Obama’s healthcare law takes full effect this week

WASHINGTON — Nearly four years after it was signed and after months of scrambling and uncertainty, President Obama’s landmark bid to guarantee Americans health security takes full effect Wednesday as the Affordable Care Act begins delivering healthcare coverage to millions nationwide.

Administration officials reported Sunday that about 1.1 million people had enrolled in health plans using the federal website, HealthCare.gov, the main entry point for coverage in 36 states. Nearly all the enrollments came in the last couple of weeks as the deadline approached for coverage that would take effect Jan. 1.

Several hundred thousand people have enrolled on separate sites run by 14 states and the District of Columbia, with the largest figure coming from California, where more than 400,000 have signed up.

An exact count nationwide is not yet available because not all states have tallied their figures, but the total appears to be about 2 million. That remains short of the administration’s original goal of 3 million by this point, but marks a significant recovery from the system’s disastrous debut in October.

PHOTOS: The battle over Obamacare

More than 4 million additional people have been found eligible for coverage under the law’s expansion of Medicaid and the Children’s Health Insurance Program.

How the law will ultimately work and whether it can endure remain unclear, though the fact that coverage will now be real for several million people will almost certainly change the debate over Republican efforts to repeal it.

While that broader political fight plays out, doctors, hospitals and pharmacies across the country are bracing for more confusion as patients struggle to understand their new coverage.

Some may show up at physicians’ offices without insurance cards, victims of the error-plagued enrollment process that bedeviled the initial rollout.

Others may discover that although they’re properly enrolled in a health plan, the doctor or hospital they visit or the prescription they want to fill won’t be covered by the plan they have selected.

Still other patients, including many who have never had insurance before, may be shocked to learn they have to pay thousands of dollars out of pocket before their coverage kicks in. Like employer-provided health plans, many insurance plans set up under the health law come with low premiums and high deductibles.

Surveys indicate that many Americans have little understanding of basic insurance concepts such as co-pays and deductibles.

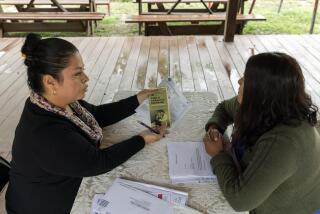

“We still have a lot of education to do for the average man on the street who doesn’t really understand the Affordable Care Act,” said J. Mario Molina, chief executive of Molina Healthcare Inc., a California-based insurer that is selling policies in nine states.

PHOTOS: 2013’s memorable political moments

Relatively few healthcare providers are likely to encounter significant numbers of patients with problems related to coverage under the new law. The number of people covered by the law is dwarfed by the more than 270 million people who already have some form of health insurance through an employer or a government program such as Medicare.

Jeff Goldman, vice president for coverage policy at the American Hospital Assn., said most hospitals already had systems to help patients sort out their insurance, something that consumers often struggle with, particularly at the beginning of the year.

“We are pretty confident that people are prepared,” he said.

Still, the health law remains a political lightning rod, and providers and others anticipate every problem will be magnified.

“The fact that not everything will go exactly as was intended by the ACA when most of its biggest changes start to go live … should surprise no one,” the American College of Physicians warned its members in a recent newsletter outlining potential headaches after Jan. 1.

“In a less political environment, the mantra as problems arise with ACA implementation would be fix it, not nix it. Until we get to that point, we’ll have to muddle through.”

HealthCare.gov and the separate state sites are the primary portals created by the health law to help Americans who don’t get coverage through work to select a plan.

Plans sold on these marketplaces must meet new consumer standards. Insurers are prohibited from turning away customers with preexisting medical conditions. Americans making less than four times the federal poverty line — about $46,000 for an individual and $94,000 for a family of four — will qualify for government subsidies to offset the cost of their premiums.

Enrollment in these plans started Oct. 1 and is scheduled to go until March 31. The surge in enrollment in the last few weeks has intensified anxieties about potential mix-ups early next year and prompted administration officials and insurers to take steps to try to head off problems.

TIMELINE: The year in politics

Insurers announced last week they would allow consumers who selected a health plan in December to begin getting coverage Wednesday even if they don’t make their first premium payment until later in the month. Initially, consumers had to pay before Tuesday to be guaranteed coverage in January.

Administration officials have also asked insurers to initially cover some out-of-network care and prescriptions to help consumers who are moving from one provider network to another. That could be particularly important for patients with complex conditions such as cancer or AIDS. Industry officials said doing so may be difficult.

CVS Caremark Executive Vice President Helena Foulkes said the pharmacy giant may provide some patients with a “transitional supply” of prescriptions if their insurance is temporarily interrupted in January.

Such interruptions dogged the first few weeks of the Medicare prescription drug benefit in 2006, prompting the George W. Bush administration to step in to help seniors who couldn’t get their medications, according to former Health and Human Services Secretary Mike Leavitt. Speaking to a group of insurance industry officials in Washington recently, Leavitt cautioned that something similar may again be necessary.

Supporters of the Affordable Care Act are nonetheless urging patients to be careful as they begin trying to use their insurance next year.

Peter Lee, executive director of Covered California, the state’s insurance marketplace, emphasized that consumers shouldn’t assume their previous doctor or prescription would be covered under their new health plan.

“Going to an out-of-network provider subjects you to out-of-network rules. Consumers need to understand that,” Lee said.

For their part, physicians and hospitals anticipate they will have to assume more responsibility for educating patients about their insurance, a job many are increasingly doing anyway.

MemorialCare Health System, which runs six hospitals in Southern California, has given its front-line admissions staff additional training on how to deal with a barrage of questions about co-pays, benefits and networks, said John Cascell, a vice president at the system.

In Ohio, the state medical association anticipates calls from members who have problems submitting insurance claims for new patients.

In Texas and elsewhere, physician groups are already increasingly asking patients to leave a credit card on file to make collecting bills easier as co-pays and deductibles increase, said Tom Banning, chief executive of the Texas Academy of Family Physicians.

Despite the challenges of dealing with newly insured patients, however, many medical providers fear that the uninsured still pose a far greater challenge. That’s particularly true in states, including Texas, where lawmakers oppose the health law and have declined to expand their Medicaid programs next year. Millions of poor Americans will lack coverage next year in those states.

“The much bigger issue is uncompensated care,” said Dave Dillon, a spokesman for the Missouri Hospital Assn. “That is what we are most concerned about.”

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.