French court throws out Hollande’s tax on rich

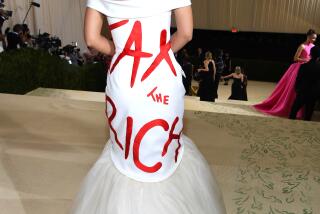

PARIS — France’s highest constitutional authority dealt a blow to President François Hollande’s plans to repair the nation’s economy Saturday by throwing out his new “supertax” on the wealthy days before it was to be imposed.

The French Constitutional Council ruled that the new fiscal measure, which would have seen individual earnings exceeding $1.32 million a year taxed at 75%, was unfair and therefore unconstitutional.

Immediately after the political setback, Hollande’s Socialist Party government pledged to redraft and resubmit the controversial proposal, which was passed by Parliament this month.

Prime Minister Jean-Marc Ayrault said in a statement that a new proposal to tax the rich “taking into account the principles raised by the Constitutional Council’s decision” would be drawn up as part of the next budget law submitted in 2013 or 2014. No further details of how and when this would be done were given.

The controversial proposal to tax the wealthy was a pillar of Hollande’s presidential campaign, which saw him installed in the Elysée Palace in May. It was expected to be a temporary measure, imposed for two years, that would affect only 1,500 people and raise less than $661 million.

It was part of a raft of tax-raising measures to be introduced by Hollande on Jan. 1 to bring down France’s public spending deficit from a forecast of 4.5% of gross domestic product this year to 3% by the end of his five-year term.

The tax rate was broadly approved by the political left but heavily criticized by conservatives and business leaders who warned that it would lead to a flood of entrepreneurs and wealthy fleeing France to neighboring countries where taxes are lower.

These fears were boosted two weeks ago when French actor Gérard Depardieu, a national institution, revealed he was moving just across France’s border into Belgium, allegedly to avoid paying the 75% tax. French billionaire Bernard Arnault, head of the luxury goods company Louis Vuitton Moet Hennessy, is also seeking Belgian nationality, though Arnault denies this is for fiscal motives.

A number of celebrated French sports and screen stars already live in Switzerland, Belgium, Britain and Luxembourg, where the tax burden is lighter.

When Ayrault described Depardieu’s move into tax exile as “shabby,” the actor wrote a furious open letter to the Journal du Dimanche Sunday newspaper accusing the Socialist government of seeking to punish “success, creation and talent.”

The politically independent Constitutional Council, made up of nine judges and three former presidents known collectively as The Wise, had been asked to rule on the tax by the center-right opposition Union for a Popular Movement party of former President Nicolas Sarkozy, who was defeated by Hollande in May.

In its ruling released Saturday, the council said the tax was unconstitutional because it “failed to recognize equality.” Unlike regular income tax, which is levied on French households, the 75% rate was to be applied to individuals. This meant an individual would have to pay the new rate on any money earned above $1.32 million a year, whereas a couple each earning just under this amount would escape it.

After the ruling, Finance Minister Pierre Moscovici confirmed that the government would not drop plans to impose higher taxes on the rich.

“Our deficit-cutting path will not be diverted,” Moscovici told BFM television.

ALSO:

India’s leaders urge calm after rape victim dies

Indian gang-rape victim dies in Singapore hospital

U.S. diplomats evacuate embattled Central African Republic

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.