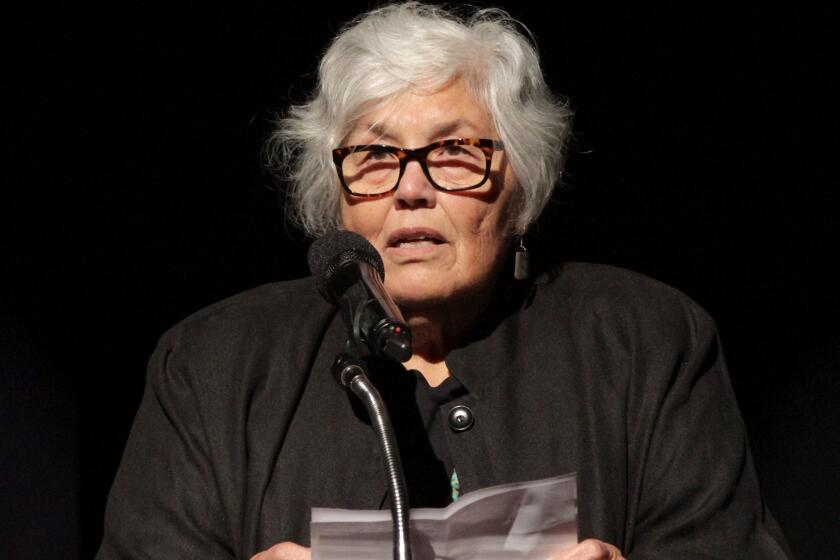

Muriel Siebert dies at 84; first woman on New York Stock Exchange

Muriel Siebert, whose success as one of Wall Street’s early, influential female analysts earned her the contacts and nest egg to become the first woman to buy a seat on the New York Stock Exchange, has died. She was 84.

Siebert died Saturday of complications from cancer at Memorial Sloan-Kettering Cancer Center in New York. Her death was confirmed to the Associated Press by Jane Macon, a director of Siebert Financial and a partner at the law firm Norton Rose Fulbright.

[For the Record, Aug. 26, 2013: A previous version of this story reported that Siebert was born Sept. 12, 1932, and was 80 when she died, according to information supplied by a spokeswoman. In fact, she was born Sept. 12, 1928, according to Ohio birth records, and was 84 when she died.]

In paying $445,000 for one of the NYSE’s 1,366 memberships on Dec. 28, 1967, “Mickie” Siebert broke up the all-male bastion of the Big Board, which until then had permitted women on the trading floor only as clerks and pages to fill shortages during World War II and the Korean War.

The lack of enthusiasm for welcoming a female colleague was evident, Siebert said, in her search for the two sponsors she needed under membership rules. After several rejections, she got James O’Brien, a partner at Salomon Bros. & Hutzler, and Kenneth Ward, a partner at Hayden Stone & Co., to back her.

Much of the opposition was couched as kindness.

“There was all manner of concern for my delicate ears — with several articles postulating that a woman couldn’t handle the rough language of Wall Street — and many comments about the absence of a ladies’ room on the Stock Exchange floor,” Siebert recalled in her 2002 memoir, “Changing the Rules: Adventures of a Wall Street Maverick,” written with Aimee Lee Ball.

“Not since I was a baby had so many people been so interested in my bathroom habits,” she wrote.

Siebert’s revolution was at least partly symbolic, since she did most of her work away from the floor, researching companies and advising clients of her sole-proprietor firm. Her stock-exchange membership meant that she could, when she desired, handle the actual buying and selling of securities, giving her a larger share of commissions.

Of the 62 traders, brokers and investors profiled by Martin Mayer and photographed by Cornell Capa for the 1969 book “New Breed on Wall Street,” Siebert was the only woman. The book was subtitled “The young men who make the money go.”

In 1975, when the Securities and Exchange Commission moved Wall Street from fixed commissions to negotiated ones, Siebert retooled Muriel Siebert & Co. into a discount brokerage, cutting her rate in half for individual investors.

She went on to serve five years as New York State’s first female superintendent of banks. Following an unsuccessful bid for the Republican nomination for U.S. Senate in 1982, she returned to her brokerage, which she took public in 1996 under the holding company Siebert Financial Corp.

The brokerage offered clients the option to trade online, and for two brief periods in 1999, as Internet-related stocks soared, her 90%-plus ownership stake made her, on paper, a billionaire. Within months, about $700 million of that disappeared.

Siebert, who had seen similar bubbles burst before, said she hadn’t let her hopes ride with the share prices.

“The day-traders giveth and the day-traders taketh away,” she said in a November 1999 interview. Of her paper billion, she added: “At least I didn’t write a check for that amount.”

Siebert was born Sept. 12, 1928, in Cleveland, the daughter of Irwin Siebert, a dentist, and the former Margaret Roseman.

As she told it in her memoir, she left home for the first time in 1953 for a summer trip to New York City with two friends and “a busload of other gawking tourists.” During a guided tour of the NYSE, she remembered looking down from the visitors gallery at a “sea of men in dark suits.”

Siebert at the time was a student at Cleveland’s Flora Stone Mather College, the women-only school at Western Reserve University, today’s Case Western Reserve University. As the only female student in a money-and-banking class at the men’s college, she recalled, she was known as “the delegate from Mather.”

Her father’s death from cancer during her junior year prompted Siebert to look for work before finishing her undergraduate degree. Plus, “I was cutting class and playing bridge,” she said in a 2010 Wagner College commencement address.

In 1954, she drove to New York in a used Studebaker to live with her older sister, who was working in public relations.

Siebert said she unsuccessfully sought jobs at the United Nations and Merrill Lynch before deciding she would have to lie about lacking a college degree. The trick worked at her next interview, with Bache & Co., which hired her as a research department trainee at $65 a week. She got her start as an analyst covering entertainment companies, then the aviation industry, at a time when railroads still dominated transport discussions on Wall Street.

“It wasn’t long before jets revitalized the industry,” Siebert wrote, “and eventually commercial jets came along. I was at the threshold of a major chapter in economic history.”

Siebert worked on Wall Street in the research department of Shields & Co. from 1958 to 1960, when she became a partner at Stearns & Co. She broke into trading at Finkle & Co., urging her clients to buy Boeing Co. before it introduced its top-selling 737.

By 1965, when she became a partner at Brimberg & Co., she was earning $250,000 a year and had her eye on more.

“When I started to bring in institutions on the research that I was doing, I wasn’t being paid what the men were making,” she told Charlie Rose in a 1999 interview. “Don’t misunderstand me: I was making a lot of money then. I was making a couple hundred thousand dollars a year — that was back in 1967. And I asked a client, where can I go where I can get credit on the business I do? What big firm could I go to? He said, Don’t be ridiculous. Buy a seat, work for yourself.”

On the advice of that client — Gerald Tsai Jr., who had gained fame as a money manager for what today is Fidelity Investments — she researched NYSE rules and found no legal bar to her admission.

Two years earlier, in 1965, the younger and less-prestigious American Stock Exchange had admitted its first two women, Julia Montgomery Walsh and Phyllis Peterson. Both were partners in Washington-based brokerages and didn’t venture onto the exchange floor, according to a New York Times report.

Siebert paid the $445,000 cost, plus an initiation fee of $7,515, with cash and a bank loan backed by her stock portfolio. Starting with the stock exchange’s announcement of her membership, she said, she resumed telling the truth about leaving college before earning her degree. She received her white metallic NYSE badge, with No. 2646 in red.

Siebert wrote that at a Christmas party on the night she was admitted, one NYSE governor asked her, “How many more women are there behind you?”

The answer for almost a decade would be just one — Jane Larkin, a partner in Hirsch & Co., who was a member for a few months until she gave up her seat when her firm was merged into F.I. duPont, Glore Forgan & Co. It wasn’t until 1976 that a woman member — Alice Jarcho, a broker for Oppenheimer & Co — began working full-time on the NYSE trading floor.

As an office for her and her (male) secretary, Siebert used space at the Stern Lauer & Co. brokerage a few blocks from Wall Street. She said she earned almost $1 million in sales commissions in 1968, in large part by recommending that her client funds and banks buy stock in aviation companies.

“If people want Beech Aircraft or Emery Airfreight, they come to me,” she told Mayer for his book. “I’ve put away tons of Beech Aircraft, tons of it. In all my stocks, I know who has a profit and wants to sell, or who has a loss and wants to sell.” Her firm became Muriel Siebert & Co. when she took on two partners in 1970.

With her accumulating wealth, she took flying lessons and bought fur coats and a Mercedes-Benz 350SL. In 1972, she sold her seat for $175,000 — strategically taking a $270,000 tax loss — and bought a different one for $180,000.

With the abolition of fixed commissions in 1975, price considerations overwhelmed analysis and advice, Siebert’s stock in trade.

“The research game is over,” she told Forbes magazine.

A new challenge presented itself when New York Gov. Hugh Carey asked her to fill the post of superintendent of banking.

During her five years in that position, from mid-1977 to mid-1982, she oversaw the mergers of ailing banks into stronger competitors.

Describing herself as “very conservative fiscally and probably quite liberal in terms of people and human rights,” she stepped down in May 1982 to seek the Republican nomination to challenge Democratic U.S. Sen. Daniel Patrick Moynihan. She lost to Florence Sullivan, a member of the state Assembly who went on to lose to Moynihan.

Siebert never married. Starting in 1999, she developed and promoted an academic curriculum to teach personal-finance skills to high school students.

“Do not be afraid to go into uncharted territories,” she told Wagner College graduates at their commencement. “You might find some pretty good things there.”

More to Read

Start your day right

Sign up for Essential California for the L.A. Times biggest news, features and recommendations in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.