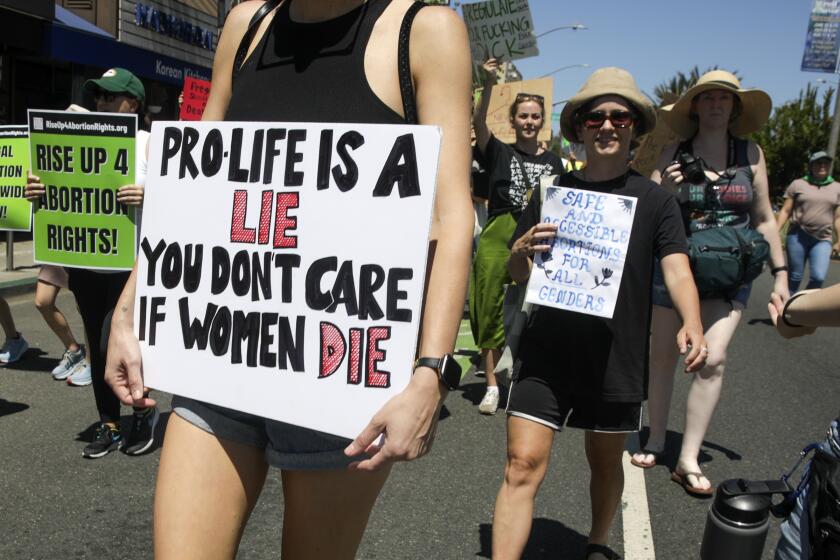

Opinion: Three (business) reasons the Sterlings should sell the Clippers now

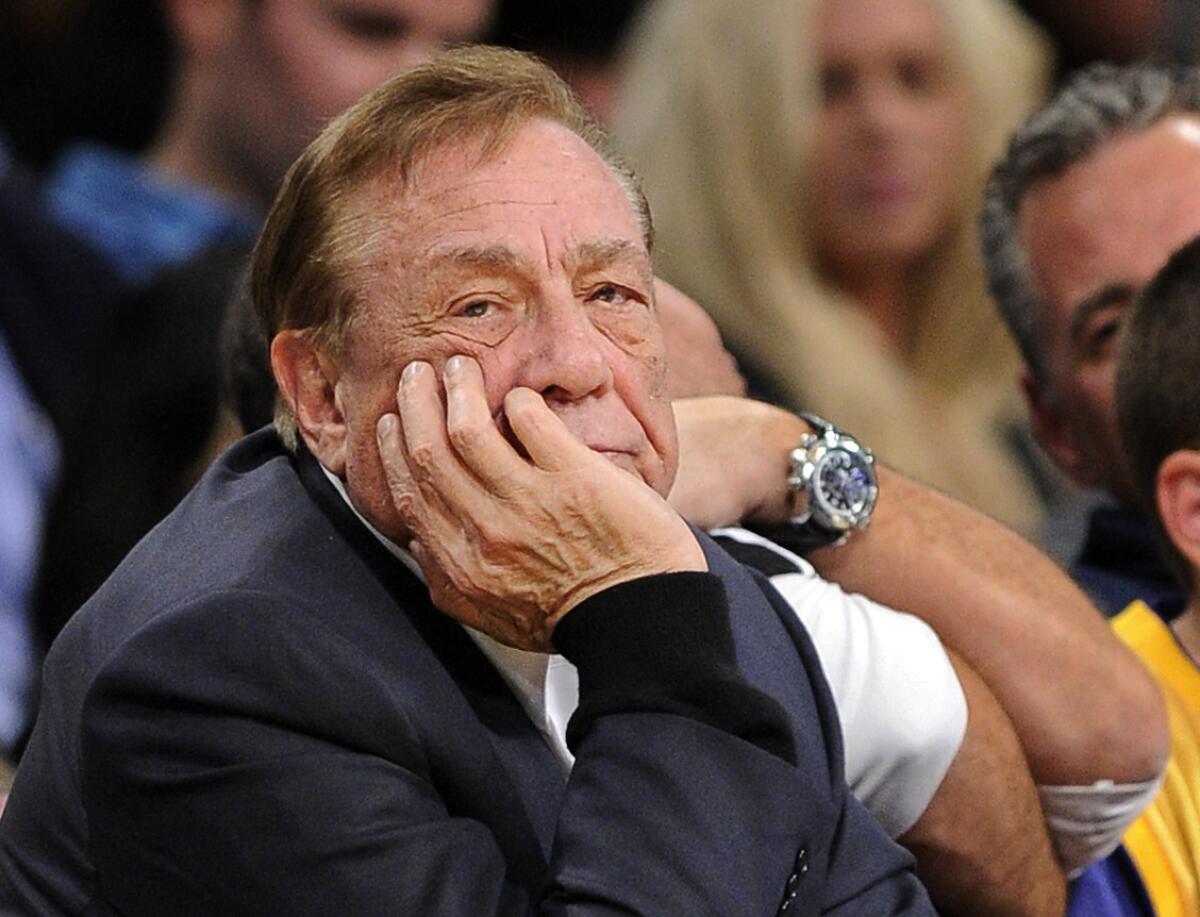

Could it be that Donald T. Sterling’s business acumen overcame his litigiousness?

Reports swirled Friday morning that Sterling was ready to concede defeat to the National Basketball Assn. and sell the L.A. Clippers, provided that his wife Shelly handled the sale. Jim Rainey’s article in The Times raised the possibility that the maneuvering was designed to let Shelly Sterling keep a stake in the team, an outcome the league has said it will not abide. But it may just be a way for the Sterlings to retain control over the sale and, ahem, the sale price.

Sterling is a lawyer, and he’s seen the NBA’s confidential set of bylaws that set the terms of ownership. So if he really has agreed to sell, that’s a pretty good indication that he knows he can’t win a legal battle with the league if it decides to boot him based on those bylaws. The NBA is essentially a private club that sets its own rules, and would-be owners have to agree to those rules to take over a team. That gives the league leeway to do things that a government or a corporation couldn’t.

But there are three additional, powerful reasons for Sterling to sell now, and given his track record as a businessman, he must certainly recognize them.

First, as his crosstown rivals demonstrated this year, good teams can go bad in a hurry. And when they do, all sorts of support systems for the team’s brand -- partnerships with large national advertisers, appearances on national TV, prominent placement of team jerseys in sporting goods stores -- evaporate. Whatever the opposite of cha-ching is, that’s the sound an owner hears on the elevator ride down into Lotteryville.

And there’s no surer path to the bottom than chasing off marquee players and coaches. For all but the last few years of his tenure as owner, Sterling trapped the Clippers in an aspic of failure by refusing to pay the dollars necessary to keep young stars or attract free agents who could, you know, play. His unexpected willingness to open the vault for Chris Paul, Blake Griffin and Doc Rivers removed the “Do Not Enter” sign from the Clippers’ locker room, but his comments about blacks in general and Magic Johnson in particular have put it right back up. While several of the Clippers’ best players remain under contract for at least one more year, can they really be expected to put out the same kind of effort they did before Sterling’s racist rant became public?

In other words, the team’s personnel and its performance have peaked, at least as long as the Sterlings are parking in the owner’s spaces at Staples Center. And so, perhaps, has the value of major-league sports franchises. That’s the second factor.

The crazy increase in franchise value has been driven by the skyrocketing fees for broadcasting a team’s games. The main force behind those fees has been cable operators, who’ve been paying princely sums for the exclusive deals that have wrested pro teams from their longtime partners in local TV. But the Dodgers and Time Warner Cable may have brought the insanity to an end by striking a deal too rich for rival pay-TV operators to accept.

Their $8.35-billion multi-year contract was predicated on the assumption that Time Warner Cable could persuade all the pay-TV operators in the region (including DirecTV and DISH) to fork over several dollars per month per subscriber to carry the new Dodgers TV channel, SportsNet LA. But rival TV services pushed back, demanding the ability to confine SportsNet LA and its fees to a special sports tier. Being stuck in a sports gulag would probably generate far less money for Time Warner Cable than being part of the basic cable tier, which is why SportsNet LA has yet to make its way into local homes served by anyone other than Time Warner -- which is to say, most of them.

The Dodgers have an exceptionally large and loyal fan base, so the SportsNet LA setback is a chilling one for franchise owners everywhere. It suggests that pay-TV operators have squeezed as much as they can out of their basic-tier customers, and the days of dropping expensive new regional sports channels into that tier are over.

The Clippers’ last TV contract was in 2009, and though it nearly doubled the franchise’s annual take (from $12.5 million a year to about $20 million, according to The Times and Forbes), it’s nowhere close to the $180 million the Lakers will get annually (on average) from Time Warner Cable over 20 years. The Clippers will get the chance to narrow the gap before too long; their deal with Fox ends after two more seasons. But thanks to the Dodgers and Time Warner overshooting the mark, the days of irrationally exuberant broadcasting rights deals may be over.

In sum, Sterling is holding an asset at its peak value, with his own involvement among the factors threatening to lower it. Now here’s the kicker: There’s a growing sentiment on Capitol Hill to overhaul the tax code to broaden the base and lower rates. That effort threatens the considerable tax break in current law for capital gains, which are taxed at about half the rate of ordinary income. And considering that Sterling paid only $12.5 million in 1981 for a team he could sell for upward of $750 million, he’s looking at a whopping capital gain.

Now’s the time for the Sterlings to sell. In fact, it couldn’t happen soon enough.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.