Op-Ed: Why tax day is a nightmare for freelancers

For the 55 million Americans who make their living as freelance workers, tax day is more than just a headache. It’s an annual fleecing.

Freelancers now constitute a third of the American workforce, and over the past decade, 94% of new jobs added to the U.S. economy were created in the so-called gig economy. Yet freelancers must retrofit themselves into an archaic system designed for the industrial era, one that taxes independent workers disproportionately even as they benefit less from the social safety net.

A quaint 400 pages, the original tax code was adopted in 1913, when industrial-era workers might have had one or two jobs for life. It has since evolved into a 74,608-page behemoth that few self-employed individuals can navigate on their own.

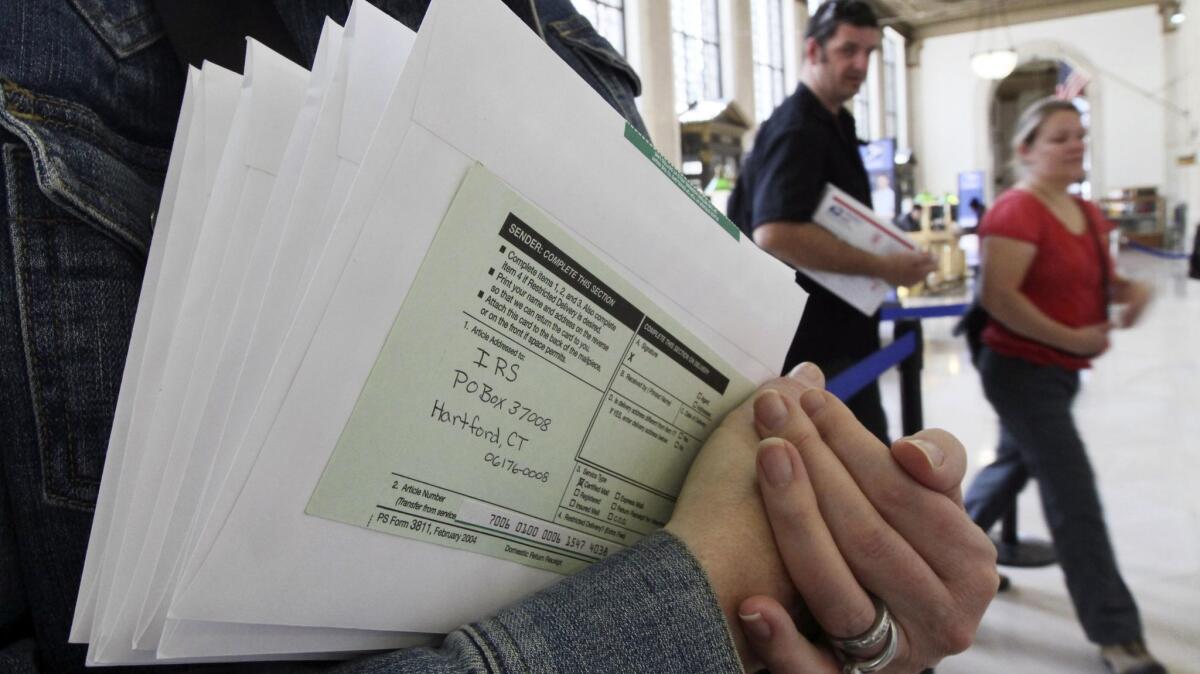

Hiring an accountant to serve as one’s guide through the Byzantine process is only the first step — and only the first expense. Freelancers must collect 1099s from each of their multiple clients, organize countless bills and small receipts into deductible expenses, and plan out a confusing payment schedule for making separate, estimated outlays toward federal, state and even local tax collectors.

Freelancers are paying taxes toward a social safety net to which they have little access.

The last quarterly payment is due in January of the following year, so many freelancers begin the new year in debt. In April, freelancers actually face two due dates: The balance on the previous year, as well as the first estimated quarterly payment of the new year.

Because the system is so complicated, freelancers often pay not only their taxes, but also penalties for miscalculating or missing their quarterly payments. And because freelancers can rarely catch their breath, setting aside retirement or any kind of savings becomes all the more challenging. In a 2016 survey commissioned by the Freelancers Union, independent workers reported that debt was among their top three concerns. In part for this reason, Silicon Valley is pouring billions into developing software that emulates withholdings and automates tasks like expense-tracking and invoicing.

But the real rub is that freelancers are paying taxes toward a social safety net to which they have little access. Many pay both employer and employee contributions to Social Security, yet are ineligible for unemployment benefits and workers’ compensation.

Freelancers who make just enough to receive little or no subsidy for their health insurance are arguably the most penalized. Though they usually live in expensive urban areas, they may bring in only $35,000 or $40,000 a year, and are often subject to unpredictable swings in income that make them highly susceptible to debt.

Say you’re a freelancer making a net income of $40,000. You would pay roughly $5,000 in self-employment taxes, $3,500 in income taxes and $4,500 in health insurance. That’s 30% of your income. Compare this to a traditional worker with the same salary. Such an employee would pay 9% to 15% in taxes and health insurance payments, depending on what portion of the insurance is covered by the employer. They would also have access to group-rate benefits at a fraction of the cost an independent worker would pay.

The gig economy is not a passing fad or interim stage, and that’s not all bad. While it comes with risks, independent work enables people to diversify their sources of income. It can also allow workers to spend more time with their families: 82% of the freelancers we surveyed said they were able to spend enough time with their families, while 69% of traditional full-time employees said the same.

In fact, half of the freelancers in our survey said that no amount of money would entice them to take a traditional job. That’s good news for their clients, who increasingly seek out freelancers for a range of specialized services.

But we need a tax system that is aligned with this new reality, one that doesn’t burden freelancers disproportionately or perpetually expose them to debt. Although President Trump and Congress frequently say tax reform is a top priority, and Washington has floated several plans to simplify the code, no one has proposed a coherent strategy for mitigating the many ways in which the tax system disadvantages freelancers. The social safety net should also be adjusted, especially health and unemployment benefits, to afford freelancers basic protections as they move from gig to gig.

Freelancers contribute $1 trillion to the economy annually. They no longer occupy a niche category. Independent workers deserve a tax code that values their labor as much as their clients do.

Sara Horowitz is the founder and executive director of the Freelancers Union.

Follow the Opinion section on Twitter @latimesopinion or Facebook

MORE

Thousands march in Los Angeles to demand release of Trump tax returns

Trump: ‘Who paid for’ rallies seeking release of tax returns

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.