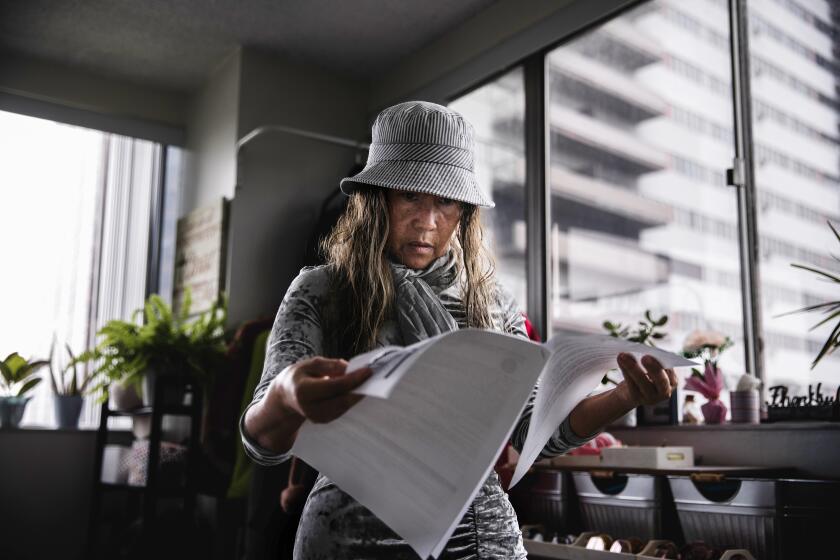

But, Lisa Cody, a research policy analyst with the Fix L.A. Coalition -- which is pushing for renegotiation -- said the banks preyed on municipalities locked into high rates during the financial crisis, and need to be punished.

“The too-big-to-fail and the too-big-to-jail mentalities in this country have allowed financial institutions to run wild,” Cody said.

Koretz’s original motion recommended that if the banks refuse to renegotiate or terminate the deals at no cost, the city should stop doing business with the banks altogether.

City administrative officer Miguel Santana discussed renegotiation with the two banks this month. According to a report from his office, Dexia said it will consider renegotiating the swap but will unlikely offer a significant discount and Mellon said it is open to negotiating, but will not terminate at no cost.

Councilman Bob Blumenfield said that because of their “manipulation of the market,” these banks “unfairly benefited in this swap deal at our expense.”

Though the city used all the information it had when it entered into the deal, it didn’t know the “real risks that were brewing,” he said.

Brill admitted that if the city had known in 2006 how low interest rates were going to fall when the market crashed, they wouldn’t have entered into the swap deal.

Instead of recommending that the city cease all business with the banks if they won’t renegotiate at no cost, the committee approved an amended motion Monday that said if the banks refuse to renegotiate or terminate at no cost, the issue will return to the city administrative officer, which will analyze the risks and benefits of termination.

Follow @skarlamangla on Twitter for more city and county government news.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.