Fed cements tapering with another cut in bond-buying stimulus

WASHINGTON — Shrugging off the recent turbulence in financial markets, the Federal Reserve gave an upbeat take on the U.S. economy and went through with a second straight cut to its large bond-buying stimulus program.

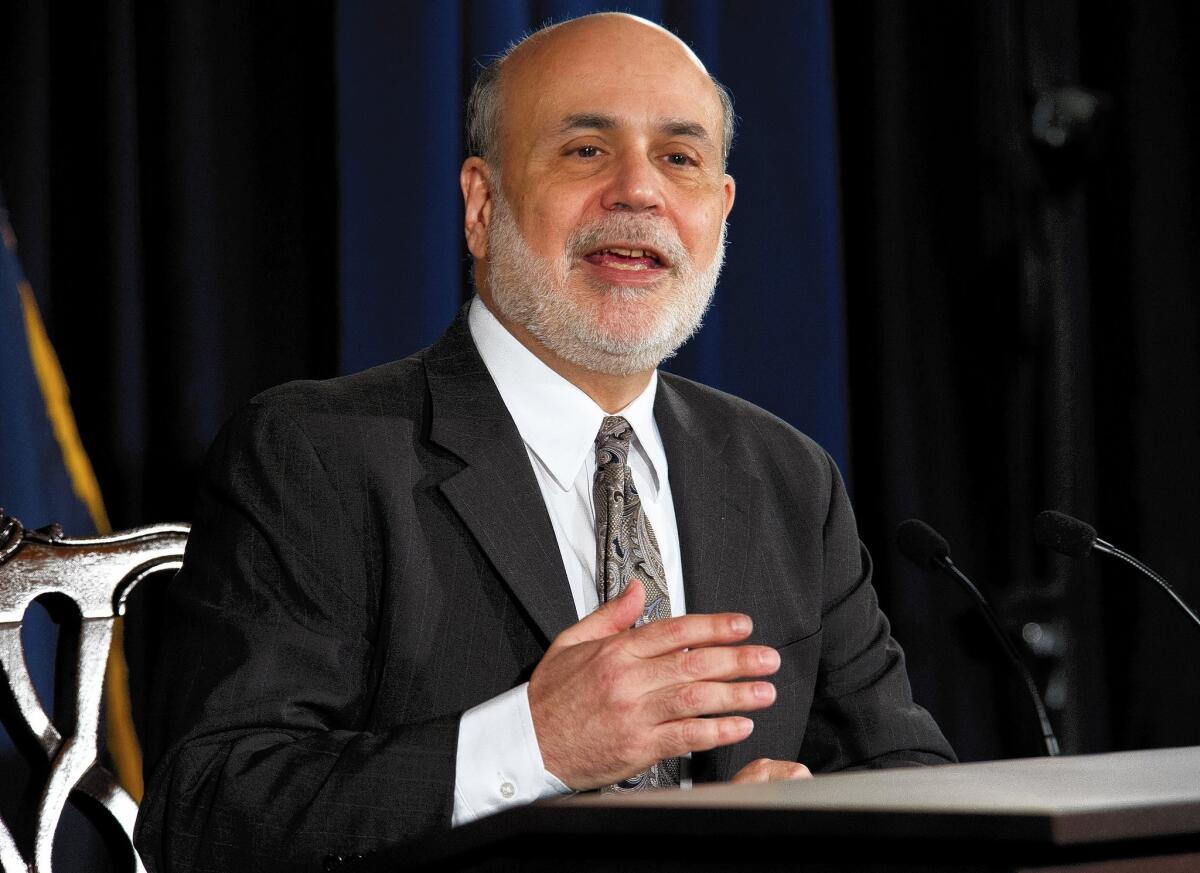

Although the decision to reduce its purchases was expected, Ben S. Bernanke won rare unanimous backing in his last meeting as Fed chairman Wednesday.

The 10-0 vote to make another $10-billion-a-month cut in its bond purchases also cemented the central bank’s plan to gradually dial back its unprecedented monetary stimulus.

Maintaining that effort will be more challenging for Bernanke’s successor, Janet L. Yellen, should the recent sell-off in emerging market currencies continue and threaten U.S. and global growth.

For now, Fed officials seemed unfazed by the problems abroad or by the weak U.S. job growth that was reported for December, results that many analysts think could be a weather-related aberration.

The Fed’s statement after its two-day meeting said economic activity had accelerated in recent quarters and noted that both consumer spending and business investment had strengthened.

The statement gave no hint of the broad investor retreat from major emerging markets such as Turkey and Argentina, pullbacks that have hurt stocks in the U.S. and elsewhere in recent days. Their statement simply reiterated that risks to the economic and job outlook had “become more nearly balanced.”

The Fed last month announced an initial $10-billion tapering of its $85-billion-a-month bond purchases, and Bernanke indicated that the central bank was likely to take similar steps at each meeting, so long as the economy kept improving as projected.

At that rate, the Fed’s program to buy Treasury and mortgage securities, aimed at lowering long-term interest rates and spurring investment and lending, would end in the fourth quarter.

Reductions could be halted if the outlook for economic growth and the labor market changes.

But analysts agreed that, at this point, the troubles in select developing countries had not risen to a level of high concern for the U.S. recovery, which gained momentum in the second half of last year. That pickup should be confirmed Thursday when the fourth-quarter U.S. economic growth numbers are released.

“The potential for contagion [from emerging markets] is certainly there,” said Carl Tannenbaum, senior vice president at the Chicago financial services firm Northern Trust.

But, he said, “The Federal Reserve probably gave the signal that unless signs of contagion are far more apparent than they are today, the tapering program they started last month is going to continue unabated.”

Many experts, including Fed officials and the International Monetary Fund, have forecast stronger U.S. growth this year, in large part because of receding head winds from government spending cuts and an emerging recovery in Europe.

But as Fed officials noted in their statement, the U.S. housing sector has slowed somewhat recently and some other economic data in recent days, such as orders for American durable goods, have come in weaker than expected.

Moreover, the outlook for the Chinese economy has been clouded by statistics indicating a contraction in industrial production. A slowdown in China, the second-largest economy in the world, could put even more pressure on emerging market economies, especially those such as Brazil and South Africa, that rely heavily on commodity exports.

Thus far, most analysts remain cautiously optimistic that this could be the year that the U.S. economy takes off.

Just as the Fed found it hard to make its first cut in bond purchases, the central bank would also find it difficult to stop or reverse course.

“If they were to pull back a little on the pace of this tapering, it could be viewed as a warning shot and could aggravate the situation,” said Gary Schlossberg, senior economist at Wells Capital Management in San Francisco.

“Ultimately the Fed has to look at what’s going on globally and weigh that against its own policy goals,” he said. “There is a tipping point, but I don’t think we’re there at the moment. I think it’s going to take more turbulence in the global economy for them to slow the tapering.”

Fed officials made no other major change in policy, leaving their main lever for controlling the money supply, the benchmark short-term interest rate, near zero.

The so-called federal funds rate has been at rock-bottom levels since late 2008, and the central bank reiterated Wednesday that it was likely to keep the rate there “well past” the time that the unemployment rate declines below 6.5%.

Most Fed officials expect the jobless rate to fall to as low as 6.3% by the end of the year from the December rate of 6.7%.