Tax hikes, improving economy bode well for state budget

SACRAMENTO — Although a modest deficit will linger into next year, California’s finances are poised for marked improvement as the state reaps the benefits of newly approved taxes and the economy continues to recover, the Legislature’s top budget advisor said Wednesday.

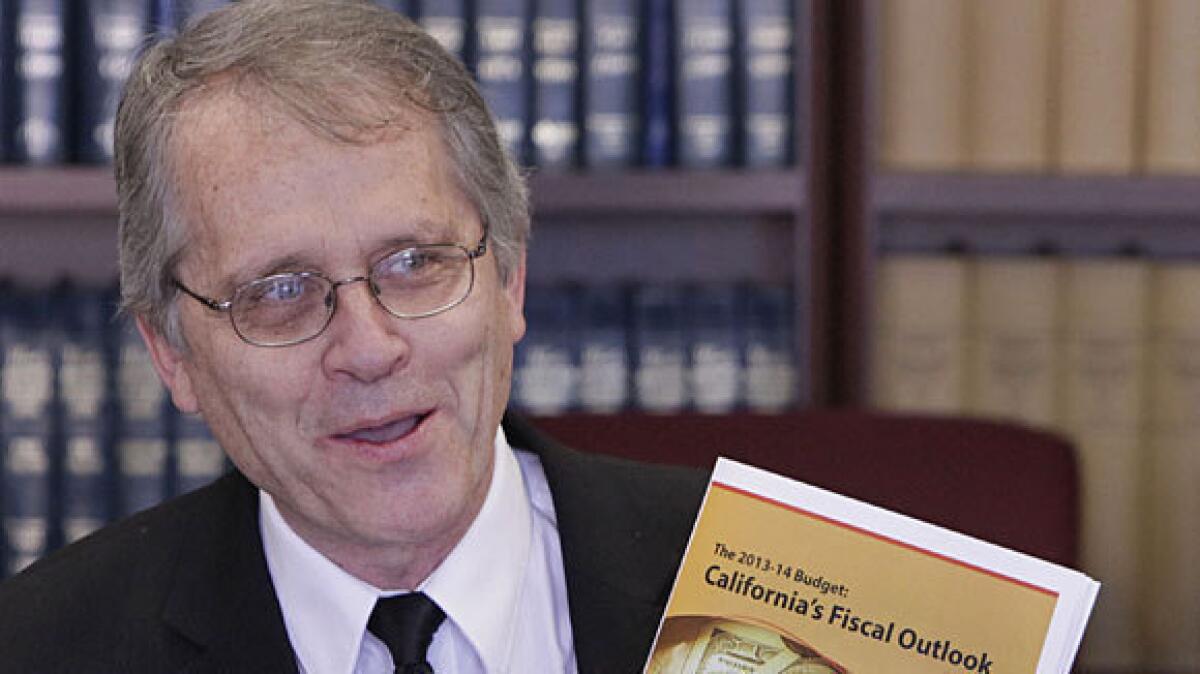

Schools can expect more money eventually, and the state may even start to see surpluses, according to Legislative Analyst Mac Taylor, who provides nonpartisan counsel to lawmakers. He said a healthier budget should then allow officials to turn their attention to California’s other chronic financial issues, such as an unstable tax base and an expensive debt burden.

In a report released Wednesday, his office estimates that state officials will need to close a $1.9-billion budget gap in the spending plan they pass next summer, about one-eighth of the problem they faced this year. The gap is smaller than it might have been because state officials, as part of a regular process, recalculated how much tax revenue arrived in recent years, resulting in a $1.4-billion boost.

A big chunk of the remaining deficit is due to the lagging stock price of Facebook, which went public this year. The analyst’s office said there would be $626 million less in tax revenue than expected from the initial public offering. The state also is saving far less from closing redevelopment agencies than officials had projected.

Nonetheless, Gov. Jerry Brown hailed the analyst’s forecast.

“This report validates the hard work the state has done to cut its deficit and balance its budget over the long term,” he said in a statement. “California is now on the path for a fair and sustainable budget as long as we continue to exercise fiscal discipline and pay down debt.”

Chipping away at California’s most intractable budget problems has been Brown’s primary goal since beginning his second tour of duty in Sacramento in 2010.

On election day last week, voters approved Proposition 30, the governor’s plan to temporarily raise the sales tax and income taxes on high earners, providing an estimated $6 billion annually for state coffers. Voters also passed Proposition 39, which changes the corporate tax code to raise an estimated $1 billion a year for the general fund and clean energy projects.

Within six years, the report said, California could find itself with a $9-billion surplus, a stark turnaround after many years of severe budget deficits. But continuing financial challenges could quickly eat up any extra money.

Taylor said surplus dollars may be used to shore up the underfunded public pension system or pay back more debt. “We still have a lot of catching up to do,” he said.

There will also be intense pressure from activists to restore funding to social services cut during many budget crises.

“We’re turning the corner,” said Chris Hoene, executive director of the California Budget Project in Sacramento, a think tank that advocates for low-income families. “We should approach the budget with some cautious optimism.”

Despite the improved financial outlook, Taylor said the state will probably burn through its existing reserve of nearly $1 billion and end up with a nearly $1-billion deficit by the end of the current fiscal year.

Most of the problem, he said, is the lack of savings from dissolving redevelopment agencies. The state may reap only $1.4 billion, he said, less than half of the Brown administration’s estimate.

Facebook, once expected to provide California with a tax windfall, has also been a disappointment. Brown administration officials expected to reap $1.9 billion in taxes by the end of the current fiscal year from the company’s initial public offering, but the report issued Wednesday said they should count on only $1.25 billion.

Kim Rueben, a senior fellow at the nonpartisan Tax Policy Center in Washington, D.C., said California needs to be more careful when dealing with potential tax windfalls like Facebook, perhaps routing the money to a separate reserve fund.

“You don’t want it to be in your day-to-day budget,” she said.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.