First, fix the tax code

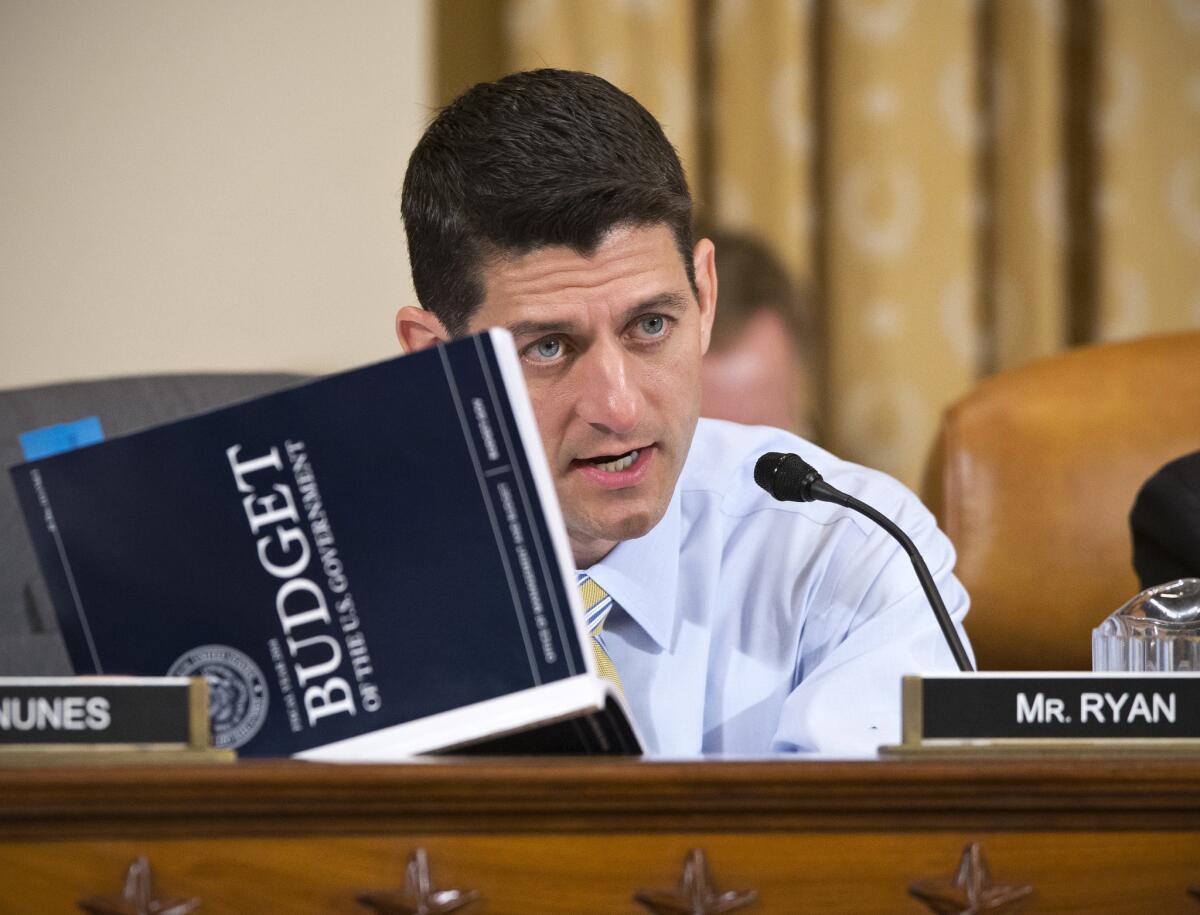

The federal government is expected to hit its statutory credit limit later this month, setting the stage for yet another battle between the Obama administration and the House GOP over raising the debt ceiling. Republican leaders of the House Ways and Means Committee reportedly want something new in return for raising the limit: an agreement to simplify the tax code and reduce rates. Lawmakers should know by now that it’s self-destructive to play games with the debt ceiling, and that the brinkmanship that characterizes contemporary Washington politics needs to stop. On the other hand, reforming the tax code is a goal both parties can and should embrace.

As we’ve said numerous times over the last few years, Congress shouldn’t try to rein in the growing debt by threatening not to pay for the commitments it’s already made. Not raising the ceiling is the congressional equivalent of not paying one’s credit card bill, a fiscally irresponsible move that would raise the government’s borrowing costs and exacerbate the annual budget deficits. The right way to attack the debt problem is by addressing the tax, spending and entitlement policies responsible for the red ink, as well as the sluggish economic growth that has widened the budget gap.

Economists on both sides of the political aisle say that the complexities in the current tax code make it inefficient and costly. Even President Obama has said he supports the idea of simplifying it. A thicket of exemptions, credits, deductions and preferences subsidize a slew of activities and shield various types of revenue from taxation, yet many of them don’t serve their intended purposes. For example, if the deduction for interest on mortgages was designed to make homeownership more affordable for lower- and middle-income Americans, why is it also available for multimillion-dollar mortgages and for more than one house per family?

OPINION: The wrong way for Washington to avoid defaulting

The goal of an overhaul should be to eliminate ineffective or wasteful tax breaks without reducing the progressive nature of the system. The complexity in today’s tax code lies in the special treatment given to multiple forms of income and expenses, such as municipal bond income and energy-efficient skylights, not in the fact that the tax paid on the millionth dollar earned is higher than on the ten-thousandth. Still, there’s a potential win here for Republicans and Democrats alike. Done the right way, a simplified tax code could generate more revenue at lower rates, giving the GOP the rate cut it covets without shifting the tax burden from the wealthy onto everyone else. It won’t be easy to pull off, considering the myriad special interests that will fight to preserve the tax breaks they receive. But it’s worth the effort.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.