Alan Greenberg dies at 86; former CEO oversaw Bear Stearns’ rise

Alan C. “Ace” Greenberg, who as chief executive officer of Bear Stearns transformed a small bond shop into the fifth-largest U.S. securities firm before it collapsed in 2008 in one of the key events of the global credit crisis, has died. He was 86.

He died Friday at Mount Sinai Hospital in New York of complications from cancer, according to his son, Ted Greenberg.

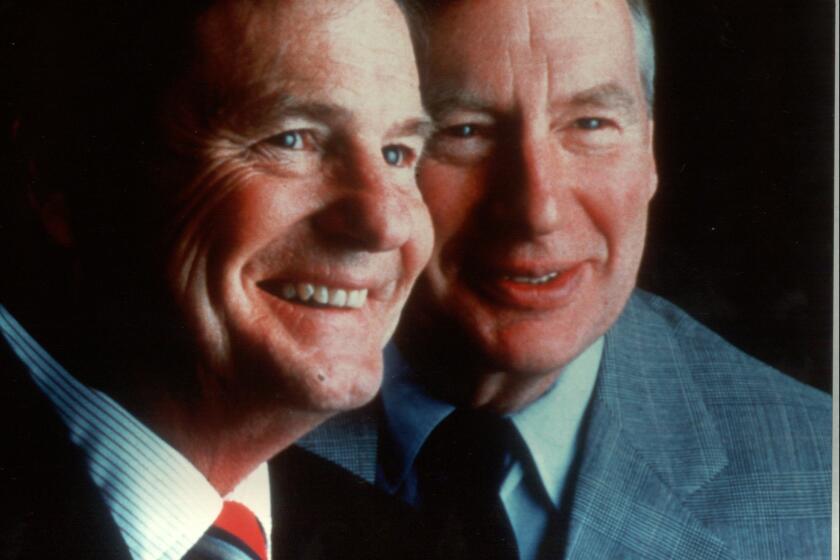

An amateur magician and bridge player, Greenberg took over New York-based Bear Stearns in 1978, when it was a private partnership with about 1,000 employees and $46 million in capital. He expanded shareholders’ equity to $1.8 billion and the workforce reached 6,300 by 1993, when he handed power to James “Jimmy” Cayne, himself a one-time professional bridge player. Greenberg stayed on with Bear Stearns as an equities trader.

The forced sale of 85-year-old Bear Stearns to JPMorgan Chase & Co. in March 2008 followed a bank run by clients that left Bear Stearns on the brink of bankruptcy. The firm’s troubles traced to 2007, when two of its hedge funds tied to the real estate market collapsed. In a 2010 book, Greenberg said the run on Bear Stearns in 2008 stemmed from “a groundless rumor” that it had a liquidity problem at a time when it had $18 billion in cash reserves.

On March 16, 2008, JPMorgan CEO Jamie Dimon agreed to buy Bear Stearns for $2 a share, later raised to $10. The stock had traded at $172 in January 2007. After the sale, Greenberg became vice chairman emeritus of JPMorgan.

Greenberg blamed Cayne, his successor as CEO, for the demise of Bear Stearns. In his book, he described Cayne as a megalomaniac more interested in playing bridge than in representing the firm. He said Cayne became “more aloof and full of himself” as the firm’s share price rose in 2007, which “couldn’t help but impair certain business judgments.” He said the Bear Stearns fixed-income department used too much leverage to build its mortgage-backed securities portfolio.

Cayne, likewise, had little nice to say about Greenberg.

There “isn’t anybody that will tell you he’s an honest guy,” Cayne said to William Cohan for “House of Cards,” a 2009 book. “There isn’t anybody who will tell you that he’s sincere. There isn’t anybody that would tell you they choose him as their best man, or best friend, or one who they would have lunch with, or go on a trip with, or socialize with, or whatever. They don’t exist. He had one friend — me.”

Some Wall Street veterans said the reluctance of both Greenberg and Cayne to venture into new markets restricted the firm’s growth. “They underinvested in new businesses and international expansion in the past and focused on maximizing return on equity,” Brad Hintz, an analyst at Sanford C. Bernstein & Co. and a former Wall Street executive, said in a November 2006 interview.

Greenberg, whose clients included billionaire real estate developer Donald Trump and Henry Kravis’ KKR & Co., followed a simple stock-market philosophy: Take losses as soon as the price falls.

“I put my children’s accounts with him,” Trump said in an August 2006 interview. “That should tell you how much I trust him.”

A reputation for discretion made Greenberg valuable to corporate raiders including Trump, Kravis and Irwin Jacobs when they tried to buy shares of target companies quietly. Greenberg helped Trump collect 9.6% of Bally Entertainment Corp. during his 1986 unsuccessful takeover attempt of the rival casino operator.

A member of the Society of American Magicians, Greenberg enjoyed showing magic tricks to reporters during interviews and at public events such as fundraising dinners for the Jerusalem Foundation or the Parkinson’s Disease Foundation. He required all Bear Stearns executives to contribute 4% of their salaries to charity.

Some of Greenberg’s handouts created controversy. In 1998, he donated $1 million to help poor elderly men who couldn’t afford the impotence drug Viagra. “It’s something that will give a lot of pleasure to a lot of people,” Greenberg told the New York Times.

Alan Courtney Greenberg was born on Sept. 3, 1927, in Wichita, Kan., the grandson of Russian Jewish immigrants. At 6, he moved with his family to Oklahoma City, where his father, Theodore, opened a women’s clothing store during the Great Depression.

Greenberg attended the University of Oklahoma on a football scholarship for a year before a back injury ended his playing career. He transferred to the University of Missouri a year later, where he received a bachelor’s degree in business as well as the nickname “Ace,” suggested by a friend who thought he’d get more dates with a less obviously Jewish name.

Inspired by a book he read about financier Bernard Baruch, Greenberg moved to New York after graduation to start a career on Wall Street. His attempts suffered because he “wasn’t from an Ivy League school,” Greenberg told the Horatio Alger Assn. of Distinguished Americans, which honored him in 1997. Of six job applications, the only offer came from Bear Stearns.

Greenberg started at the firm as a clerk in 1949, putting pins on a map to locate oil wells. He got noticed by John Slade, head of the arbitrage trading desk, who took Greenberg under his wing. When Slade became head of international business, Greenberg took over arbitrage.

Six years later, at 31, he was made partner and began managing the firm’s principal investments. He also was diagnosed with colon cancer and given a 25% chance to live. After surgery he submitted to regular checkups for the next 12 years.

Greenberg clashed with the firm’s managing partner, Salim “Cy” Lewis, demanding that falling stocks be sold. Usually, Greenberg got his way. He started running the company when Lewis fell ill and then became CEO when Lewis died in 1978.

The firm grew in profits and personnel under Greenberg, who said he sought to hire people with “PSD” degrees, meaning “poor, smart and a deep desire to become rich.” In 1985, he took the firm public and became chairman of the board, a post he held until 2001.

He scrimped to save every penny made by his firm. He told Bear Stearns employees to turn off the lights when leaving and to seal envelopes only partially so they could be reused. Those edicts and others were immortalized in a collection of his internal missives to the staff, published in 1996 as “Memos from the Chairman.”

Under Greenberg, Bear Stearns expanded into investment banking, where it was traditionally weak, and transaction clearing, a business he discovered earlier than his bigger rivals. Before it collapsed, those businesses generated a quarter of the company’s revenue.

Greenberg never spoke of an intention to retire.

“I do plan to die some day,” Greenberg told Traders magazine in 2000. “I definitely plan to die, but I haven’t picked a time yet.”

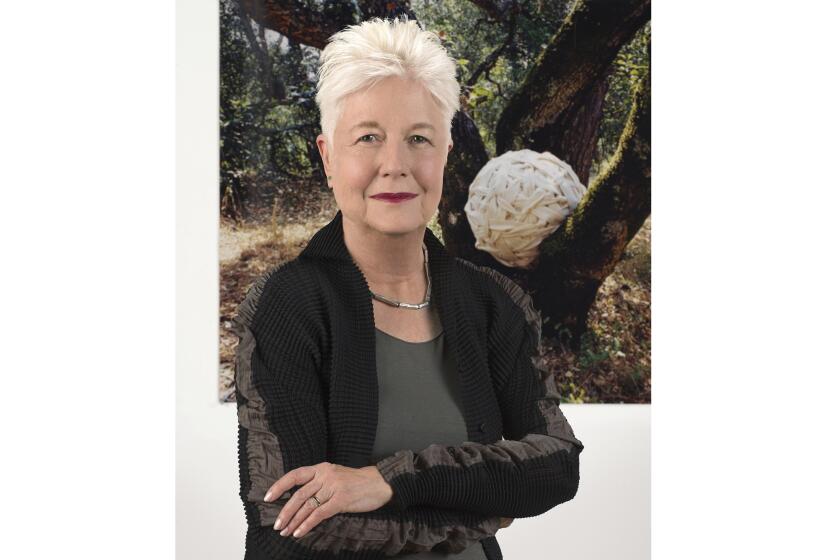

Greenberg is survived by two children from his first marriage, Ted, and Lynne Koeppel; his second wife, the former Kathryn Olson; a brother, Maynard; a sister, DiAnne Hirsch; and five grandchildren.

Onaran writes for Bloomberg News.

More to Read

Start your day right

Sign up for Essential California for the L.A. Times biggest news, features and recommendations in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.